Storebrand (OB:STB) Valuation in Focus Following Share Buyback Program Progress

Reviewed by Simply Wall St

Storebrand (OB:STB) has just reported further progress in its ongoing share buyback program, confirming that it now holds over 10 million of its own shares. Share buybacks are always worth watching because they can influence a company’s valuation and investor sentiment.

See our latest analysis for Storebrand.

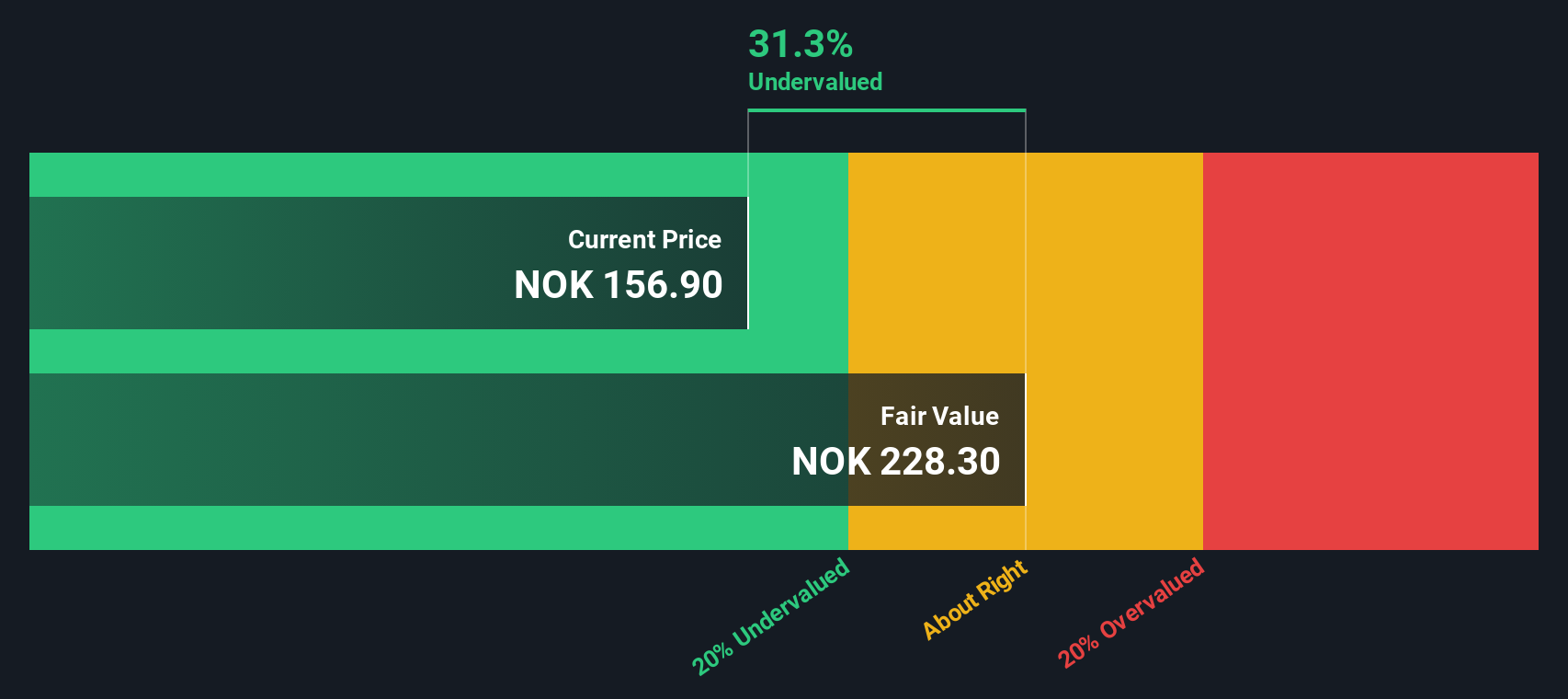

Storebrand’s ongoing share buyback program has brought fresh energy to the stock, with the latest share price at NOK 156.3 and a year-to-date share price return of 28.5%. Long-term shareholders have seen strong momentum rewarded by a 33.9% total return over the past year and an impressive 197% total return over five years. This highlights both recent enthusiasm and robust multi-year performance.

If you’re interested in finding other companies showing rapid growth and strong management alignment, now’s the perfect chance to discover fast growing stocks with high insider ownership

Yet, with such strong momentum and a share price just below analyst targets, the critical question for investors now is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 6% Overvalued

Storebrand's current share price of NOK 156.3 sits just above the narrative fair value estimate of NOK 147.5, suggesting that optimism is running high. The narrative reflects upbeat sentiment, but key assumptions and bold projections drive this valuation.

Storebrand's strategic growth, sustainability leadership, and financial maneuvers strengthen its revenue potential, brand value, and shareholder returns while boosting future asset management growth.

Want to know which headline-grabbing assumptions push Storebrand’s value higher? This narrative includes ambitious profit margin forecasts and calls for a leap in future earnings multiples. See the numbers that build this bullish case.

Result: Fair Value of $147.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks tied to new strategic initiatives and uncertainty from broader economic shifts could quickly challenge the current upbeat outlook.

Find out about the key risks to this Storebrand narrative.

Another View: Discounted Cash Flow Model Suggests Value Upside

While the narrative fair value points to Storebrand being overvalued, our DCF model provides a very different outlook. Based on long-term cash flows, the SWS DCF model estimates fair value at NOK 228.91 per share. This suggests the shares may actually be trading well below their intrinsic worth. Could this signal an overlooked opportunity, or are the DCF assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Storebrand for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Storebrand Narrative

If these perspectives don’t reflect your own or you’d rather investigate further, you can quickly craft your own Storebrand narrative based on the data. Get started in under three minutes with Do it your way

A great starting point for your Storebrand research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for Your Next Move? Unmissable Investment Ideas Worth Your Attention

Why settle for just one great stock when outstanding opportunities are waiting? The right screener can help you zero in on winners others might miss.

- Capitalize on the explosive potential of artificial intelligence by browsing these 27 AI penny stocks at the forefront of automation and future tech.

- Tap into consistent income streams by checking out these 15 dividend stocks with yields > 3%, which deliver impressive yields and steady returns.

- Harness breakthrough innovation in computing with these 26 quantum computing stocks, highlighting companies racing ahead in transformative quantum technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:STB

Storebrand

Provides insurance products and services in Norway, Sweden, the United Kingdom, Finland, Denmark, Germany, Luxemburg, and Ireland.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives