Elliptic Laboratories ASA's (OB:ELABS) P/S Is Still On The Mark Following 33% Share Price Bounce

Elliptic Laboratories ASA (OB:ELABS) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

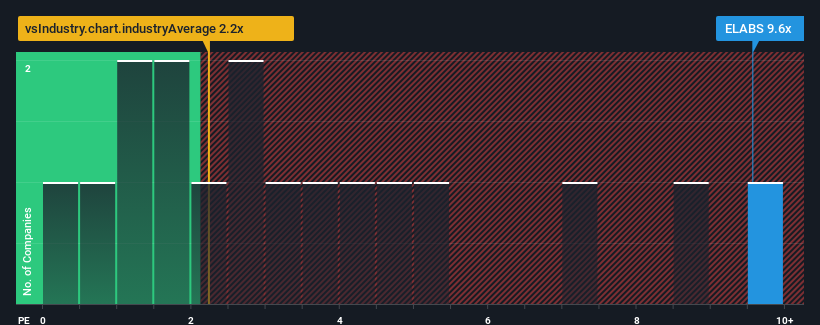

Since its price has surged higher, you could be forgiven for thinking Elliptic Laboratories is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.6x, considering almost half the companies in Norway's Software industry have P/S ratios below 1.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

We've discovered 1 warning sign about Elliptic Laboratories. View them for free.View our latest analysis for Elliptic Laboratories

What Does Elliptic Laboratories' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Elliptic Laboratories has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Elliptic Laboratories.Is There Enough Revenue Growth Forecasted For Elliptic Laboratories?

In order to justify its P/S ratio, Elliptic Laboratories would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 93% gain to the company's top line. Pleasingly, revenue has also lifted 142% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 39% each year as estimated by the dual analysts watching the company. With the industry only predicted to deliver 12% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Elliptic Laboratories' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Elliptic Laboratories' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Elliptic Laboratories maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Elliptic Laboratories that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Elliptic Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ELABS

Elliptic Laboratories

An artificial intelligence (AI) software company, engages in the provision of AI virtual smart sensors for the smartphone, laptop, Internet of Things, and automotive markets in Norway, the United States, China, South Korea, Taiwan, and Japan.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026