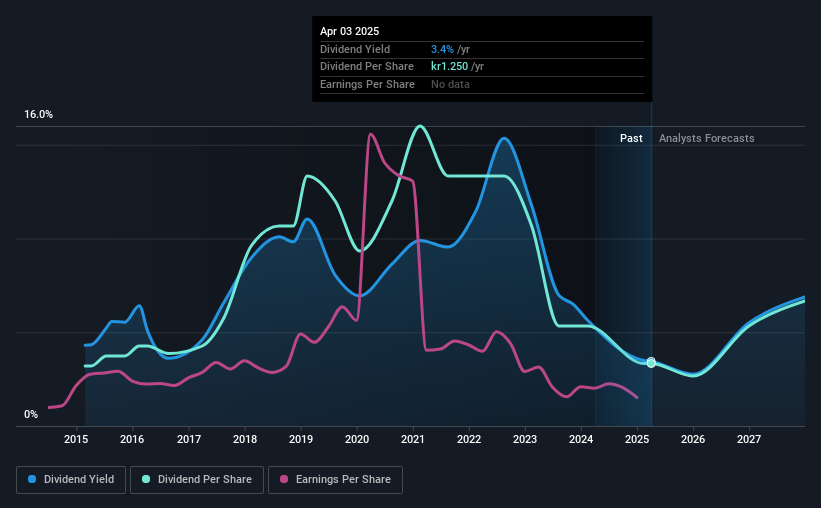

The board of Selvaag Bolig ASA (OB:SBO) has announced that it will be paying its dividend of NOK1.25 on the 8th of May, an increased payment from last year's comparable dividend. The payment will take the dividend yield to 3.4%, which is in line with the average for the industry.

Selvaag Bolig's Projected Earnings Seem Likely To Cover Future Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last dividend, Selvaag Bolig is earning enough to cover the payment, but then it makes up 141% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

The next year is set to see EPS grow by 80.5%. If the dividend continues on this path, the payout ratio could be 39% by next year, which we think can be pretty sustainable going forward.

See our latest analysis for Selvaag Bolig

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was NOK1.20 in 2015, and the most recent fiscal year payment was NOK1.25. Dividend payments have been growing, but very slowly over the period. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Selvaag Bolig's EPS has fallen by approximately 23% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Selvaag Bolig's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Selvaag Bolig's payments are rock solid. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Selvaag Bolig has 2 warning signs (and 1 which is concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SBO

Selvaag Bolig

A housing development company, engages in the development, construction, and sale of residential properties in Greater Oslo, Bergen, Stavanger, Trondheim, and Stockholm.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives