- Norway

- /

- Communications

- /

- OB:HDLY

Huddly AS (OB:HDLY) Just Reported, And Analysts Assigned A kr13.50 Price Target

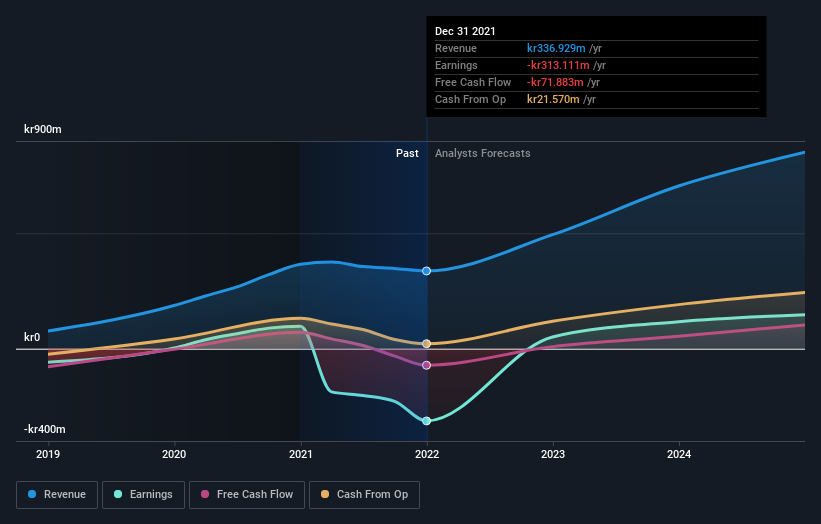

The yearly results for Huddly AS (OB:HDLY) were released last week, making it a good time to revisit its performance. The results look positive overall; while revenues of kr337m were in line with analyst predictions, statutory losses were 5.9% smaller than expected, with Huddly losing kr1.45 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analyst has changed their earnings models, following these results.

View our latest analysis for Huddly

Taking into account the latest results, the most recent consensus for Huddly from sole analyst is for revenues of kr494.0m in 2022 which, if met, would be a sizeable 47% increase on its sales over the past 12 months. Huddly is also expected to turn profitable, with statutory earnings of kr0.24 per share. Yet prior to the latest earnings, the analyst had been anticipated revenues of kr472.0m and earnings per share (EPS) of kr0.25 in 2022. So it's pretty clear consensus is mixed on Huddly after the latest results; whilethe analyst lifted revenue numbers, they also administered a minor downgrade to per-share earnings expectations.

The consensus price target fell 10.0% to kr13.50, suggesting that the analyst are primarily focused on earnings as the driver of value for this business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Huddly's rate of growth is expected to accelerate meaningfully, with the forecast 47% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 36% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 3.7% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Huddly to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Huddly. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. Furthermore, the analyst also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Huddly. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

Before you take the next step you should know about the 1 warning sign for Huddly that we have uncovered.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huddly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HDLY

Huddly

A technology company, creates tools for team collaboration in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion