- China

- /

- Electronic Equipment and Components

- /

- SZSE:002362

3 Growth Companies With Insider Ownership And Earnings Up To 86%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating corporate earnings and geopolitical tensions, investors are keenly observing how these factors influence stock performance. With the Federal Reserve holding interest rates steady amidst persistent inflation concerns, and AI competition creating volatility in tech stocks, the search for resilient growth companies becomes paramount. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

We'll examine a selection from our screener results.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

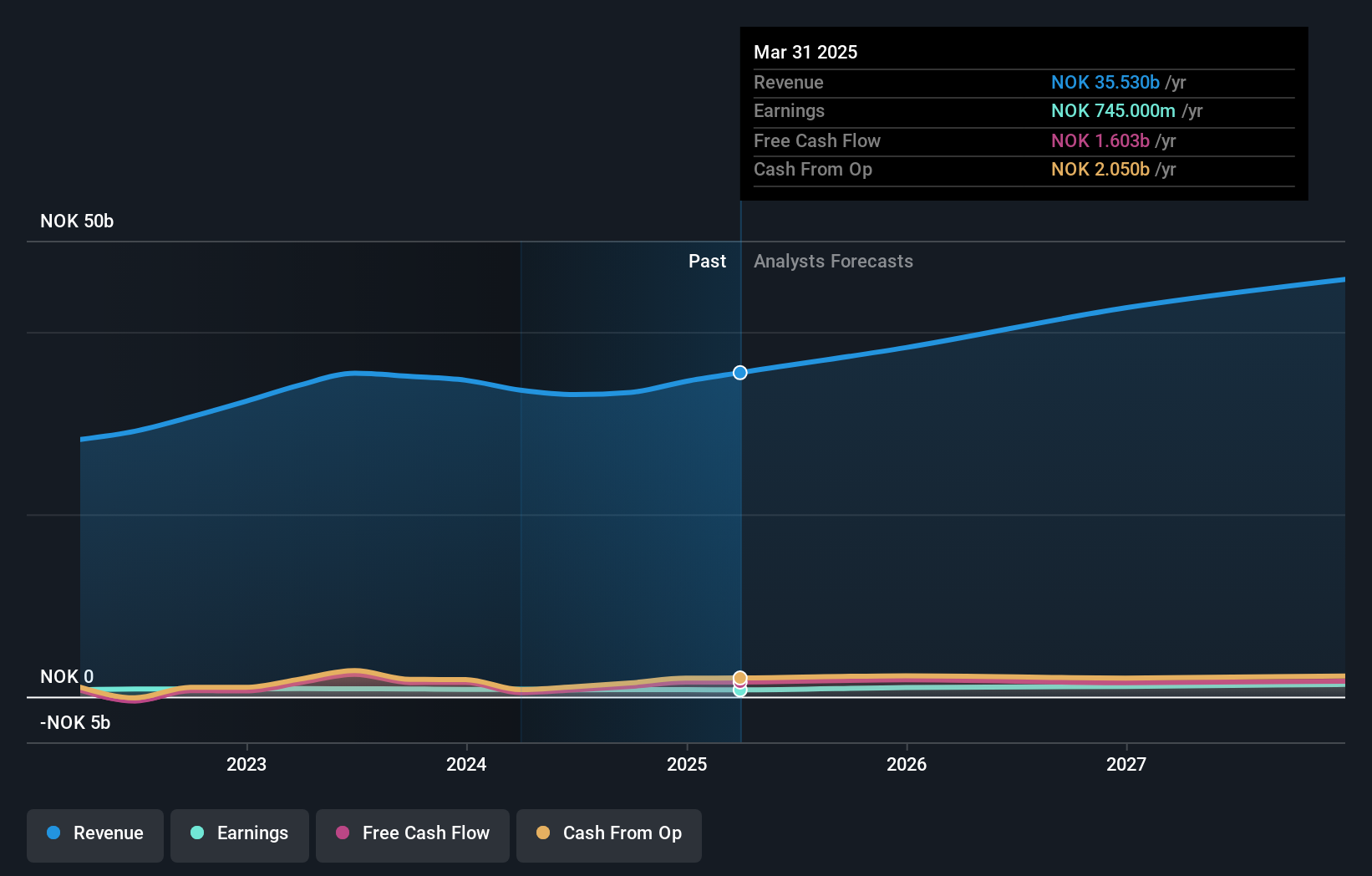

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK16.10 billion.

Operations: The company's revenue segments include NOK8.28 billion from Norway, NOK12.44 billion from Sweden, NOK7.37 billion from Denmark, NOK3.62 billion from Finland, and NOK1.76 billion from the Baltics, with additional contributions of NOK9.20 billion from Group Shared Services.

Insider Ownership: 29.0%

Earnings Growth Forecast: 19% p.a.

Atea's earnings are forecast to grow at 19% annually, outpacing the Norwegian market's 9%. However, its dividend yield of 4.77% is not well covered by earnings. Trading significantly below estimated fair value suggests potential undervaluation. Revenue growth is expected at 8% per year, exceeding the market average but not reaching high growth thresholds. No substantial insider trading activity has been reported recently, indicating stability in insider sentiment.

- Unlock comprehensive insights into our analysis of Atea stock in this growth report.

- In light of our recent valuation report, it seems possible that Atea is trading behind its estimated value.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Ronds Science & Technology Incorporated Company offers machinery condition monitoring solutions for predictive maintenance in China and has a market cap of CN¥3.85 billion.

Operations: Anhui Ronds Science & Technology generates its revenue through providing solutions for machinery condition monitoring within the predictive maintenance sector in China.

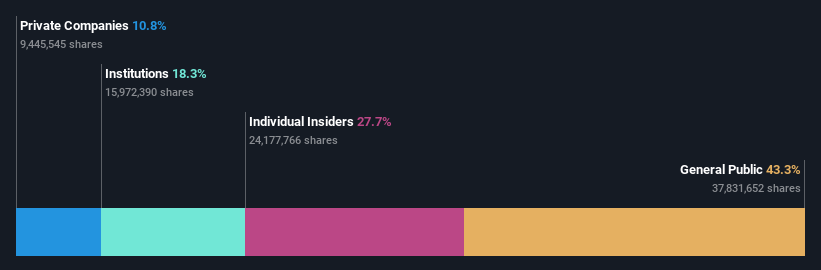

Insider Ownership: 27.7%

Earnings Growth Forecast: 30.8% p.a.

Anhui Ronds Science & Technology is poised for significant growth, with revenue projected to increase by 22.6% annually, surpassing the Chinese market average. Earnings are expected to grow at a robust 30.8%, also exceeding market expectations. The company's price-to-earnings ratio of 47x aligns closely with the industry average, indicating fair valuation. Despite no recent insider trading activity, its low future return on equity forecast of 13.7% may be a concern for some investors.

- Get an in-depth perspective on Anhui Ronds Science & Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Anhui Ronds Science & Technology is trading beyond its estimated value.

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanwang Technology Co., Ltd. develops handwriting recognition, optical character recognition, and handwriting input products for both domestic and international markets, with a market capitalization of CN¥6.33 billion.

Operations: Hanwang Technology Co., Ltd. generates revenue through its handwriting recognition, optical character recognition, and handwriting input products across both domestic and international markets.

Insider Ownership: 28.2%

Earnings Growth Forecast: 86.3% p.a.

Hanwang Technology is positioned for substantial growth, with revenue expected to rise by 25.3% annually, outpacing the Chinese market average of 13.3%. Despite a volatile share price recently, the company is forecasted to become profitable within three years and achieve an impressive earnings growth rate of 86.31% per year. At CES 2025, Hanwang showcased its innovative EMC-Touch chip and Penstar digital notebook brand, emphasizing its technological prowess and global expansion ambitions.

- Take a closer look at Hanwang TechnologyLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hanwang TechnologyLtd's share price might be on the cheaper side.

Make It Happen

- Click through to start exploring the rest of the 1475 Fast Growing Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hanwang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002362

Hanwang TechnologyLtd

Provides handwriting recognition, optical character recognition, and handwriting input products in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives