- Norway

- /

- Real Estate

- /

- OB:ENTRA

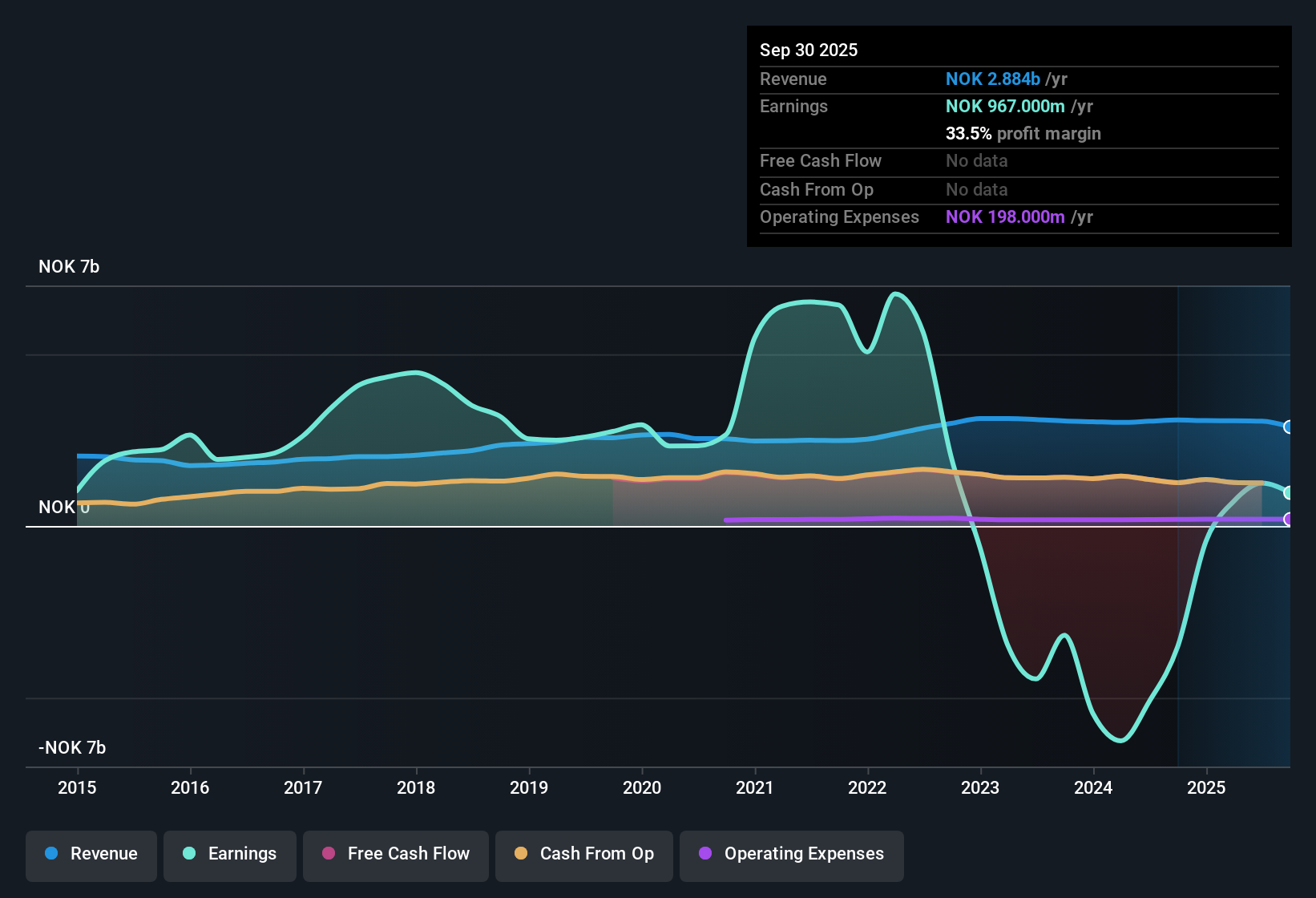

Entra (OB:ENTRA) Profitability Boosted by NOK 583M One-Off Gain, Challenging Quality Narrative

Reviewed by Simply Wall St

Entra (OB:ENTRA) swung to profitability over the past year, reporting improved net profit margins even as earnings have declined at an average rate of 53.3% per year over the last five years. Looking ahead, revenue growth is projected at 2.7% per year, matching the broader Norwegian market. However, anticipated earnings growth is expected to fall short of the market’s 13.8% annual rate. Notably, the recent results included a one-off gain of NOK 583.0 million, an adjustment that helped bolster the bottom line amid ongoing concerns around premium valuation and the quality of reported earnings.

See our full analysis for Entra.Next, we will see how this set of results stacks up against the key narratives investors are following for Entra, highlighting where consensus holds and where views may shift.

See what the community is saying about Entra

PE Ratio Sits Above Peers

- Entra’s price-to-earnings ratio is 17.4x, which is higher than both its industry (15.4x) and peer group (17.1x). This makes it one of the pricier options in European real estate at the moment.

- Analysts' consensus view points out that for the company to justify this premium, it would need to reach a 23.0x PE on projected 2028 earnings if revenue rises to NOK 3.3 billion and earnings to NOK 1.4 billion.

- Despite the premium valuation, the current share price of 118.8 nearly matches the analyst consensus price target of 124.2. This suggests limited near-term upside based on standard valuation methods.

- This creates an interesting contrast because the stock trades above sector averages, yet analyst targets offer little room for further price appreciation.

- For a full breakdown of the consensus narrative shaping these expectations and what it could mean for Entra if targets aren’t met, check out the official analyst consensus insights. 📊 Read the full Entra Consensus Narrative.

One-Off Gain Inflates Margins

- Entra’s latest results were boosted by a one-off gain of NOK 583.0 million, making the company appear more profitable than if only standard recurring performance were considered.

- Analysts' consensus view highlights that while profit margins are forecast to rise from 40.9% to 41.9% over three years, critics question whether true underlying margin growth can be sustained without further extraordinary income.

- Skepticism is reinforced by the backdrop of a 53.3% per year earnings decline across the past five years, meaning that recurring income trends still lag behind the next stage of the bullish narrative.

- The ongoing debate centers on how much weight investors should place on adjusted results versus GAAP figures, with consensus analysts urging caution on extrapolating recent margin improvement.

Vacancy and Sustainability Costs Challenge Outlook

- Persistent vacancies, driven by lower rental income (NOK 770 million, down NOK 83 million year-over-year), signal ongoing threats to long-term revenue as tenants transition to remote or hybrid work and competition increases for quality office space.

- Analysts' consensus view notes that risk factors like high leverage (49.1%) and costly sustainability compliance could weigh on future margins, particularly if stricter ESG regulations require heavy property upgrades.

- Entra’s concentration in Norwegian city offices leaves it exposed if local economic shifts or new workplace trends reduce occupancy. This amplifies the need for active management of debt and capital investments.

- Even as the company attempts to mitigate these pressures through green-certified buildings and cost controls, investors should closely watch execution on sustainability and balance sheet discipline as key determinants of future returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Entra on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others might miss? Share your unique viewpoint and craft your personal narrative in just a few minutes. Do it your way

A great starting point for your Entra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Entra faces headwinds from overvaluation, persistent earnings declines, and heavy balance sheet pressures that cast doubt on its ability to deliver steady long-term returns.

If you want to sidestep those challenges, zero in on financially resilient stocks with strong fundamentals by checking out our solid balance sheet and fundamentals stocks screener (1985 results), your shortcut to companies better positioned for sustained health and future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ENTRA

Entra

Develops real estate properties in Oslo, Bergen, Drammen, Sandvika, and Stavanger.

Very low risk with concerning outlook.

Similar Companies

Market Insights

Community Narratives