- Poland

- /

- Capital Markets

- /

- WSE:DRF

Uncovering Opportunities: I.M.D. International Medical Devices And 2 More European Penny Stocks

Reviewed by Simply Wall St

As the European market experiences a modest rise, with major indices like Italy's FTSE MIB and France's CAC 40 showing notable gains, investors are keenly observing opportunities amid stable interest rates set by the European Central Bank. In this context, penny stocks—despite their somewhat outdated moniker—continue to captivate those seeking potential growth in smaller or newer companies. These stocks can offer a blend of value and growth when supported by strong financial health, making them intriguing prospects for investors interested in uncovering long-term opportunities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.26 | €1.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €233.2M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.09 | PLN108.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.99 | €40.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.23 | €373.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.938 | €31.63M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 330 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

I.M.D. International Medical Devices (BIT:IMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: I.M.D. International Medical Devices S.p.A. operates in the medical device industry and has a market cap of €26.15 million.

Operations: The company generates revenue from its Medical Imaging Systems segment, amounting to €39.74 million.

Market Cap: €26.15M

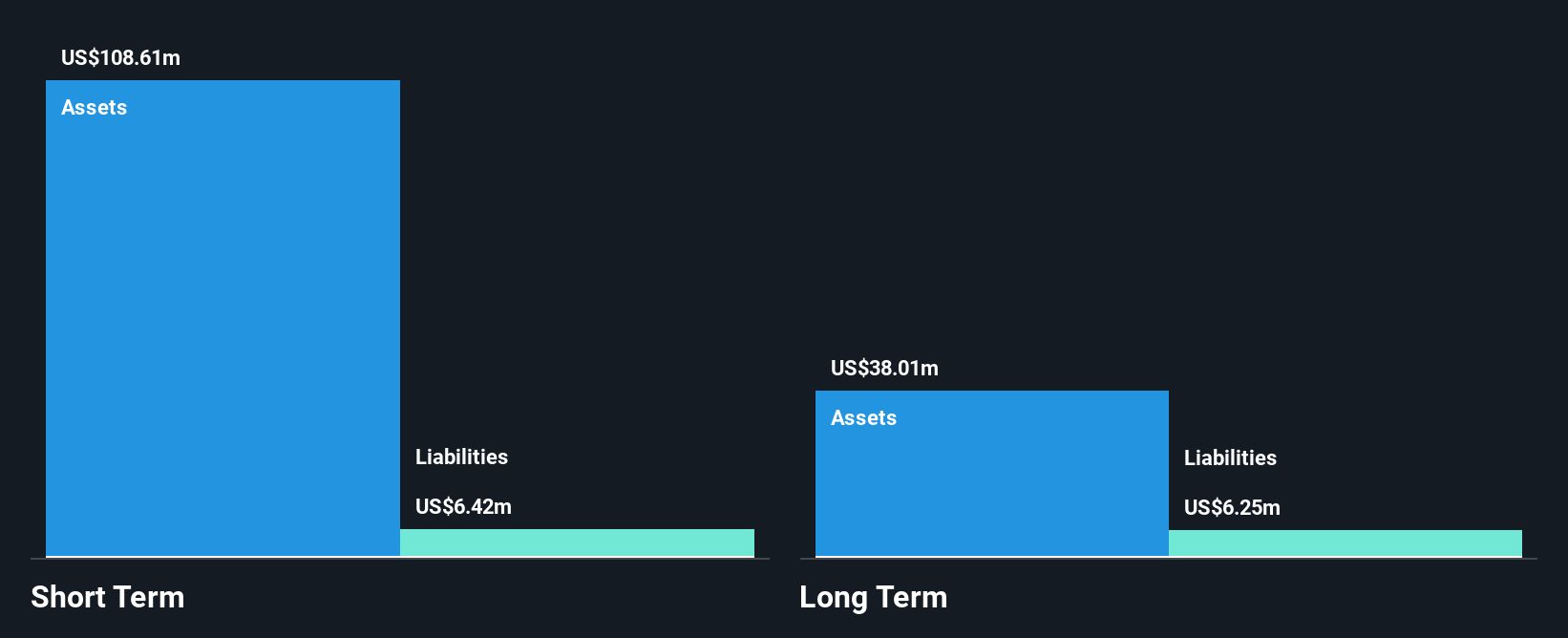

I.M.D. International Medical Devices S.p.A., with a market cap of €26.15 million, operates in the medical device industry and generates revenue from its Medical Imaging Systems segment amounting to €39.74 million. The company has more cash than total debt, with short-term assets exceeding both short- and long-term liabilities, indicating strong financial health. Earnings growth of 0.6% over the past year outpaced the industry decline but remains modest overall, while profit margins have slightly decreased compared to last year. Despite low Return on Equity at 9.6%, high-quality earnings and stable volatility suggest potential resilience in this volatile sector.

- Click to explore a detailed breakdown of our findings in I.M.D. International Medical Devices' financial health report.

- Explore I.M.D. International Medical Devices' analyst forecasts in our growth report.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies for cancer and autoimmune diseases, with a market cap of NOK 489.82 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, totaling $7.89 million.

Market Cap: NOK489.82M

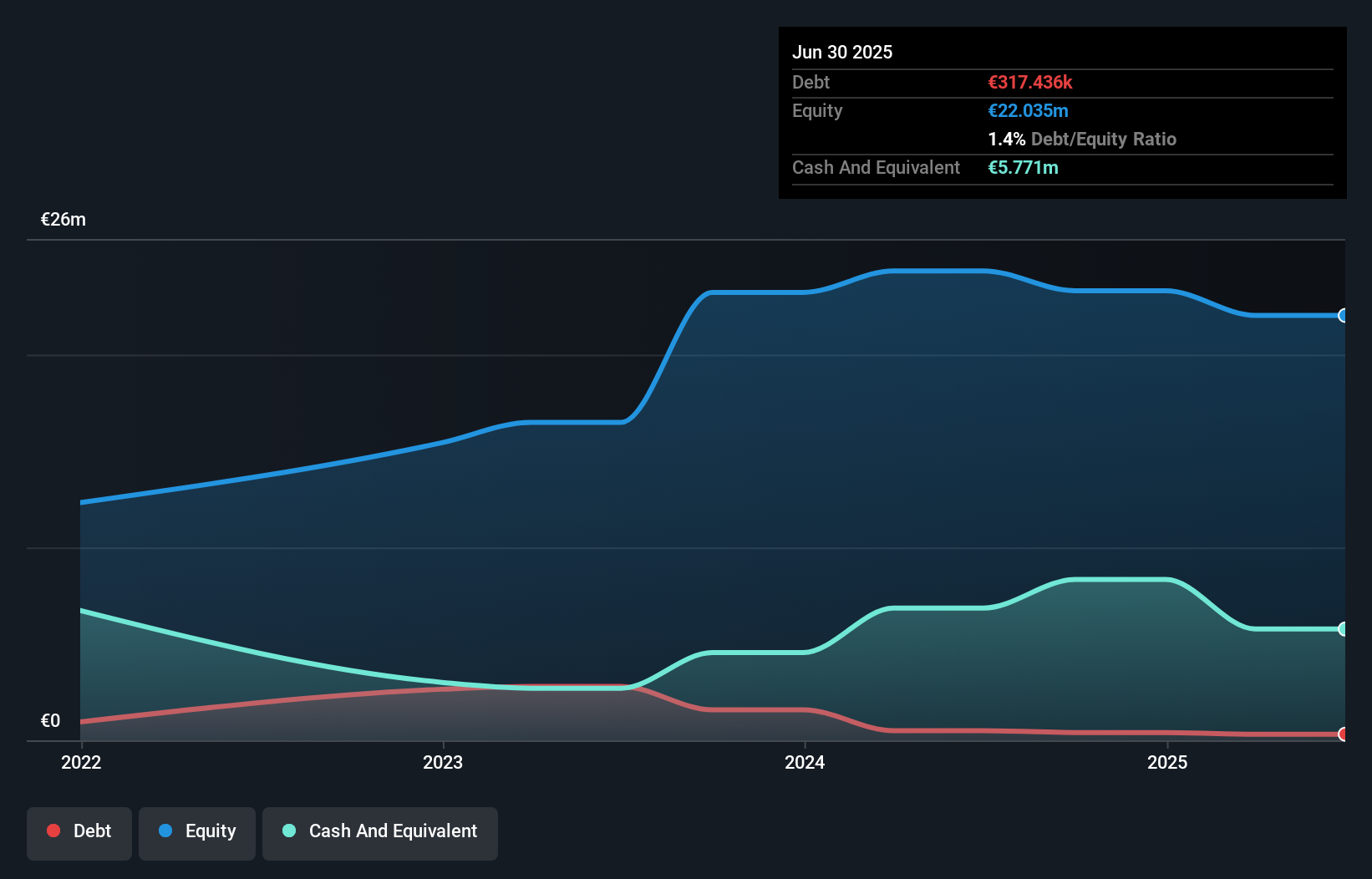

Nykode Therapeutics, with a market cap of NOK 489.82 million, is navigating the challenges typical for clinical-stage biopharmaceutical companies. It remains pre-revenue with minimal earnings reported recently and is unprofitable, showing a negative Return on Equity of -16.61%. The company has no debt and its short-term assets ($72.8M) comfortably cover both short- and long-term liabilities, suggesting a solid financial footing despite ongoing losses that have increased at an annual rate of 51.1% over the past five years. While earnings are forecast to decline by 7.2% annually over the next three years, Nykode maintains sufficient cash runway for more than two years if current expenditure trends continue.

- Dive into the specifics of Nykode Therapeutics here with our thorough balance sheet health report.

- Understand Nykode Therapeutics' earnings outlook by examining our growth report.

Dr.Finance (WSE:DRF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dr.Finance S.A. offers a range of financial products and services to individuals and businesses in Poland, with a market cap of PLN8 million.

Operations: The company's revenue is generated from its Asset Management segment, amounting to PLN9.54 million.

Market Cap: PLN8M

Dr.Finance S.A., with a market cap of PLN8 million, operates in Poland's financial sector. Despite being unprofitable, it reported a modest net income of PLN0.13 million for Q2 2025, marking an improvement from the previous year's loss. The company's short-term assets (PLN569K) exceed its liabilities (PLN248.3K), and it maintains a positive cash flow with a runway exceeding three years even as free cash flow declines annually by 46.7%. However, Dr.Finance faces challenges such as increased weekly volatility and an inexperienced board with an average tenure of 2.2 years amidst declining earnings over five years by 49.1% annually.

- Get an in-depth perspective on Dr.Finance's performance by reading our balance sheet health report here.

- Explore historical data to track Dr.Finance's performance over time in our past results report.

Summing It All Up

- Click this link to deep-dive into the 330 companies within our European Penny Stocks screener.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DRF

Dr.Finance

Provides financial products and services for individuals and businesses in Poland.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives