Amidst a backdrop of record highs in key indices such as the Dow Jones Industrial Average and the S&P 500, small-cap stocks have finally joined their larger peers in reaching new milestones, with the Russell 2000 Index hitting an intraday high. This optimistic market sentiment, influenced by domestic policy shifts and geopolitical developments, sets a compelling stage for investors to keep an eye on promising high-growth tech companies like Kitron and others that demonstrate strong potential through innovation and adaptability in evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kitron ASA is an electronics manufacturing services company with operations across several countries, including Norway, Sweden, and the United States, and has a market cap of NOK6.27 billion.

Operations: Kitron ASA focuses on electronics manufacturing services, generating revenue primarily from this segment, which amounted to €685.70 million. The company operates in multiple countries, providing a broad geographical footprint for its services.

Kitron, amidst a challenging fiscal landscape with a 26.7% dip in earnings last year, still projects an upward trajectory with expected revenue growth at 7% annually, outpacing the Norwegian market's 1.9%. This optimism is bolstered by an anticipated earnings increase of 15.5% per year, significantly above the local market average of 9.7%. However, recent quarterly reports reflect some turbulence; Q3 sales dropped to €145.1 million from €179.2 million year-over-year and net income fell to €6.1 million from €9.7 million, alongside revised full-year revenue forecasts down from initial expectations between €660 million and €710 million to now between €635 million and €660 million due to restructuring costs impacting financials early in the year. Despite these setbacks, Kitron's commitment to innovation remains evident through robust R&D investments aimed at driving future growth in high-demand sectors like electronics manufacturing services for defense and aerospace—areas where technological advancements are critical for maintaining competitive edges in global markets.

- Delve into the full analysis health report here for a deeper understanding of Kitron.

Gain insights into Kitron's historical performance by reviewing our past performance report.

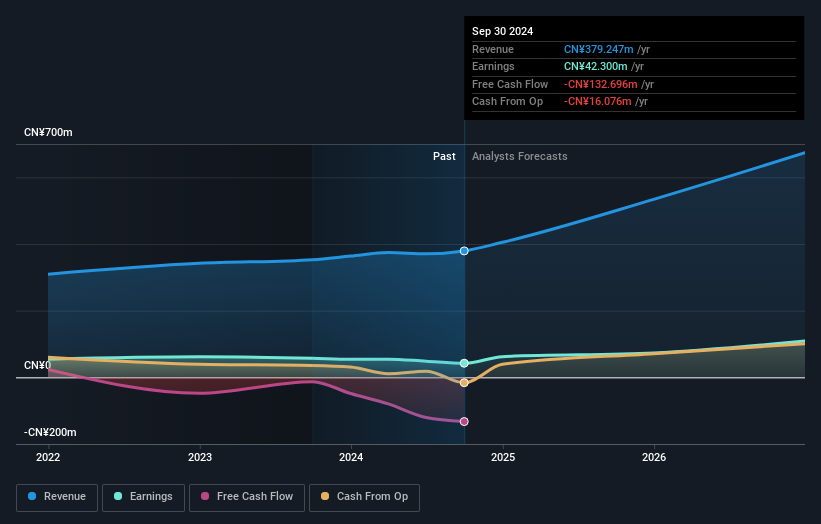

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd (SZSE:301421)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Wavelength Opto-Electronic Science & Technology Co., Ltd. specializes in the development and production of laser systems and components, with a market capitalization of CN¥6.40 billion.

Operations: The company generates revenue primarily from its laser systems and components segment, amounting to CN¥379.25 million.

Nanjing Wavelength Opto-Electronic Science & Technology Co., Ltd. has demonstrated a robust commitment to growth with a notable 26.4% increase in annual revenue, outpacing the Chinese market average of 13.8%. This surge is complemented by an impressive forecast for earnings growth at 36.8% per year, significantly higher than the market's 26.2%. Despite recent financial turbulence—evidenced by a decline in net income from CNY 42.64 million to CNY 30.82 million over nine months—the company’s strategic investments in R&D are poised to enhance its competitive edge in opto-electronic technologies, signaling potential for sustained advancement in this high-tech sector.

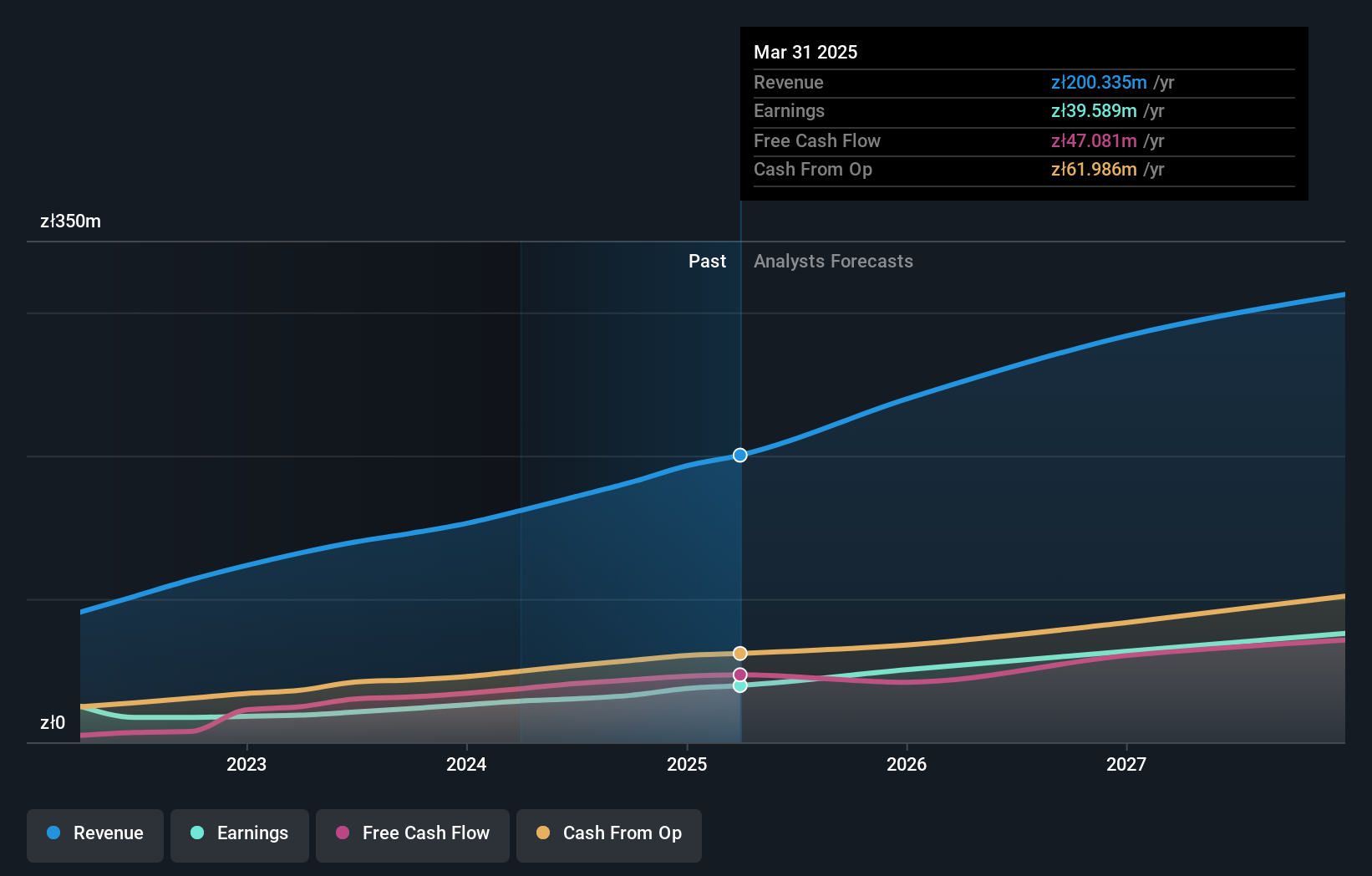

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper SA offers Software as a Service solutions tailored for the e-commerce sector in Poland, with a market capitalization of PLN1.22 billion.

Operations: Shoper SA generates revenue primarily through its Solutions segment, contributing PLN141.44 million, and Subscriptions, adding PLN39.87 million.

Shoper S.A. has demonstrated robust performance with a 26.5% increase in revenue over nine months, reaching PLN 137.67 million, underpinned by a net income rise to PLN 23.64 million from PLN 17.14 million previously. This financial growth is complemented by an aggressive R&D strategy, with expenditures aligning closely with its revenue uptick, ensuring continuous innovation and competitiveness in the software sector. Moreover, Shoper's earnings are expected to surge by approximately 24.8% annually, outpacing the broader Polish market's forecast of 15.2%, showcasing its potential to further solidify its market position through strategic investments and technological advancements.

- Navigate through the intricacies of Shoper with our comprehensive health report here.

Evaluate Shoper's historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 1289 High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Shoper SA provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with high growth potential.

Market Insights

Community Narratives