It's Unlikely That Shareholders Will Increase BEWI ASA's (OB:BEWI) Compensation By Much This Year

Key Insights

- BEWI's Annual General Meeting to take place on 21st of May

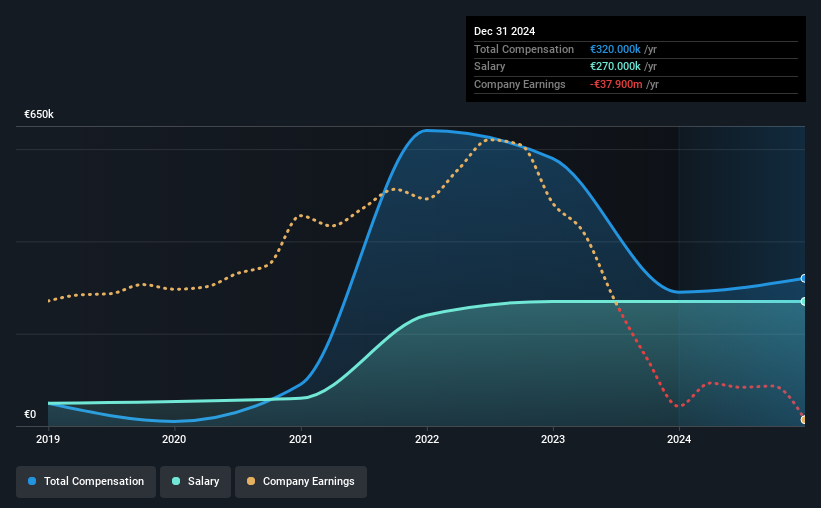

- Salary of €270.0k is part of CEO Christian Bekken's total remuneration

- Total compensation is 51% below industry average

- BEWI's EPS declined by 106% over the past three years while total shareholder loss over the past three years was 66%

Performance at BEWI ASA (OB:BEWI) has not been particularly rosy recently and shareholders will likely be holding CEO Christian Bekken and the board accountable for this. At the upcoming AGM on 21st of May, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for BEWI

How Does Total Compensation For Christian Bekken Compare With Other Companies In The Industry?

Our data indicates that BEWI ASA has a market capitalization of kr4.4b, and total annual CEO compensation was reported as €320k for the year to December 2024. That's a notable increase of 10% on last year. We note that the salary portion, which stands at €270.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Norwegian Chemicals industry with market capitalizations ranging between kr2.1b and kr8.3b had a median total CEO compensation of €650k. That is to say, Christian Bekken is paid under the industry median. Furthermore, Christian Bekken directly owns kr2.0m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €270k | €270k | 84% |

| Other | €50k | €20k | 16% |

| Total Compensation | €320k | €290k | 100% |

Talking in terms of the industry, salary represented approximately 55% of total compensation out of all the companies we analyzed, while other remuneration made up 45% of the pie. According to our research, BEWI has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

BEWI ASA's Growth

Over the last three years, BEWI ASA has shrunk its earnings per share by 106% per year. In the last year, its revenue is down 5.8%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has BEWI ASA Been A Good Investment?

The return of -66% over three years would not have pleased BEWI ASA shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for BEWI that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if BEWI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:BEWI

BEWI

Produces, markets, and sells packaging, components, and insulation solutions in Norway and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives