As global markets experience a surge in optimism driven by hopes for softer tariffs and enthusiasm around artificial intelligence, major indices like the S&P 500 have reached record highs, with growth stocks outperforming value shares for the first time this year. In this climate of heightened investor sentiment, identifying high-growth tech stocks that can capitalize on AI advancements and favorable trade developments becomes crucial for those looking to navigate the evolving market landscape effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kitron ASA is an electronics manufacturing services company with operations across multiple countries, including Norway, Sweden, and the United States, and has a market capitalization of NOK7.72 billion.

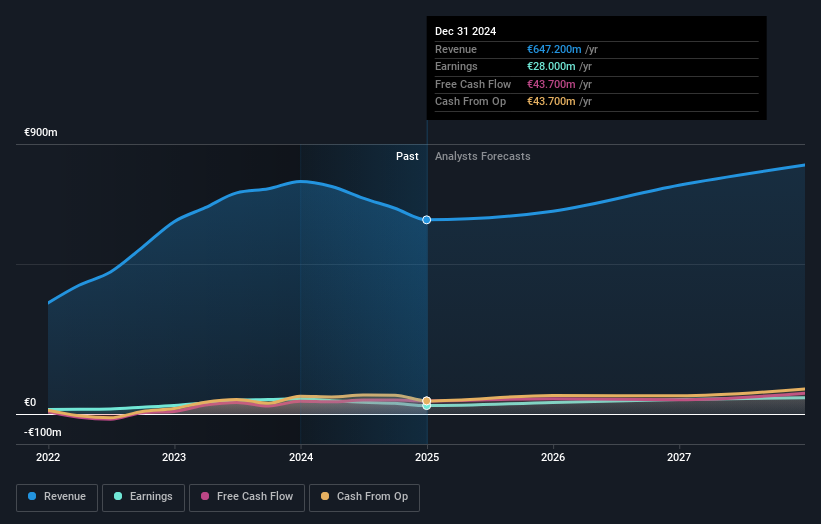

Operations: Kitron ASA focuses on electronics manufacturing services, generating revenue of €685.70 million from this segment.

Kitron, a player in the high-tech electronics sector, is demonstrating robust growth prospects with a revenue forecast growing at 7.9% annually, outpacing the Norwegian market average of 2%. This growth is bolstered by recent strategic contracts such as a NOK 300 million deal with Kongsberg for naval missile electronics and a significant agreement to produce advanced optical assemblies for drones, expected to generate over EUR 30 million in 2025. These developments underscore Kitron's critical role in defense and UAV technologies while leveraging its sophisticated manufacturing capabilities across Europe. Moreover, with earnings expected to rise by approximately 15.8% per year, Kitron is setting itself apart in an industry where innovation and precision are paramount.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

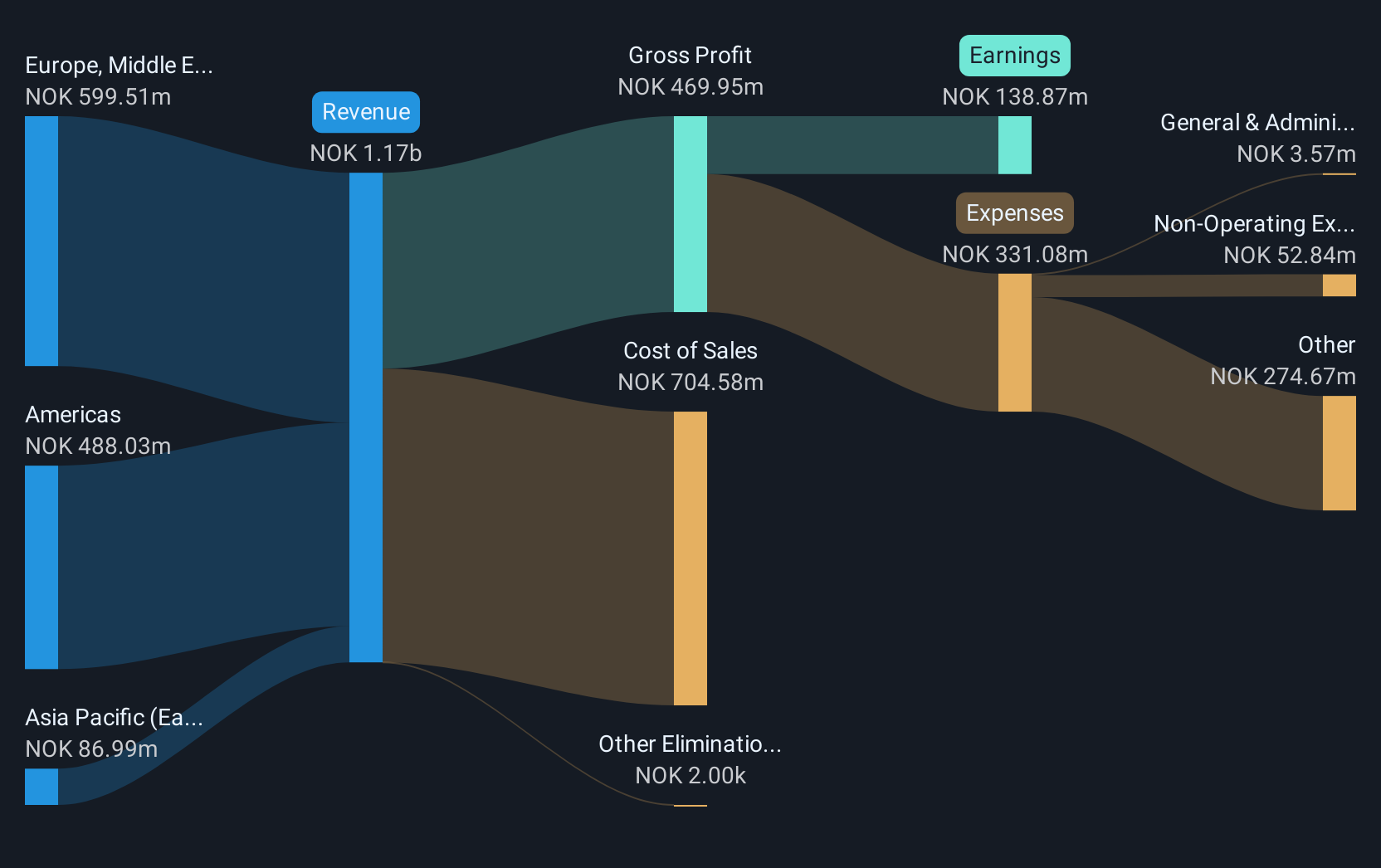

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure globally, with a market capitalization of NOK4.42 billion.

Operations: Pexip Holding ASA generates revenue primarily from the sale of collaboration services, amounting to NOK1.07 billion.

Pexip Holding's recent performance and strategic positioning underscore its potential in the tech sector. With a significant turnaround from a net loss to reporting a net income of NOK 58.24 million for the nine months ending September 2024, Pexip exemplifies resilience and adaptability. The company's revenue growth at 13.7% annually outstrips the broader Norwegian market's expansion rate of just 2%, highlighting its ability to capture and grow market share effectively. Furthermore, Pexip’s participation in high-profile industry events, like the Morgan Stanley European Technology Conference, signals robust engagement with key industry players and stakeholders, potentially paving the way for future growth avenues as it aims to become profitable within three years—an optimistic projection given its current trajectory.

- Delve into the full analysis health report here for a deeper understanding of Pexip Holding.

Evaluate Pexip Holding's historical performance by accessing our past performance report.

VGI (SET:VGI)

Simply Wall St Growth Rating: ★★★★☆☆

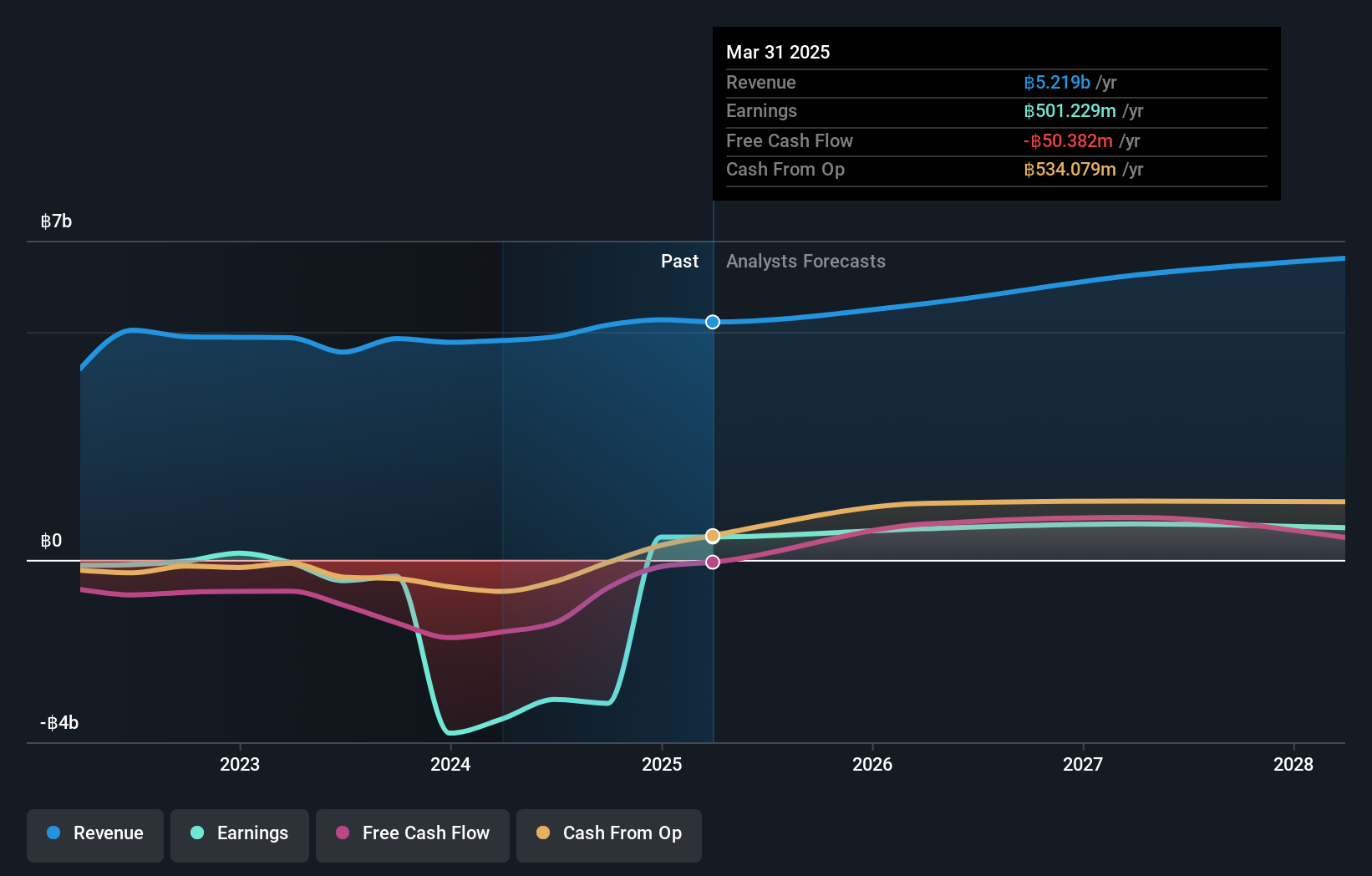

Overview: VGI Public Company Limited, with a market cap of THB64.80 billion, operates in Thailand by providing advertising services through its subsidiaries.

Operations: The company generates revenue primarily from three segments: Transit (THB2.55 billion), Digital Services (THB1.86 billion), and Distribution (THB1.26 billion). These segments reflect its focus on advertising services within Thailand through various platforms and channels.

VGI has demonstrated resilience in a challenging market, transitioning from a net loss to a net income of THB 140.81 million in the first half of FY2024, contrasting sharply with the previous year's loss of THB 200.57 million. This turnaround is underpinned by a robust sales increase from THB 660.74 million to THB 777.99 million over the same period, reflecting strategic adaptability amid industry shifts. Despite recent revenue fluctuations, VGI's anticipated annual earnings growth rate stands at an impressive 123.84%, signaling potential for substantial profitability within three years as it aligns with evolving market dynamics highlighted during its recent presentation at Opportunity Day Q3/2024.

- Take a closer look at VGI's potential here in our health report.

Examine VGI's past performance report to understand how it has performed in the past.

Taking Advantage

- Click through to start exploring the rest of the 1227 High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PEXIP

Pexip Holding

A video technology company, provides end-to-end video conferencing platform and digital infrastructure in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives