As European markets experience a positive shift, with the pan-European STOXX Europe 600 Index climbing by 3.44% amid easing tariff concerns and an accelerated economic growth rate in the eurozone, investors are keeping a close eye on high-growth tech stocks that could capitalize on this momentum. In such dynamic market conditions, identifying promising tech stocks often involves evaluating companies with strong innovation potential and adaptability to current economic trends.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 20.83% | 67.27% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Digital Value (BIT:DGV)

Simply Wall St Growth Rating: ★★★★★★

Overview: Digital Value S.p.A. offers IT solutions and services in Italy, with a market capitalization of €253.53 million.

Operations: The company specializes in IT solutions and services within Italy. Its business model focuses on delivering technology-driven solutions to various sectors, leveraging its expertise to drive digital transformation for clients.

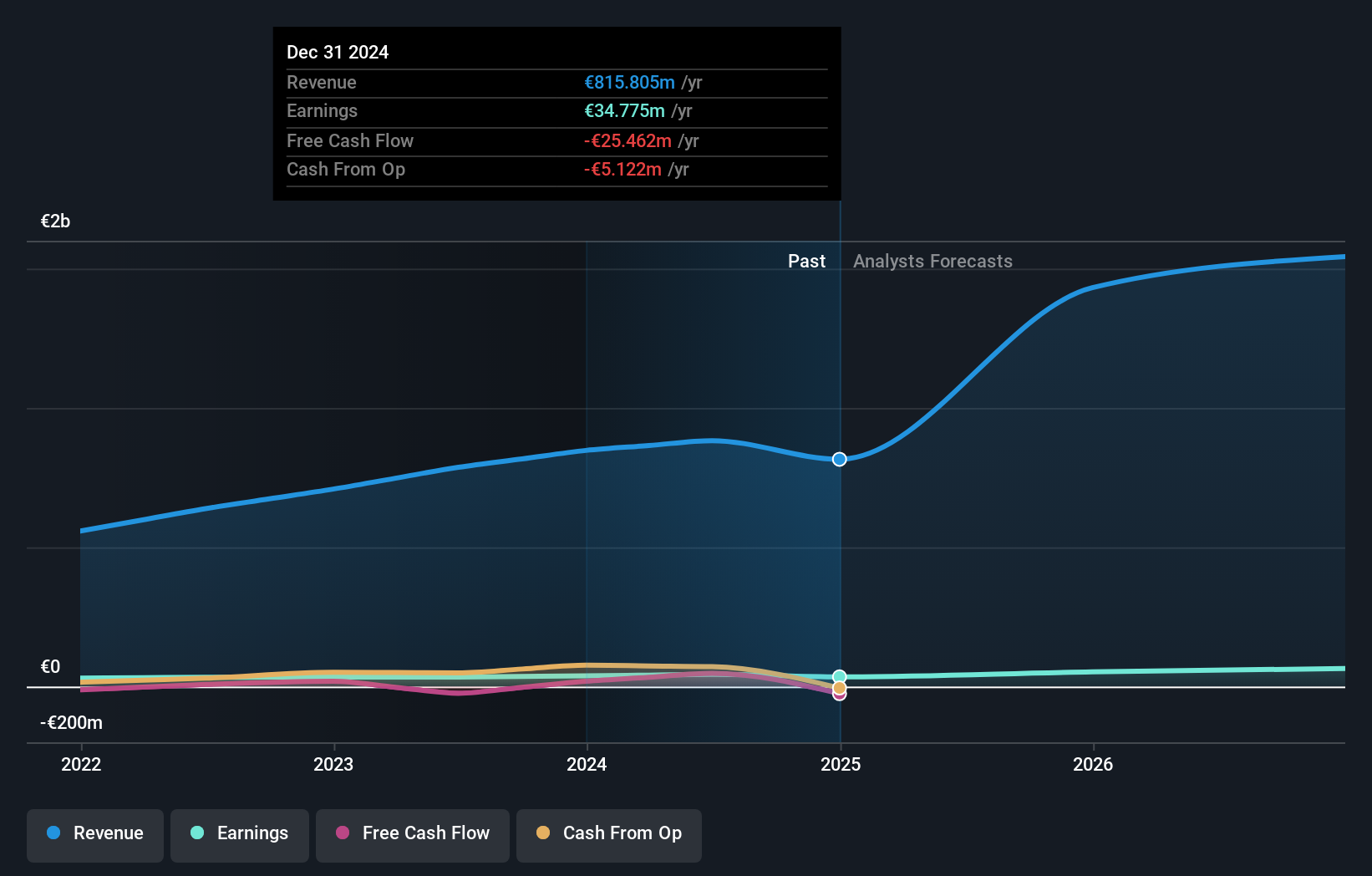

Despite a challenging year where Digital Value S.p.A. saw its revenue dip slightly from €847.39 million to €815.81 million, the company's forward-looking indicators remain robust, particularly in earnings growth and R&D commitment. With an annualized earnings increase projected at 29.5%—significantly outpacing the Italian market average of 7.4%—Digital Value is poised for recovery. The firm's dedication to innovation is evident from its R&D spending trends, crucial for staying competitive in the rapidly evolving tech landscape of Europe where technological advancement is key to maintaining and gaining market share.

- Click here and access our complete health analysis report to understand the dynamics of Digital Value.

Explore historical data to track Digital Value's performance over time in our Past section.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atea ASA specializes in delivering IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market capitalization of NOK16.44 billion.

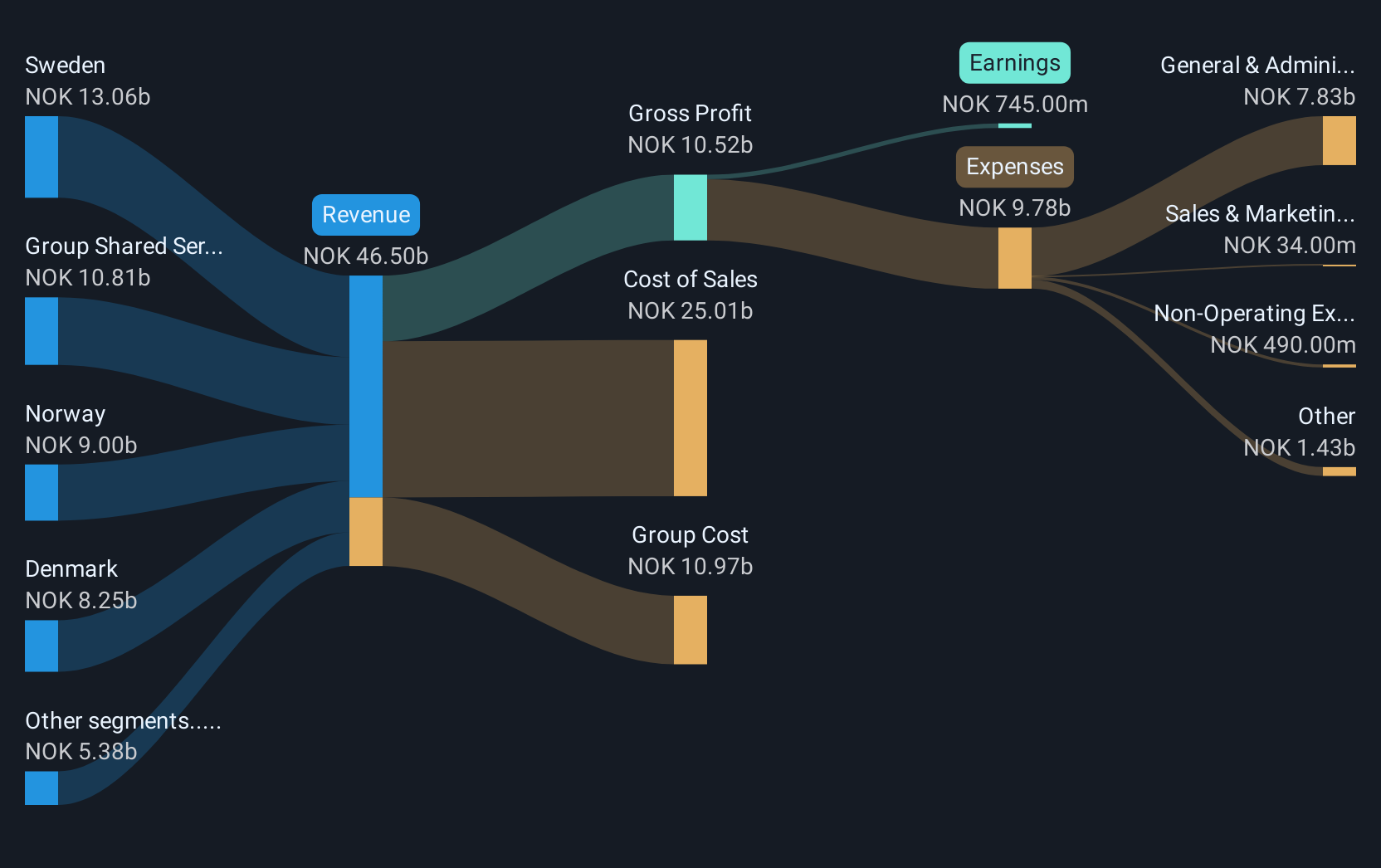

Operations: With a focus on IT infrastructure, Atea ASA generates revenue primarily from Norway (NOK 9 billion), Sweden (NOK 13.06 billion), and Denmark (NOK 8.25 billion). The company's operations in Finland and the Baltics contribute NOK 3.57 billion and NOK 1.80 billion respectively, while Group Shared Services adds NOK 10.81 billion to the total revenue stream.

Atea ASA, navigating through a fluctuating market, reported a revenue increase to NOK 8.55 billion from NOK 7.61 billion year-over-year in Q1 2025, despite a dip in net income from NOK 192 million to NOK 162 million. The company's commitment to shareholder value is evident with a robust dividend distribution of NOK 7.00 per share for the year. With an expected annual earnings growth of 21.3%, Atea is outpacing the Norwegian market's average and demonstrating resilience and potential in the competitive IT sector, especially given its high forecasted Return on Equity at 25.9%. This performance underscores Atea’s capability to adapt and potentially thrive amidst industry challenges.

- Navigate through the intricacies of Atea with our comprehensive health report here.

Evaluate Atea's historical performance by accessing our past performance report.

Nemetschek (XTRA:NEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nemetschek SE develops software solutions for architecture, engineering, construction, media, and entertainment sectors globally with a market cap of €13.96 billion.

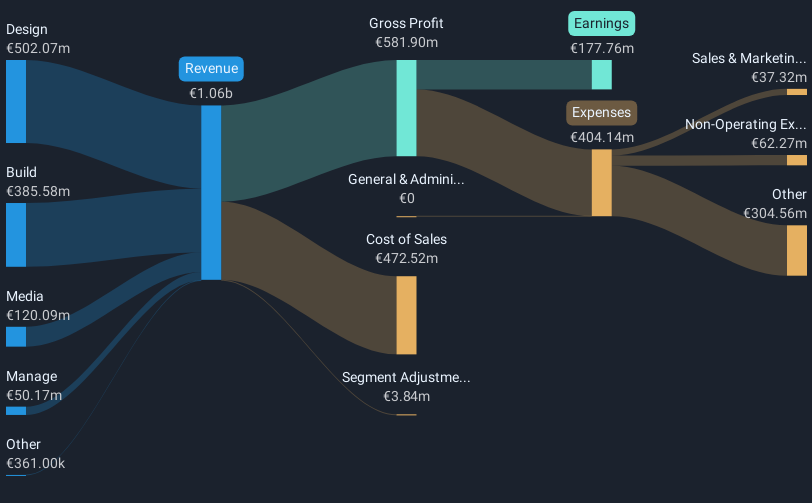

Operations: Nemetschek SE generates revenue primarily from its Design segment (€502.07 million), followed by the Build (€385.58 million) and Media (€120.09 million) segments, with a smaller contribution from the Manage segment (€50.17 million). The company operates across Germany, Europe, the Americas, and Asia Pacific, focusing on providing software solutions tailored to architecture, engineering, construction, media, and entertainment industries globally.

Nemetschek SE, a European tech entity, showcases robust growth with its recent Q1 2025 earnings revealing a revenue jump to €285.89 million from €227.33 million year-over-year. This performance is complemented by an 18% forecast in annual earnings growth, outpacing the German market's average of 15.8%. Strategic leadership changes, including the appointment of Sunil Pandita as Chief Division Officer for the Planning & Design Division, underscore a commitment to digital transformation and innovation in software solutions. The company's focus on R&D is evident from its consistent investment in this area, positioning it well for sustained technological advancement and market competitiveness.

Key Takeaways

- Explore the 223 names from our European High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nemetschek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NEM

Nemetschek

Provides software solutions for architecture, engineering, construction, operation, and media industries in Germany, the rest of Europe, the Americas, the Asia Pacific, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives