Investors Aren't Buying ArcticZymes Technologies ASA's (OB:AZT) Revenues

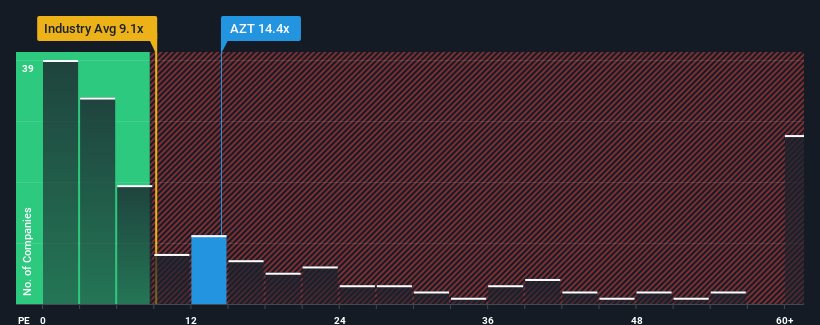

When close to half the companies operating in the Biotechs industry in Norway have price-to-sales ratios (or "P/S") above 27.4x, you may consider ArcticZymes Technologies ASA (OB:AZT) as an attractive investment with its 14.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for ArcticZymes Technologies

How Has ArcticZymes Technologies Performed Recently?

ArcticZymes Technologies has been struggling lately as its revenue has declined faster than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on ArcticZymes Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

ArcticZymes Technologies' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. Regardless, revenue has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 23% per annum during the coming three years according to the only analyst following the company. With the industry predicted to deliver 79% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that ArcticZymes Technologies' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On ArcticZymes Technologies' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of ArcticZymes Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for ArcticZymes Technologies that you need to be mindful of.

If you're unsure about the strength of ArcticZymes Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade ArcticZymes Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AZT

ArcticZymes Technologies

A life sciences company, develops, manufactures, and commercializes recombinant enzymes for use in molecular research, in vitro diagnostics, and biomanufacturing in Norway, Germany, Lithuania, France, Italy, rest of Europe, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives