- Norway

- /

- Real Estate

- /

- OB:SBO

Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets rally with smaller-cap indexes outperforming their larger counterparts, the focus on small-cap stocks has intensified amid positive economic indicators such as falling U.S. jobless claims and rising home sales. In this dynamic environment, identifying promising small-cap companies—often overlooked in favor of their larger peers—requires a keen eye for those with robust fundamentals and potential to capitalize on current market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

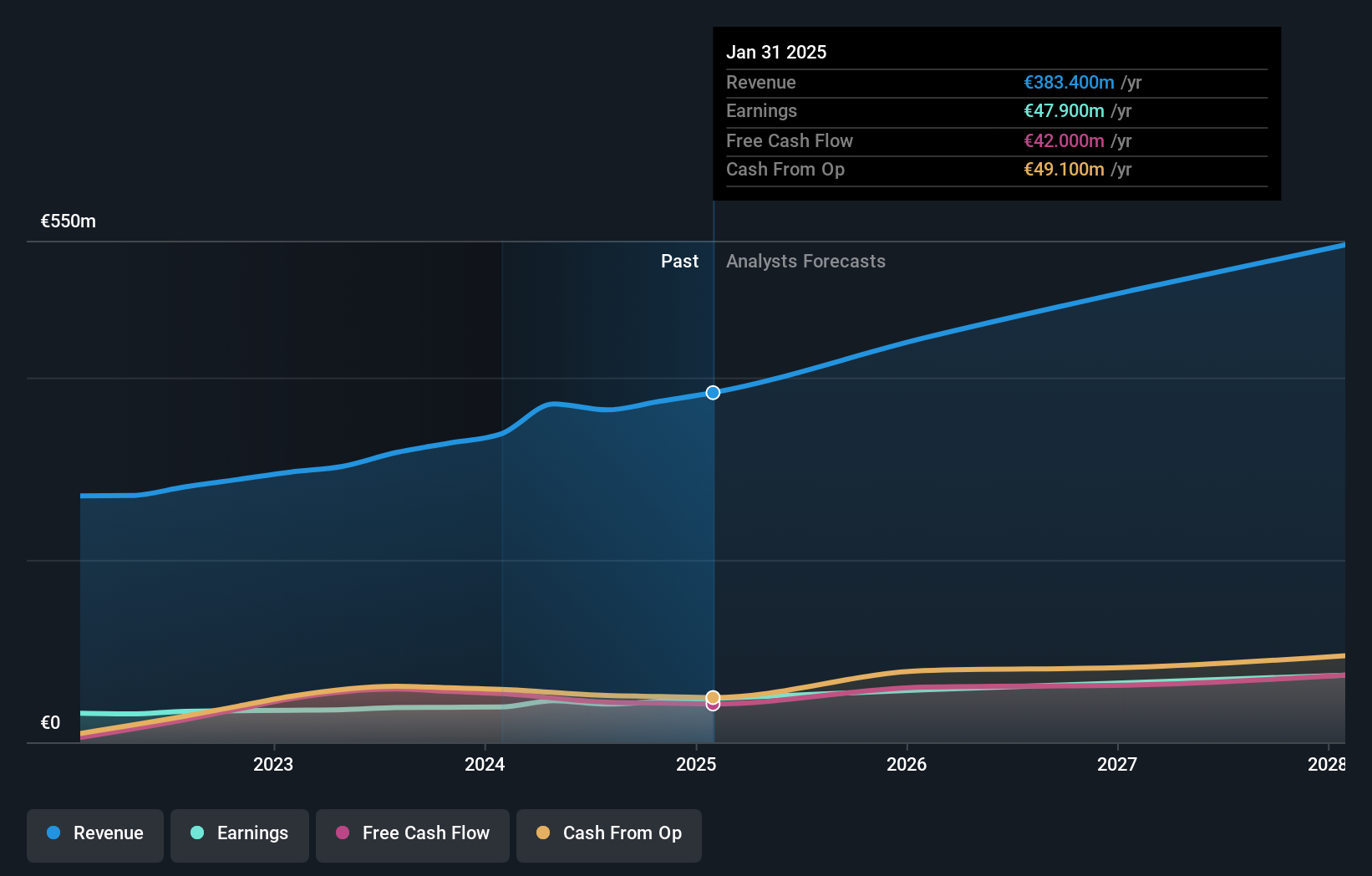

Puuilo Oyj (HLSE:PUUILO)

Simply Wall St Value Rating: ★★★★★★

Overview: Puuilo Oyj operates a discount retail chain in Finland with a market capitalization of €763.89 million.

Operations: The company's primary revenue stream is from its retail department stores, generating €364.50 million.

Puuilo Oyj, a notable player in the retail sector, showcases promising financial health with its interest payments well covered by EBIT at 13 times. This Finnish retailer has seen its earnings grow by 10.3% over the past year, outpacing the broader Multiline Retail industry which saw a -12.7% shift. The company's net debt to equity ratio stands at a satisfactory 23.1%, reflecting prudent financial management as it reduced from 165.6% to 65% over five years. Despite revising down its sales forecast for 2024 slightly, Puuilo remains an attractive value proposition trading at about 32% below estimated fair value.

- Click here to discover the nuances of Puuilo Oyj with our detailed analytical health report.

Gain insights into Puuilo Oyj's historical performance by reviewing our past performance report.

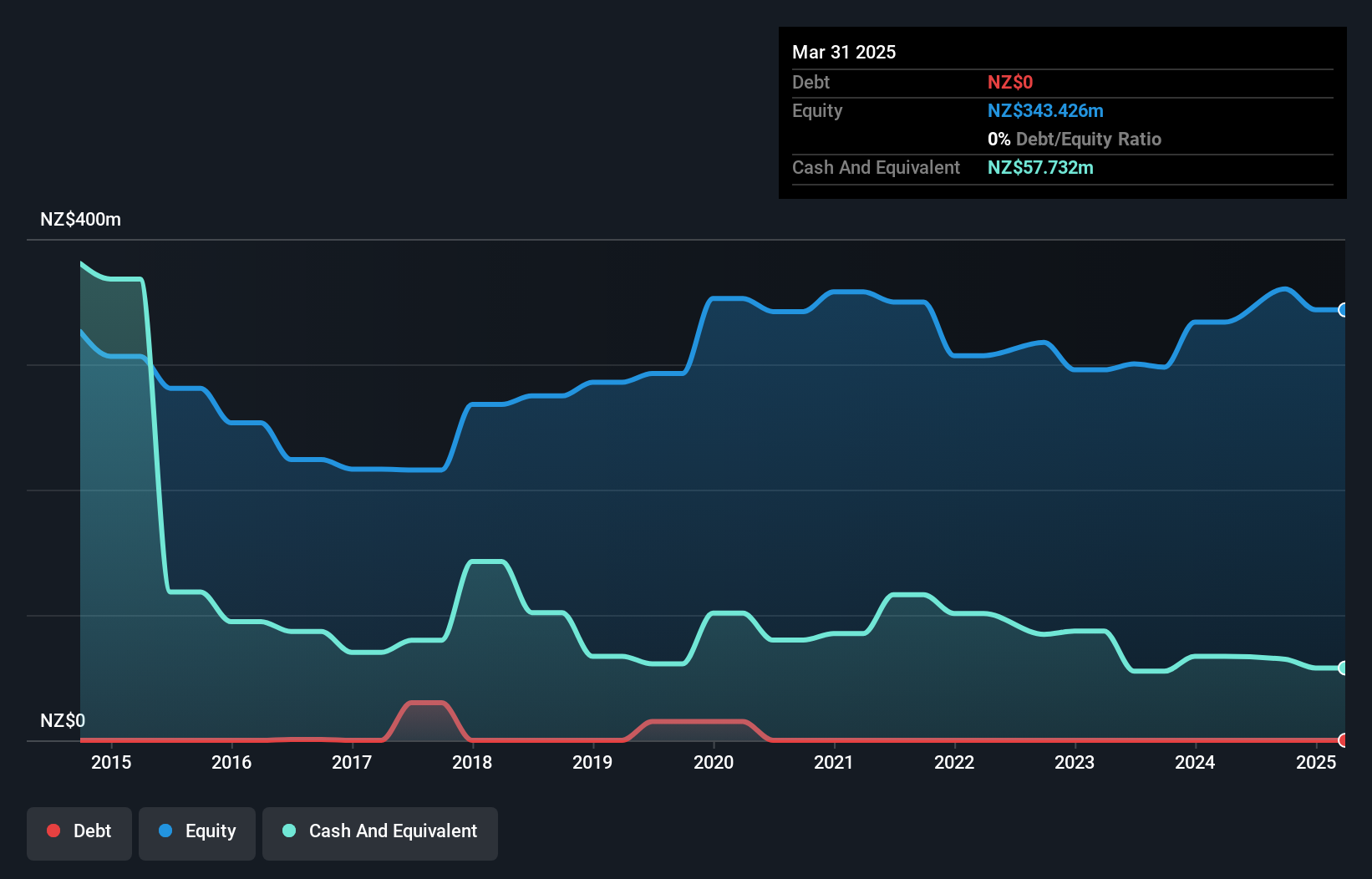

Tower (NZSE:TWR)

Simply Wall St Value Rating: ★★★★★★

Overview: Tower Limited offers general insurance products in New Zealand and the Pacific Islands, with a market capitalization of NZ$497.12 million.

Operations: Tower Limited generates revenue primarily from its general insurance products, with NZ$420.53 million coming from New Zealand and NZ$31.12 million from the Pacific Islands.

Tower Limited shines with impressive financials, reporting a net income of NZ$74.29 million for the year ending September 2024, bouncing back from a loss of NZ$1.02 million the previous year. The company boasts high-quality earnings and operates debt-free, eliminating concerns about interest payments. With its price-to-earnings ratio at 14.7x, Tower is valued attractively compared to the broader NZ market's 20.3x average. Earnings surged by 128%, outpacing industry growth of 33%. Future prospects look promising with earnings forecasted to grow by over 20% annually, supported by positive free cash flow and robust profitability metrics.

- Dive into the specifics of Tower here with our thorough health report.

Understand Tower's track record by examining our Past report.

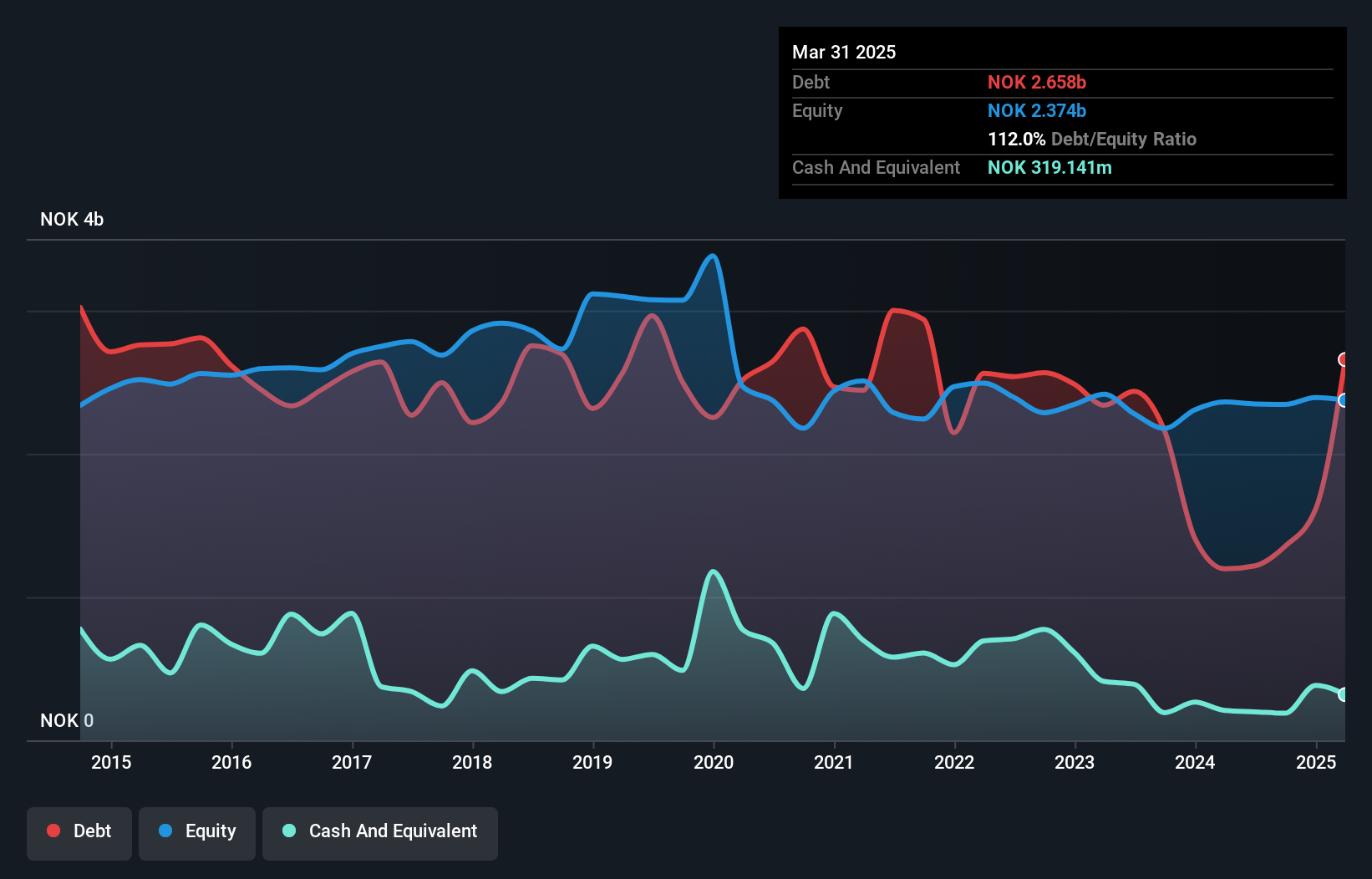

Selvaag Bolig (OB:SBO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Selvaag Bolig ASA is a housing development company focused on the development, construction, and sale of residential properties in Greater Oslo, Bergen, Stavanger, Trondheim, and Stockholm with a market cap of NOK3.05 billion.

Operations: Selvaag Bolig generates revenue primarily from its housing development segment, which accounts for NOK3.26 billion.

Selvaag Bolig, a nimble player in the real estate sector, offers an intriguing mix of financial metrics and operational performance. The company's price-to-earnings ratio sits at 12.8x, undercutting the industry average of 16.5x, suggesting potential value for investors. Despite high debt levels with a net debt to equity ratio at 49.7%, Selvaag's ability to cover interest payments remains robust. Over five years, its debt-to-equity has improved from 81.4% to 57.8%. Recent earnings show a net loss of NOK 4.98 million for Q3 compared to last year's profit but overall nine-month earnings remain positive at NOK 130 million.

- Click to explore a detailed breakdown of our findings in Selvaag Bolig's health report.

Explore historical data to track Selvaag Bolig's performance over time in our Past section.

Next Steps

- Unlock our comprehensive list of 4633 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SBO

Selvaag Bolig

A housing development company, engages in the development, construction, and sale of residential properties in Greater Oslo, Bergen, Stavanger, Trondheim, and Stockholm.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives