As of April 2025, the European market has shown resilience amid global trade tensions, with key indices like the STOXX Europe 600 Index rising by 2.77% following positive signals from U.S.-China trade discussions and a reduction in tariff threats. In this environment of cautious optimism, identifying high-growth tech stocks requires a focus on companies that demonstrate strong innovation potential and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 28.91% | 53.88% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

We'll examine a selection from our screener results.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, Finland, and the United Kingdom with a market capitalization of NOK4.18 billion.

Operations: SmartCraft ASA specializes in providing software solutions for the construction industry in Norway, Sweden, Finland, and the United Kingdom. The company's market capitalization stands at NOK4.18 billion.

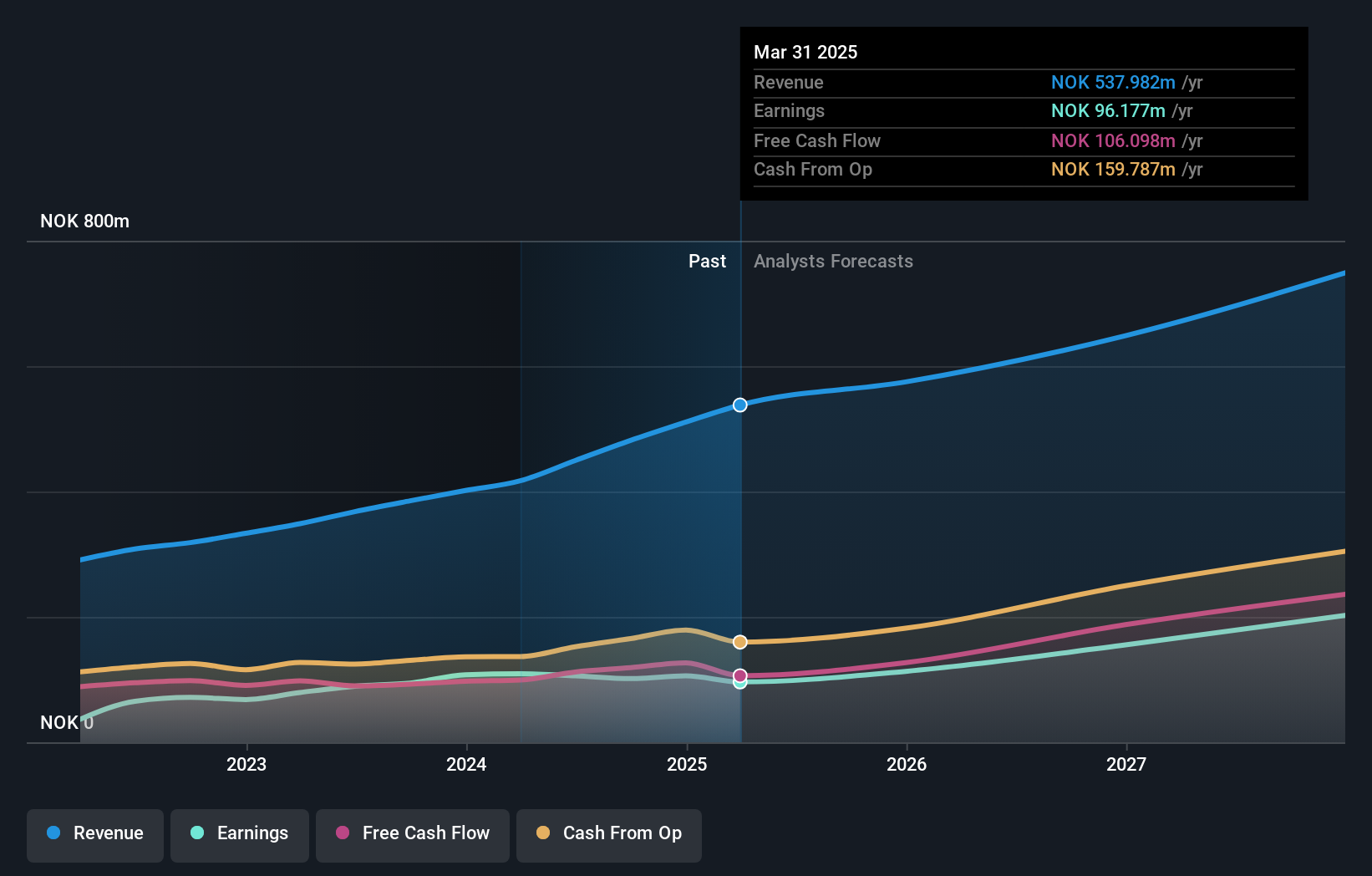

SmartCraft ASA, a European tech firm, recently reported a robust annual revenue increase to NOK 510.89 million from NOK 401.65 million, marking a growth of 27%. Despite this surge, the company saw a slight dip in net income year-over-year, from NOK 107.63 million to NOK 105.43 million. Looking ahead, SmartCraft is poised for significant earnings expansion with an anticipated growth rate of 22.6% annually over the next three years, outpacing the Norwegian market's average of 7.3%. This performance is underpinned by strong R&D commitments and strategic initiatives aimed at harnessing emerging tech trends which could further solidify its market position amidst competitive pressures and evolving industry dynamics.

- Delve into the full analysis health report here for a deeper understanding of SmartCraft.

Explore historical data to track SmartCraft's performance over time in our Past section.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of approximately SEK3.29 billion.

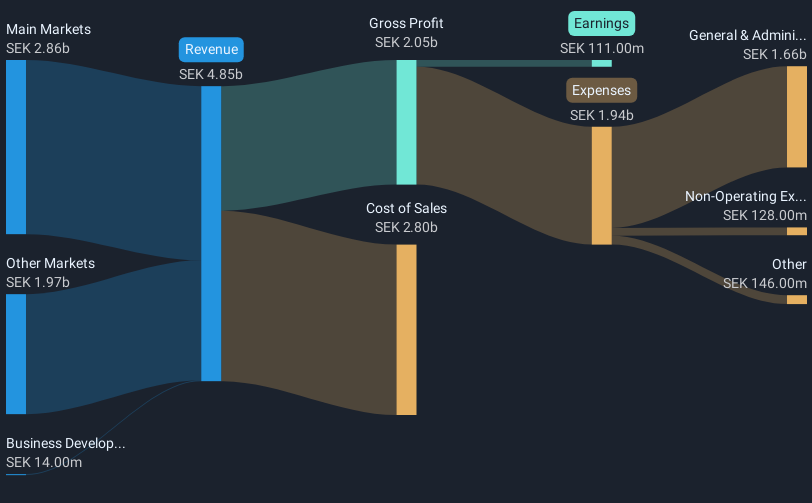

Operations: The company generates revenue primarily from Main Markets, which contributed SEK2.90 billion, and Other Markets, which added SEK2 billion. Business Development and Services accounted for SEK31 million.

Despite facing a challenging year with net income dropping to SEK 111 million from SEK 214 million, Hanza's revenue growth remains robust at 10.9% annually, outpacing the Swedish market average of 4.4%. This resilience is underlined by significant R&D investments, positioning the company well within Europe's tech sector for potential future gains. Moreover, earnings are expected to surge by an impressive 26.8% per year over the next three years, suggesting a strong rebound might be on the horizon despite current profit margin pressures at 2.3%, down from last year’s 5.2%.

- Navigate through the intricacies of Hanza with our comprehensive health report here.

Review our historical performance report to gain insights into Hanza's's past performance.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market capitalization of €399.93 million.

Operations: The company generates revenue primarily from its Drug Delivery Systems segment, which accounts for €69.67 million.

Formycon AG's recent trajectory reflects a challenging fiscal landscape, with a significant shift from a net income of EUR 75.8 million to a net loss of EUR 125.67 million in the latest reporting period. Despite these financial headwinds, the company's commitment to innovation remains robust, underscored by its strategic focus on developing biosimilars like ustekinumab and aflibercept which have secured regulatory nods across major markets including the U.S. and Europe. This pivot towards high-demand therapeutic areas could potentially recalibrate Formycon’s financial health, evidenced by an expected annual revenue growth rate of 18.4% and forecasted earnings growth at an impressive 77.62% annually, signaling potential for recovery and growth amidst prevailing market challenges.

- Click here to discover the nuances of Formycon with our detailed analytical health report.

Gain insights into Formycon's historical performance by reviewing our past performance report.

Make It Happen

- Navigate through the entire inventory of 222 European High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives