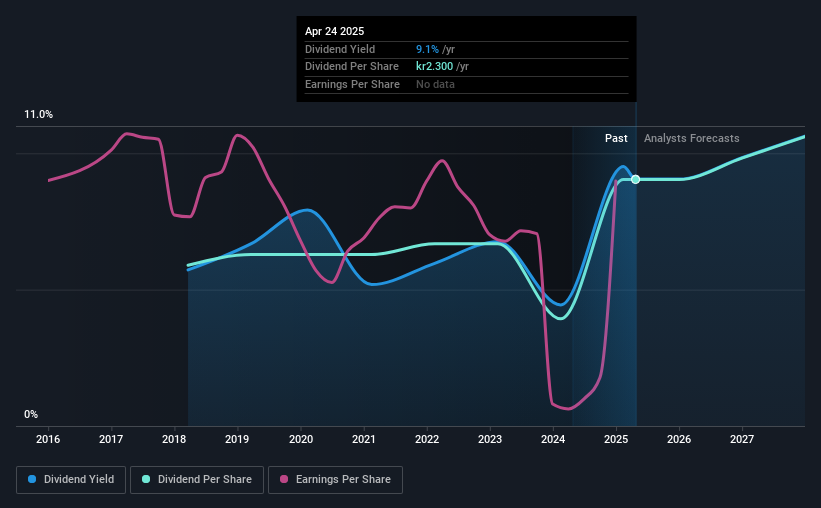

Webstep ASA (OB:WSTEP) has announced that it will be increasing its dividend from last year's comparable payment on the 1st of January to NOK2.30. This will take the annual payment to 9.1% of the stock price, which is above what most companies in the industry pay.

Webstep's Future Dividend Projections Appear Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, the company's dividend was much higher than its earnings. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Over the next year, EPS is forecast to expand by 45.2%. If recent patterns in the dividend continues, the payout ratio in 12 months could be 76% which is a bit high but can definitely be sustainable.

Check out our latest analysis for Webstep

Webstep's Dividend Has Lacked Consistency

Looking back, Webstep's dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. The dividend has gone from an annual total of NOK1.50 in 2018 to the most recent total annual payment of NOK2.30. This implies that the company grew its distributions at a yearly rate of about 6.3% over that duration. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Webstep might have put its house in order since then, but we remain cautious.

Webstep May Have Challenges Growing The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Webstep has grown earnings per share at 5.9% per year over the past five years. However, the company isn't reinvesting a lot back into the business, so we would expect the growth rate to slow down somewhat in the future.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The track record isn't great, and the payments are a bit high to be considered sustainable. We don't think Webstep is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Webstep (1 is a bit unpleasant!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Webstep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:WSTEP

Webstep

Provides information technology (IT) consultancy services to public and private businesses in Norway and Sweden.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026