3 Stocks That Might Be Trading Up To 35.5% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility due to geopolitical tensions and concerns over consumer spending, with major indices like the S&P 500 facing declines despite early gains. Amidst these fluctuations, investors are increasingly focused on identifying stocks that might be undervalued relative to their intrinsic value estimates, offering potential opportunities for those looking to navigate the uncertain economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥1862.00 | ¥3721.49 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK270.00 | SEK535.44 | 49.6% |

| América Móvil. de (BMV:AMX B) | MX$14.89 | MX$29.71 | 49.9% |

| Aoshikang Technology (SZSE:002913) | CN¥29.51 | CN¥58.56 | 49.6% |

| CD Projekt (WSE:CDR) | PLN221.70 | PLN441.47 | 49.8% |

| Food & Life Companies (TSE:3563) | ¥4154.00 | ¥8301.16 | 50% |

| BalnibarbiLtd (TSE:3418) | ¥1067.00 | ¥2117.17 | 49.6% |

| Hanwha Aerospace (KOSE:A012450) | ₩682000.00 | ₩1354744.21 | 49.7% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.69 | CN¥37.15 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16320.00 | ₩32574.92 | 49.9% |

Let's explore several standout options from the results in the screener.

Esprinet (BIT:PRT)

Overview: Esprinet S.p.A. is a company that, along with its subsidiaries, focuses on the wholesale distribution of IT products and consumer electronics across Italy, Spain, Portugal, and other parts of Europe, with a market cap of €241.67 million.

Operations: Esprinet generates revenue through the wholesale distribution of IT products and consumer electronics across Italy, Spain, Portugal, and other European regions.

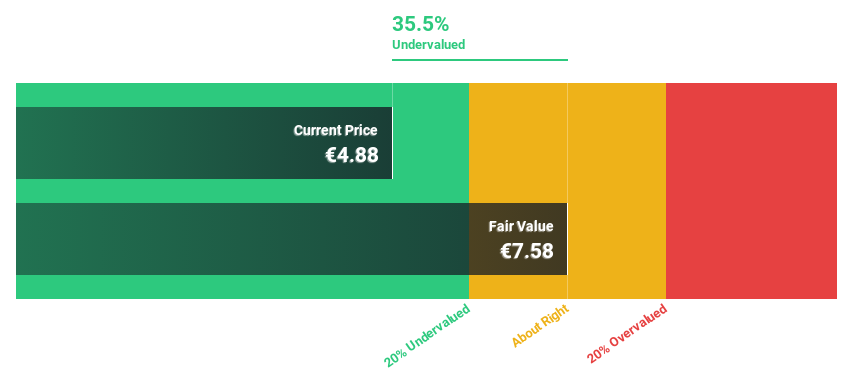

Estimated Discount To Fair Value: 35.5%

Esprinet is trading at €4.89, significantly below its estimated fair value of €7.58, offering potential upside. Analysts agree on a 33.7% price increase potential, despite low forecasted Return on Equity of 7.9%. Earnings are expected to grow significantly at 22.12% annually, outpacing the Italian market's growth rate of 7.8%. However, interest payments aren't well covered by earnings and revenue growth is modest at 4.6% per year but exceeds the Italian market's average.

- The growth report we've compiled suggests that Esprinet's future prospects could be on the up.

- Click here to discover the nuances of Esprinet with our detailed financial health report.

Fiskars Oyj Abp (HLSE:FSKRS)

Overview: Fiskars Oyj Abp manufactures and markets consumer products for indoor and outdoor living across Europe, the Americas, and the Asia Pacific, with a market cap of €1.26 billion.

Operations: Fiskars generates revenue from its Vita segment, which accounts for €605.10 million, and the Fiskars segment, contributing €547.20 million.

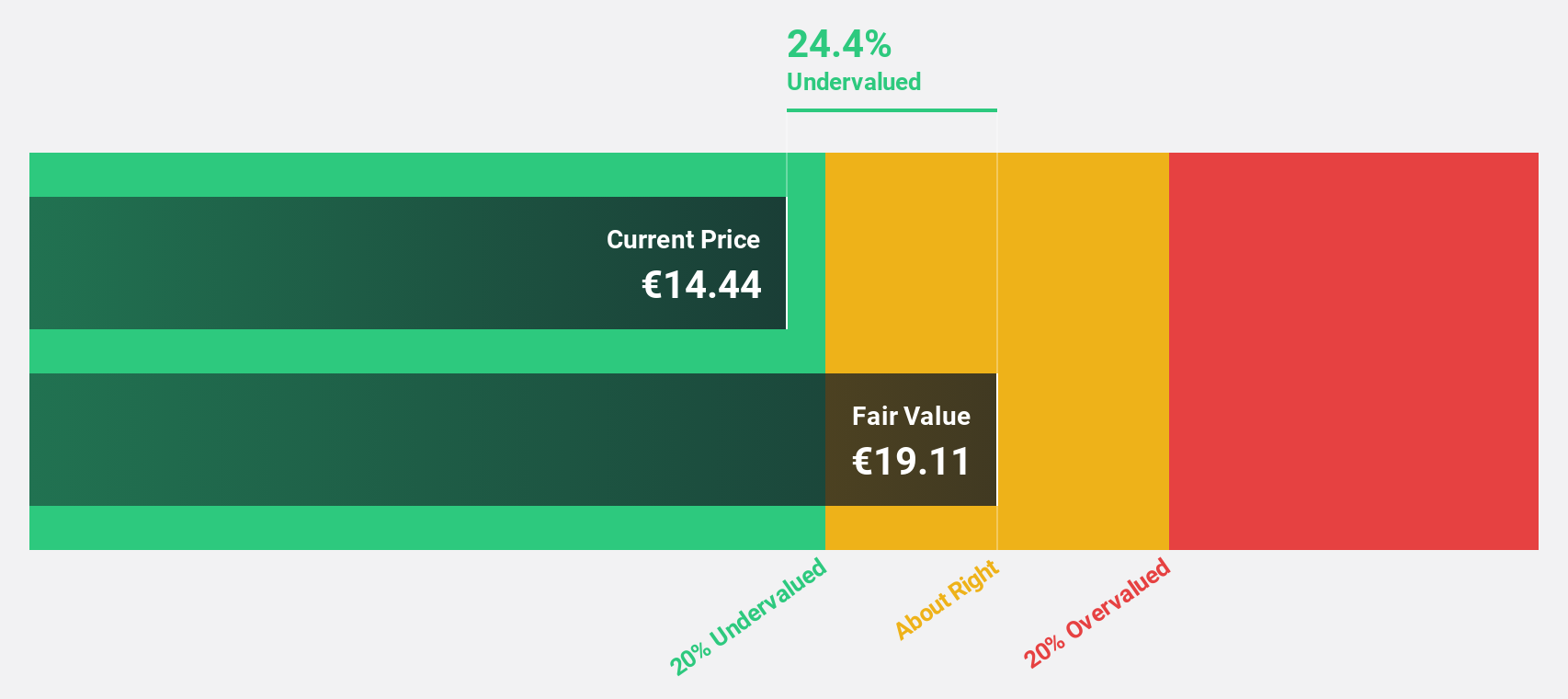

Estimated Discount To Fair Value: 21.9%

Fiskars Oyj Abp is trading at €15.64, below its estimated fair value of €20.02, indicating potential undervaluation based on cash flows. Despite a challenging net profit margin drop from 6.2% to 2.3%, earnings are forecast to grow significantly at over 40% annually, surpassing the Finnish market's growth rate of 11.7%. However, interest payments aren't well covered by earnings and the dividend yield of 5.37% isn't supported by free cash flows or earnings.

- Our growth report here indicates Fiskars Oyj Abp may be poised for an improving outlook.

- Take a closer look at Fiskars Oyj Abp's balance sheet health here in our report.

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions to the construction industry in Norway, Sweden, and Finland, with a market cap of NOK4.34 billion.

Operations: SmartCraft ASA's revenue is derived from providing software solutions tailored for the construction sectors in Norway, Sweden, and Finland.

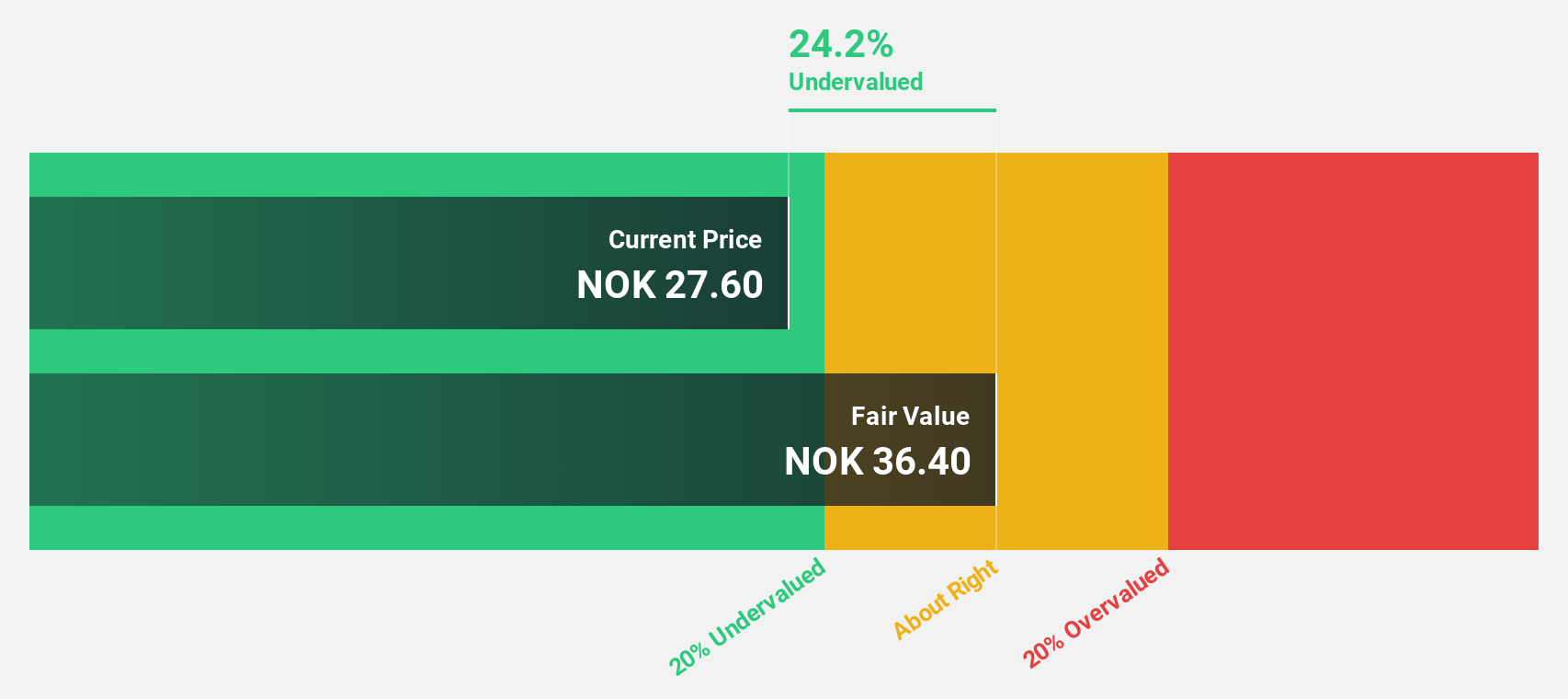

Estimated Discount To Fair Value: 30.4%

SmartCraft ASA, trading at NOK26, is significantly undervalued with a fair value estimate of NOK37.36. Analysts forecast its earnings to grow 21.5% annually, outpacing the Norwegian market's growth rate of 8.3%. Despite recent net income decline from NOK 28.25 million to NOK 25.53 million in Q4 2024, revenue rose to NOK136.25 million from NOK106.96 million year-over-year, highlighting robust cash flow potential amidst executive changes and strategic presentations in Nordic tech forums.

- In light of our recent growth report, it seems possible that SmartCraft's financial performance will exceed current levels.

- Dive into the specifics of SmartCraft here with our thorough financial health report.

Where To Now?

- Delve into our full catalog of 916 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Esprinet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PRT

Esprinet

Engages in the wholesale distribution of information technology (IT) products and consumer electronics in Italy, Spain, Portugal, and rest of Europe.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)