With its stock down 17% over the past three months, it is easy to disregard Webstep (OB:WSTEP). Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. In this article, we decided to focus on Webstep's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Webstep

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Webstep is:

10% = kr39m ÷ kr383m (Based on the trailing twelve months to September 2023).

The 'return' is the yearly profit. So, this means that for every NOK1 of its shareholder's investments, the company generates a profit of NOK0.10.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Webstep's Earnings Growth And 10% ROE

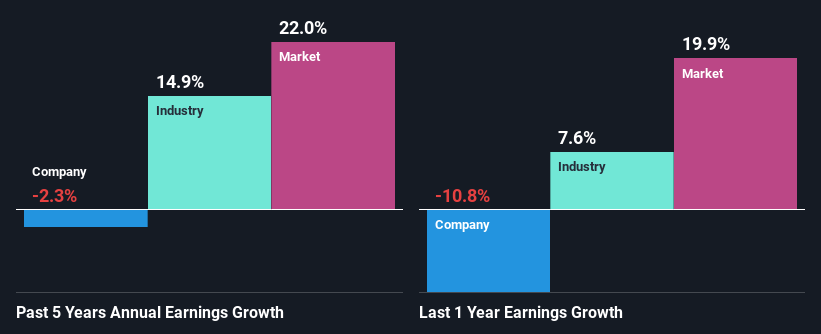

To begin with, Webstep seems to have a respectable ROE. Yet, the fact that the company's ROE is lower than the industry average of 20% does temper our expectations. Moreover, Webstep's net income shrunk at a rate of 2.3%over the past five years. Bear in mind, the company does have a high ROE. It is just that the industry ROE is higher. Hence there might be some other aspects that are causing earnings to shrink. These include low earnings retention or poor allocation of capital.

That being said, we compared Webstep's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 15% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Webstep's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Webstep Efficiently Re-investing Its Profits?

With a three-year median payout ratio as high as 105%,Webstep's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Paying a dividend higher than reported profits is not a sustainable move. You can see the 2 risks we have identified for Webstep by visiting our risks dashboard for free on our platform here.

Additionally, Webstep has paid dividends over a period of six years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 77% over the next three years. As a result, the expected drop in Webstep's payout ratio explains the anticipated rise in the company's future ROE to 15%, over the same period.

Summary

In total, we would have a hard think before deciding on any investment action concerning Webstep. Its earnings growth particularly is not much to talk about even though it does have a pretty respectable ROE. The lack of growth can be blamed on its poor earnings retention. As discussed earlier, the company is retaining hardly any of its profits. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Webstep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:WSTEP

Webstep

Provides information technology (IT) consultancy services to public and private businesses in Norway and Sweden.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

From Tasers to SaaS: Axon’s Quiet Platform Transformation

Oracle: The AI Infrastructure Story Hiding in Plain Sight

Near zero debt, Japan centric focus provides future growth

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks