- Norway

- /

- Metals and Mining

- /

- OB:NHY

Is Norsk Hydro’s Value Story Justified After Recent 11.4% Rally?

Reviewed by Bailey Pemberton

- Wondering if Norsk Hydro could be a hidden value play or if the recent buzz is just noise? Let’s break down the story behind its price and where it might be headed.

- In the past year, Norsk Hydro’s stock has climbed 8.3%, and it has gained 11.4% so far this year, grabbing the attention of investors eyeing both growth and value.

- Much of this momentum has been driven by global trends in aluminum demand and industry moves toward greener production methods. Both factors have kept Norsk Hydro in the news. Notably, the company’s strategies for advancing renewable energy use and expanding its low-carbon product lines have made headlines and could reshape its competitive edge.

- On our rating system, Norsk Hydro scores a 4 out of 6 for value, signaling real potential based on our standard checks. We will dig into what that means and examine whether traditional valuation models capture the full story, plus reveal an alternative approach at the end that could change the way you look at this stock.

Find out why Norsk Hydro's 8.3% return over the last year is lagging behind its peers.

Approach 1: Norsk Hydro Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s terms. This provides a present value estimate based on expected financial performance.

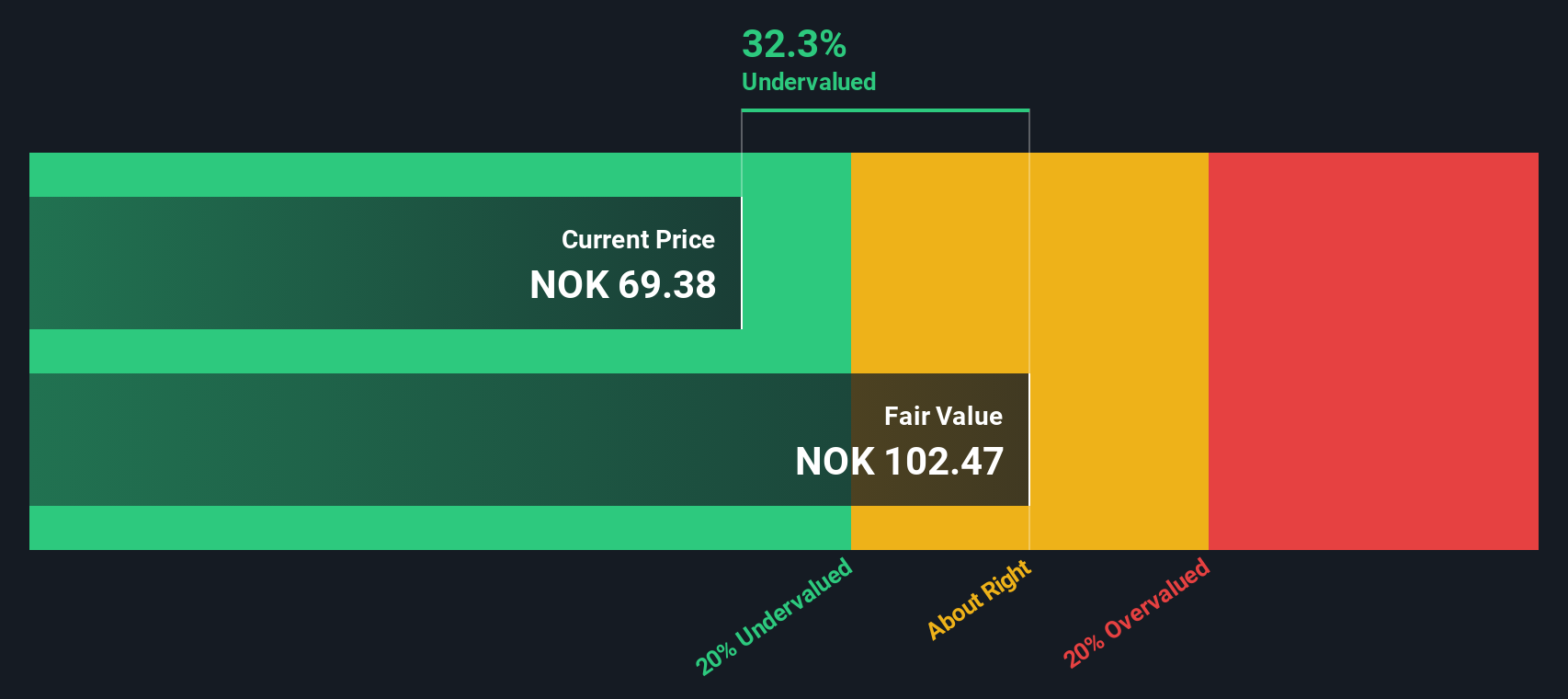

Norsk Hydro currently generates free cash flow of approximately NOK 8.2 billion. Analyst estimates extend up to five years into the future, and based on these and further projections, cash flow is expected to reach roughly NOK 8.5 billion in ten years’ time. These figures remain broadly stable throughout the projection period, which suggests moderate growth and solid operational consistency.

This DCF model uses the "2 Stage Free Cash Flow to Equity" approach, extrapolating out analyst forecasts and discounting those values back to the present. It results in an intrinsic value estimate for Norsk Hydro of NOK 71.27 per share.

When compared with the present share price, this valuation implies the stock is trading at about a 0.1% discount to its fair value. In summary, there is no significant undervaluation or overvaluation.

Result: ABOUT RIGHT

Norsk Hydro is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Norsk Hydro Price vs Earnings (PE)

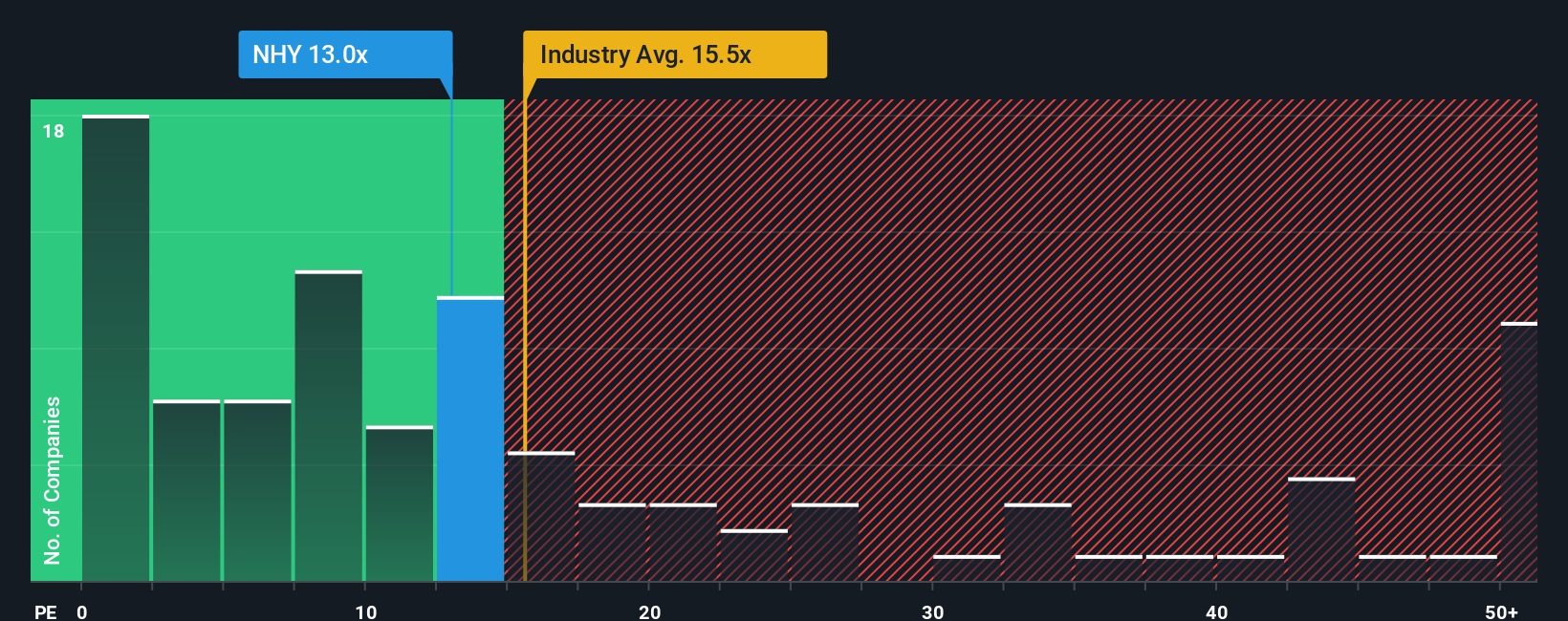

For profitable companies like Norsk Hydro, the Price-to-Earnings (PE) ratio is a widely used gauge of whether shares are attractively priced. This metric compares the company’s share price to its earnings per share, giving investors a sense of how much they are paying for each unit of profit. A lower PE can signal undervaluation, while a higher PE may reflect growth expectations that are already factored in.

Growth outlook and risk both significantly influence what a “normal” or “fair” PE ratio should be. Companies with reliable growth prospects and lower risk profiles tend to justify higher PEs, since investors are willing to pay a premium for the potential of greater future earnings.

Currently, Norsk Hydro trades at a PE ratio of 12.8x. To put this in context, the average PE for its direct peers is around 14.8x, while the broader metals and mining industry averages 20.1x. However, simply comparing raw multiples may miss the bigger picture.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This Fair Ratio stands at 17.2x for Norsk Hydro, reflecting not just peer and industry comparisons but also factors unique to the company, such as its earnings growth, profit margins, scale, and specific risks. This tailored approach accounts for details that broad averages ignore, offering a more nuanced and accurate valuation benchmark.

Comparing the Fair Ratio of 17.2x with Norsk Hydro’s current PE of 12.8x reveals that the stock is trading below what we would consider its fair value. This indicates that the shares are priced about right when taking into account all the relevant fundamentals and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norsk Hydro Narrative

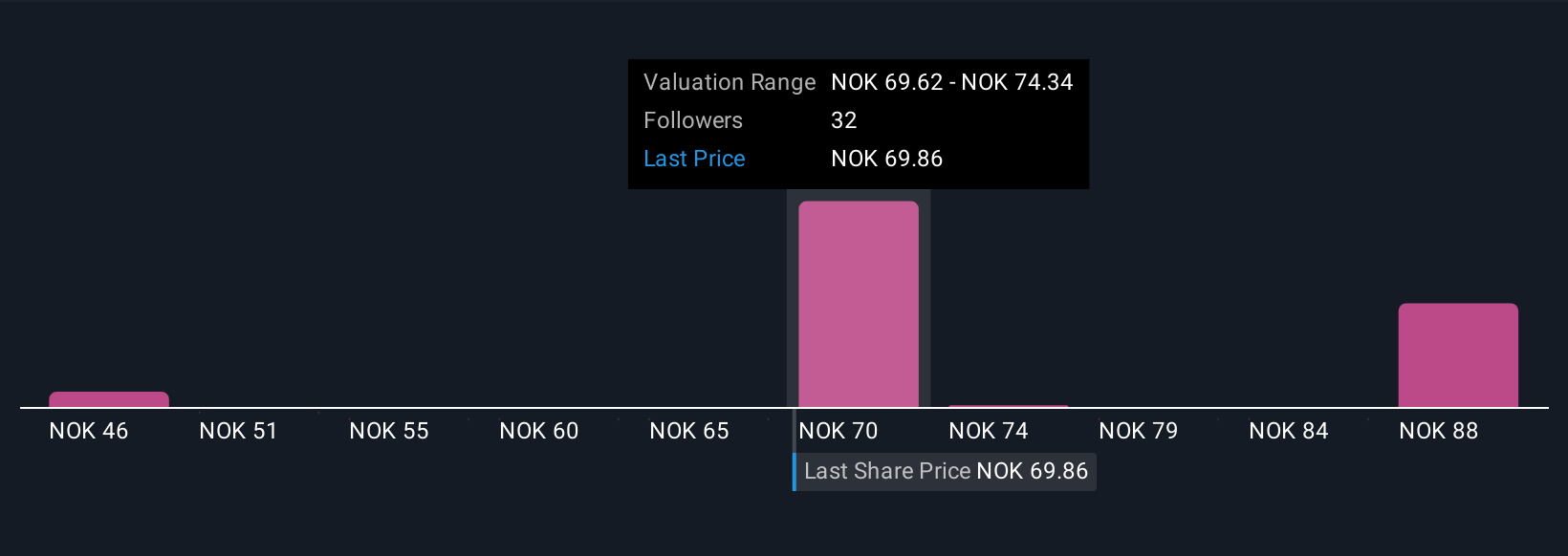

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are personal investment stories, created by you or other users, that clearly connect your perspective on a company to the actual numbers, such as future revenue, earnings, and margins, ultimately leading to your own fair value estimate.

A Narrative links the business story and outlook for Norsk Hydro with a financial forecast and a fair value, helping you make sense of the numbers in a way that is easy and relatable. Narratives are available on Simply Wall St’s Community page, where millions of investors create, explore, and compare perspectives.

With Narratives, you can decide when to buy or sell by seeing how your fair value stacks up against the latest share price. Since they update dynamically with new earnings, news, or other changes, your ideas stay relevant and actionable.

For example, some investors currently see Norsk Hydro’s future as bright, forecasting fair value as high as NOK 79.0, while others are more cautious, with estimates as low as NOK 44.0. This demonstrates how your unique outlook and assumptions can lead to very different investment decisions.

Do you think there's more to the story for Norsk Hydro? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norsk Hydro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NHY

Norsk Hydro

Engages in the power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success