High Growth Tech Stocks in Europe Featuring Three Promising Picks

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index ending higher amid easing inflation in major economies and expectations of interest rate cuts by the European Central Bank. In this environment, high growth tech stocks stand out as they can potentially capitalize on favorable economic conditions and technological advancements to drive innovation and capture market share.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.85% | 45.05% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 26.03% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Remedy Entertainment Oyj (HLSE:REMEDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Remedy Entertainment Oyj is a Finnish video game company focused on developing and selling PC and console games, with a market capitalization of €252.72 million.

Operations: The company generates revenue primarily from its Computer Graphics segment, which contributes €53.26 million.

Remedy Entertainment Oyj, a Finnish game developer, has demonstrated robust financial growth with an 18.9% annual increase in revenue and a projected earnings growth of 36.3%. This performance is notably above the Finnish market's average. The company's recent shift to self-publishing with its upcoming title FBC: Firebreak, set for release on multiple platforms including PC and PlayStation 5, underscores its strategic pivot towards controlling more of its value chain. This move could enhance profit margins and market presence. Additionally, Remedy reaffirmed positive revenue and EBIT forecasts for 2025 following a profitable Q1 with EUR 13.4 million in sales—a significant improvement from the previous year's EUR 10.8 million—highlighting effective operational adjustments and promising future prospects in the gaming industry.

- Unlock comprehensive insights into our analysis of Remedy Entertainment Oyj stock in this health report.

Gain insights into Remedy Entertainment Oyj's past trends and performance with our Past report.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kitron ASA is an electronics manufacturing services provider operating across multiple countries including Norway, Sweden, and the United States, with a market cap of NOK11.74 billion.

Operations: The company generates revenue primarily from its Electronics Manufacturing Services (EMS) segment, which amounts to €637.90 million.

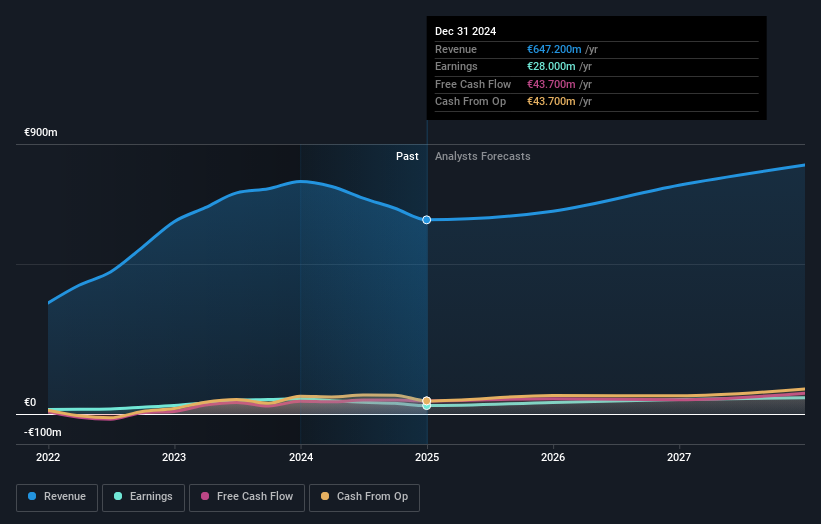

Kitron's recent strategic maneuvers, including a significant multi-year agreement to manufacture sensor-based products for the U.S. market, signal robust growth prospects in European tech sectors focused on digitalization and connectivity. Despite a challenging past with a 34.3% decline in earnings last year, Kitron's future looks promising with an expected revenue growth of 13.3% per year and earnings forecast to surge by 22.9% annually, outpacing the Norwegian market's average significantly. This upward trajectory is further supported by strong demand in the Defence/Aerospace sector as evidenced by their revised financial outlook for 2025 projecting revenues up to EUR 710 million and operating profit potentially reaching EUR 65 million, reflecting Kitron's resilience and adaptability in a rapidly evolving industry landscape.

- Dive into the specifics of Kitron here with our thorough health report.

Evaluate Kitron's historical performance by accessing our past performance report.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, Finland, and the United Kingdom, with a market capitalization of NOK4.18 billion.

Operations: SmartCraft ASA generates revenue by providing specialized software solutions to the construction sector in Norway, Sweden, Finland, and the United Kingdom. The company's market capitalization is NOK4.18 billion.

SmartCraft, a Norwegian software firm, has demonstrated resilience in the competitive tech landscape with an 11.9% expected annual revenue growth and a robust 28.2% forecast in earnings growth per year, outpacing the local market average significantly. Recent innovations like SmartCraft Spark and Congrid's BIM integration underscore its commitment to enhancing efficiency in the electrical and construction sectors. Despite recent volatility in share price and a leadership transition with CEO Gustav Line stepping down, SmartCraft's strategic product expansions and consistent financial performance signal strong future prospects within Europe's high-growth tech scene.

- Click here to discover the nuances of SmartCraft with our detailed analytical health report.

Gain insights into SmartCraft's historical performance by reviewing our past performance report.

Key Takeaways

- Investigate our full lineup of 226 European High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, Finland, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives