- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

Exploring 3 Undervalued European Small Caps With Insider Action

Reviewed by Simply Wall St

Amid recent declines in European markets, highlighted by a 2.57% drop in the STOXX Europe 600 Index, investors are closely monitoring small-cap stocks for potential opportunities. As economic sentiment shows resilience despite stagnant growth and inflation hitting the ECB's target, identifying stocks with strong fundamentals and insider activity can be key to navigating these challenging conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Instabank | 10.2x | 2.9x | 24.12% | ★★★★★☆ |

| Foxtons Group | 11.2x | 1.0x | 37.09% | ★★★★★☆ |

| Kitwave Group | 13.0x | 0.3x | 45.35% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 2.98% | ★★★★☆☆ |

| CVS Group | 44.5x | 1.3x | 39.05% | ★★★★☆☆ |

| Yubico | 32.5x | 4.6x | -10.59% | ★★★☆☆☆ |

| Oxford Instruments | 39.8x | 2.1x | 19.53% | ★★★☆☆☆ |

| A.G. BARR | 19.4x | 1.8x | 46.32% | ★★★☆☆☆ |

| SmartCraft | 44.4x | 7.9x | 33.29% | ★★★☆☆☆ |

| WithSecure Oyj | NA | 1.5x | -13.64% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Sabre Insurance Group (LSE:SBRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sabre Insurance Group is a UK-based insurer specializing in underwriting motor insurance, including taxi and motorcycle coverage, with a market capitalization of approximately £0.22 billion.

Operations: Sabre Insurance Group generates revenue primarily from its core segments, with a notable contribution from segment adjustments amounting to £213.03 million. The company has experienced fluctuations in net income margin, reaching 18.48% by mid-2025, after a decline to 6.02% in mid-2023. Operating expenses have varied significantly, impacting net profitability over the observed periods.

PE: 9.3x

Sabre Insurance Group, a small player in the European insurance sector, recently reported increased net income of £18.92 million for H1 2025, up from £15.11 million the previous year. Basic earnings per share rose to £0.0764, reflecting financial resilience despite challenging market conditions. Insider confidence is evident with recent share repurchases beginning July 2025 under a shareholder-approved program targeting up to 10% of issued capital. The company also announced an interim dividend of 3.4 pence per share for September payout and appointed David Neave as Non-executive Director on August 1, bringing extensive industry expertise to its board amid strategic growth plans focusing on profitability over volume through 2030 targets.

- Dive into the specifics of Sabre Insurance Group here with our thorough valuation report.

Understand Sabre Insurance Group's track record by examining our Past report.

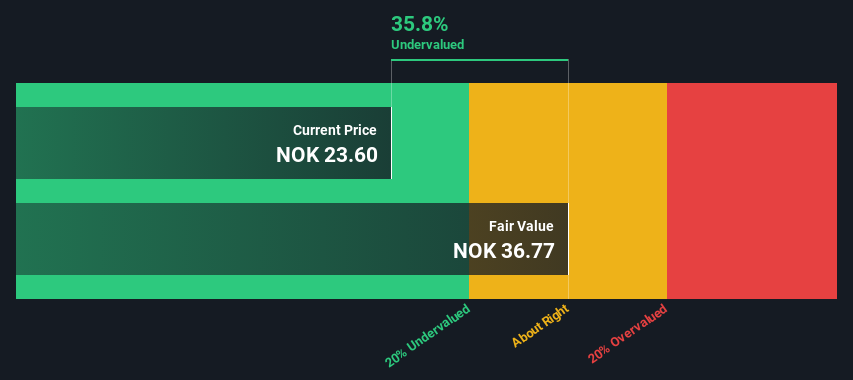

SmartCraft (OB:SMCRT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SmartCraft is a technology company providing software solutions for the construction and building industry, with a market cap of NOK 2.5 billion.

Operations: SmartCraft generates revenue primarily through its sales, with a notable gross profit margin reaching 55.60% as of December 2024. The company's cost structure includes significant expenses in operating, non-operating, and depreciation & amortization areas, with operating expenses being a major component. Over recent periods, the net income margin has shown variability but reached 17.88% by March 2025.

PE: 44.4x

SmartCraft, a small company in Europe, is attracting attention due to its potential for growth despite some challenges. The firm anticipates earnings growth of 27% annually, although its profit margins have slipped from 26.2% to 17.9%. Recent executive changes saw Hanna Konyi stepping in as interim CEO, bringing her successful track record from Bygglet. SmartCraft's strategic moves include launching SmartCraft Spark and Congrid's BIM feature to enhance industry efficiency. Insider confidence is evident with share repurchases totaling NOK 51.77 million by March 2025, indicating belief in the company's prospects amidst volatile share prices and reliance on external funding sources.

- Unlock comprehensive insights into our analysis of SmartCraft stock in this valuation report.

Gain insights into SmartCraft's historical performance by reviewing our past performance report.

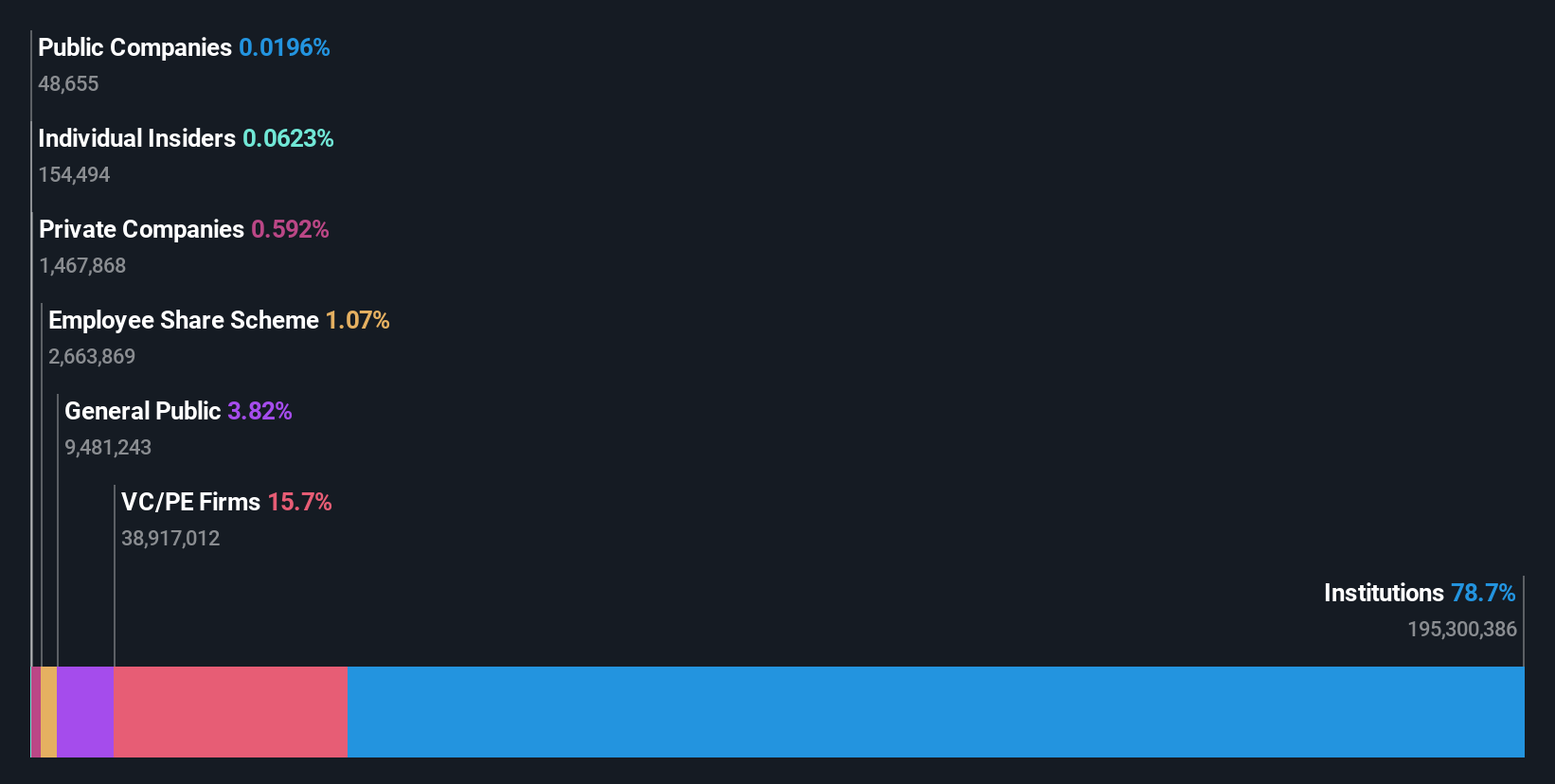

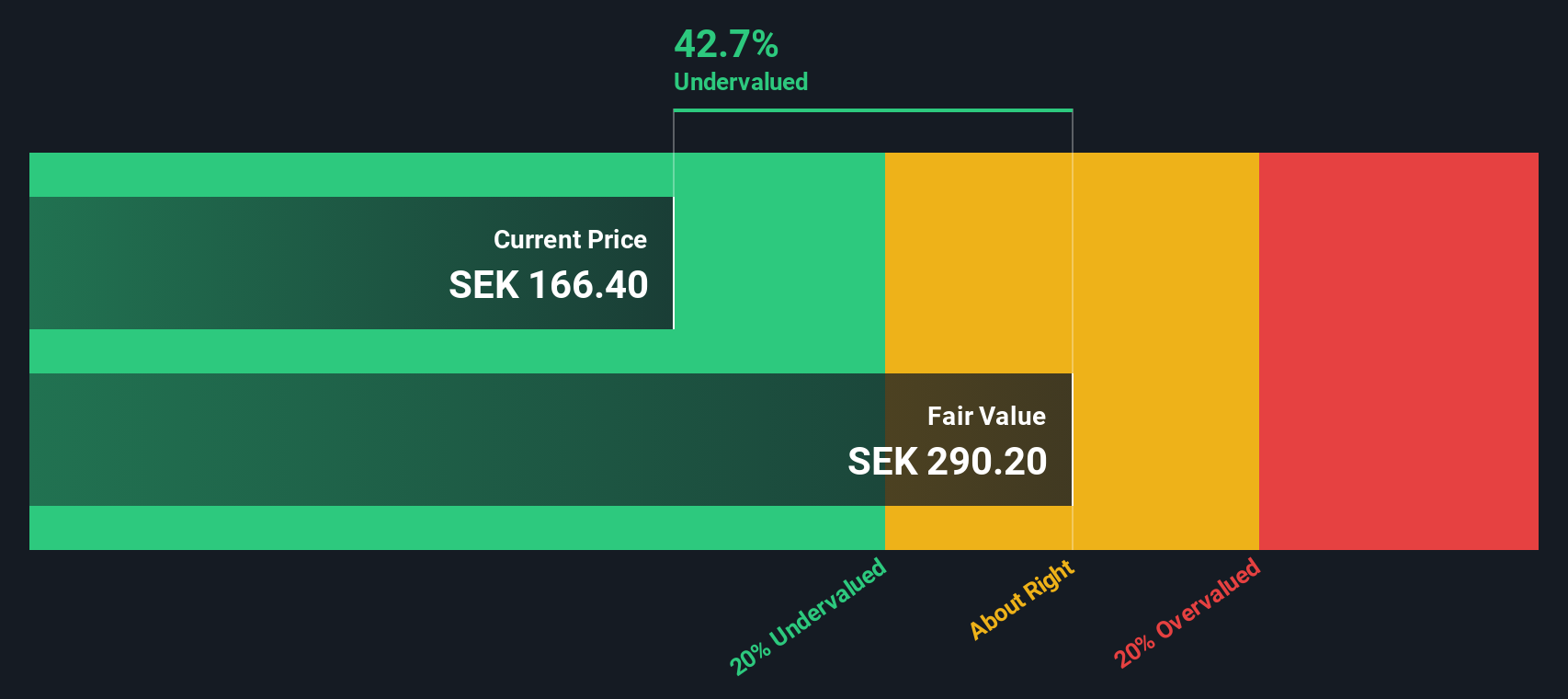

MilDef Group (OM:MILDEF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MilDef Group specializes in providing rugged IT solutions and computer hardware, with a focus on defense and security sectors, and has a market cap of approximately SEK 2.50 billion.

Operations: The company generates revenue primarily from its computer hardware segment, with the latest reported revenue at SEK 1.39 billion. As of the most recent period, it experienced a gross profit margin of 47.65%. Operating expenses include significant allocations to sales and marketing as well as research and development activities. Non-operating expenses have also been notably high in recent periods, impacting overall profitability.

PE: -35.8x

MilDef Group, a player in the defense tech sector, is catching attention with its recent contract to enhance NATO interoperability for the Swedish Army, valued initially at SEK 139 million. Despite a drop in net income to SEK 9.2 million in Q2 2025 from SEK 23.3 million last year, sales climbed to SEK 383.3 million from SEK 301.5 million. Insider confidence is evident with board changes and strategic partnerships like Kongsberg Defence & Aerospace, indicating potential growth prospects despite high volatility and external borrowing risks.

- Click here and access our complete valuation analysis report to understand the dynamics of MilDef Group.

Evaluate MilDef Group's historical performance by accessing our past performance report.

Make It Happen

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 48 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MILDEF

MilDef Group

Develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives