Desert Control (OB:DSRT) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Desert Control (OB:DSRT) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Desert Control

How Long Is Desert Control's Cash Runway?

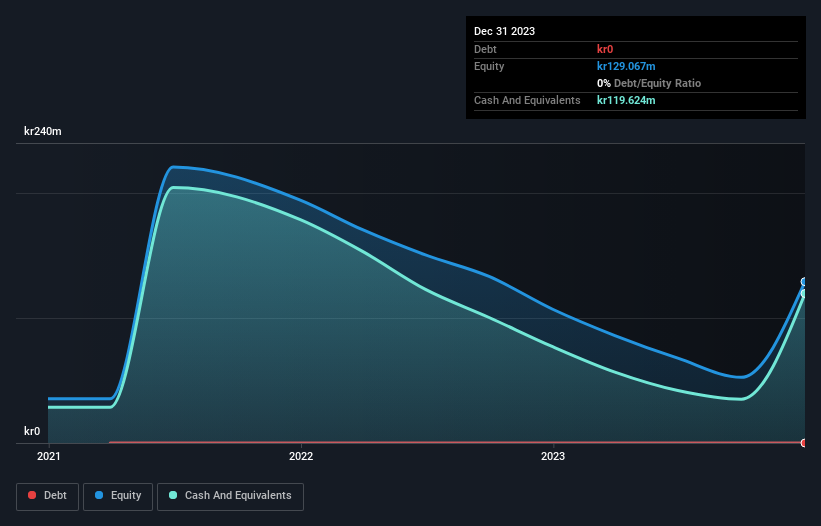

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2023, Desert Control had cash of kr120m and no debt. In the last year, its cash burn was kr61m. That means it had a cash runway of about 2.0 years as of December 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. The image below shows how its cash balance has been changing over the last few years.

How Is Desert Control's Cash Burn Changing Over Time?

Whilst it's great to see that Desert Control has already begun generating revenue from operations, last year it only produced kr845k, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. Even though it doesn't get us excited, the 41% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Desert Control To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Desert Control to raise more cash in the future. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of kr306m, Desert Control's kr61m in cash burn equates to about 20% of its market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is Desert Control's Cash Burn Situation?

Desert Control appears to be in pretty good health when it comes to its cash burn situation. One the one hand we have its solid cash burn reduction, while on the other it can also boast very strong cash runway. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Desert Control (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course Desert Control may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:DSRT

Desert Control

Provides climate-smart agri-tech solutions to combat desertification, soil degradation, and water scarcity in sandy soil regions in Norway, and the United States.

Moderate with adequate balance sheet.

Market Insights

Community Narratives