- Finland

- /

- Professional Services

- /

- HLSE:SOLWERS

Solwers Oyj And 2 Other European Penny Stocks To Watch

Reviewed by Simply Wall St

As European markets experience a lift, with the STOXX Europe 600 Index climbing 2.77% amid easing trade tensions, investors are keenly eyeing opportunities across various sectors. Penny stocks, despite their vintage nomenclature, continue to capture attention for their potential to offer growth at accessible price points. These smaller or newer companies can present compelling opportunities when backed by strong financials and stability, making them an intriguing area of focus for those looking beyond established market giants.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.17 | SEK2.08B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.70 | SEK248.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.76 | SEK281.94M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.63 | PLN123.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.9746 | €32.64M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.12 | €61.49M | ✅ 1 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.07 | €23.56M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 434 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Solwers Oyj (HLSE:SOLWERS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Solwers Oyj offers design and project management services across Finland, Sweden, and Poland with a market cap of €23.60 million.

Operations: The company's revenue from engineering services amounts to €78.28 million.

Market Cap: €23.6M

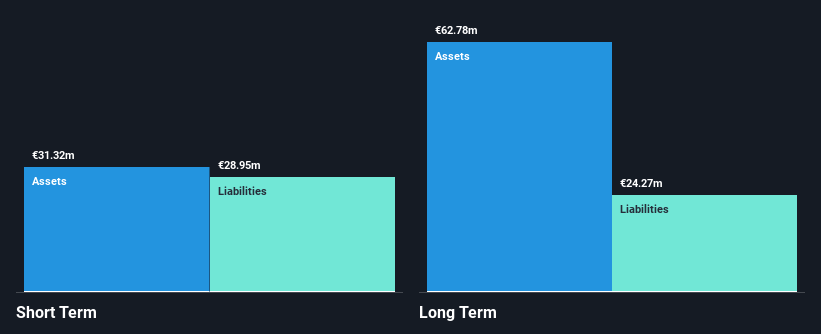

Solwers Oyj, with a market cap of €23.60 million, offers design and project management services across Finland, Sweden, and Poland. The company reported revenue of €78.28 million for 2024 but experienced a significant decline in net income to €1.14 million from the previous year. Despite stable weekly volatility and satisfactory debt levels (net debt to equity ratio at 23%), Solwers faces challenges with low return on equity (2.9%) and profit margins (1.5%). Recent changes include appointing Ernst & Young Oy as auditors and revising its Articles of Association to improve procedural flexibility at its recent AGM.

- Click here and access our complete financial health analysis report to understand the dynamics of Solwers Oyj.

- Evaluate Solwers Oyj's prospects by accessing our earnings growth report.

Lokotech Group (OB:LOKO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lokotech Group AS is a management and holding company that provides software and hardware solutions for the crypto industry, with a market cap of NOK206.95 million.

Operations: The company's revenue is derived from its Computer Services segment, totaling NOK3.71 million.

Market Cap: NOK206.95M

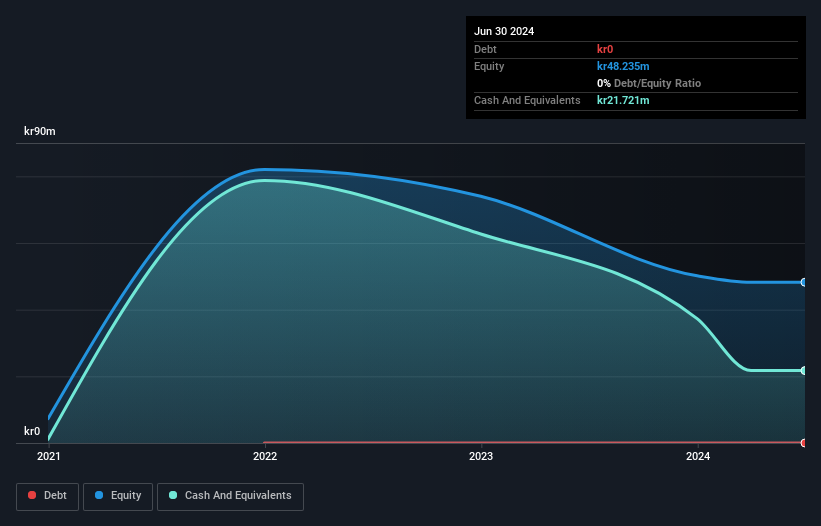

Lokotech Group AS, with a market cap of NOK206.95 million, operates in the crypto industry but remains pre-revenue with sales of NOK3.71 million for 2024. The company is unprofitable, reporting a net loss of NOK25.61 million last year, though losses have slightly decreased from the previous year. Lokotech has no debt and recently filed a follow-on equity offering worth NOK200 million to bolster its financial position. A strategic distribution agreement aims to enhance revenue through mining hardware sales and hosting services, incorporating profit-sharing to leverage market volatility while ensuring stable income during downturns.

- Navigate through the intricacies of Lokotech Group with our comprehensive balance sheet health report here.

- Explore Lokotech Group's analyst forecasts in our growth report.

Kudelski (SWX:KUD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kudelski SA, with a market cap of CHF67.33 million, offers digital access and security solutions for digital television and interactive applications across Switzerland, the United States, France, Germany, Austria, and other international markets.

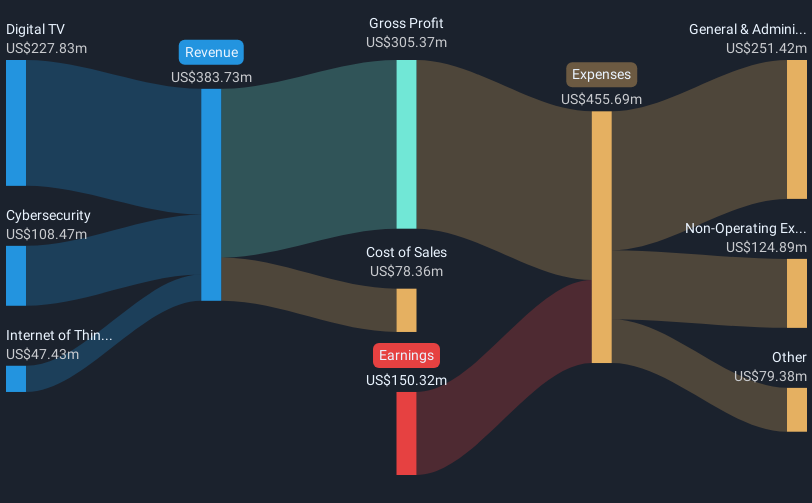

Operations: The company's revenue is primarily derived from three segments: Digital TV ($227.83 million), Cybersecurity ($108.47 million), and the Internet of Things ($47.43 million).

Market Cap: CHF67.33M

Kudelski SA, with a market cap of CHF67.33 million, is navigating challenges in the digital security sector. Despite being unprofitable, its financial structure shows resilience as short-term assets exceed both short and long-term liabilities. The company's debt-to-equity ratio has significantly improved over five years, indicating effective debt management. Recent strategic partnerships and product developments highlight Kudelski's focus on enhancing cybersecurity solutions across various sectors, including AI and GNSS technologies. However, revenue has declined from US$419.31 million to US$393.01 million year-over-year amid restructuring efforts aimed at operational efficiency and cost reduction initiatives impacting workforce numbers.

- Dive into the specifics of Kudelski here with our thorough balance sheet health report.

- Gain insights into Kudelski's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Get an in-depth perspective on all 434 European Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Solwers Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SOLWERS

Solwers Oyj

Provides design and project management services in Finland, Sweden, and Poland.

Good value with adequate balance sheet.

Market Insights

Community Narratives