Gjensidige (OB:GJF) Margin Breakout Reinforces Bullish Narratives on Profitability

Reviewed by Simply Wall St

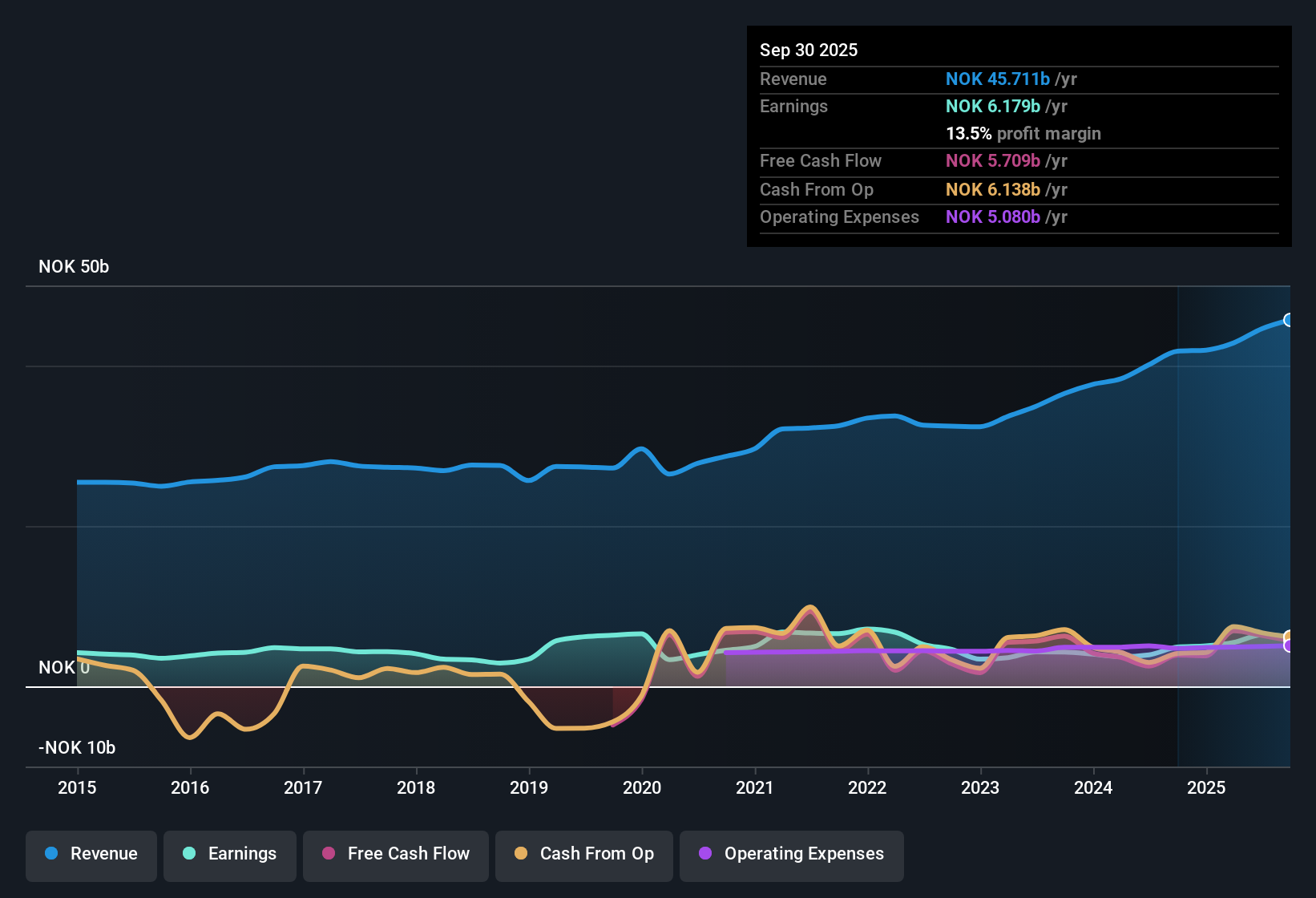

Gjensidige Forsikring (OB:GJF) posted an impressive turnaround in its latest earnings, with net profit margin soaring to 14.3% from last year’s 10% and earnings growth clocking in at 57.5%, a stark contrast to its five-year average annual decline of 5.3%. While earnings are forecast to grow at 9.86% annually and revenue at 6.1% per year, both outpacing the broader Norwegian market’s 2.3% forecast, the company trades below its discounted cash flow fair value. However, its 21x price-to-earnings ratio sits significantly above peer and industry averages. This combination of accelerating profits, improved margins, and a DCF-derived value proposition will draw attention, but the premium valuation means investors should weigh optimism against relative pricing.

See our full analysis for Gjensidige Forsikring.Next, we’ll see how these headline results square up against the leading narratives that often shape market expectations for Gjensidige Forsikring. A few views may be confirmed, while others could be in for a shakeup.

See what the community is saying about Gjensidige Forsikring

Margin Expansion Leads Peers

- Net profit margin reached 14.3%, an increase from last year's 10% and well above historical averages, indicating stronger cost controls and improved underlying performance.

- According to the analysts' consensus view, management's pricing moves in Norway and Denmark, with double-digit premium hikes and high customer retention, are credited for this margin strength.

- Consensus narrative expects margins to climb to 16.9% within three years, building on the current foundation of operational efficiency.

- They also highlight the impact of digital initiatives and claims management as critical contributors to these expanding margins.

See how the margin turnaround is feeding into the broader consensus for the company's future performance. 📊 Read the full Gjensidige Forsikring Consensus Narrative.

DCF Value Opportunity Despite High P/E

- Gjensidige Forsikring's share price of NOK266.2 trades at a steep discount to its DCF fair value of NOK425.13, even though its 21x price-to-earnings ratio is significantly higher than the peer average of 12.7x and the European insurance industry at 12.4x.

- Consensus narrative highlights this contrast, noting the compelling DCF value but indicating that to justify the price, future profit growth and an eventual multiple compression to 18.1x will be necessary.

- Analysts currently view the company as “fairly priced” with its share price near their 281.14 target, reflecting the tension between DCF upside and a high P/E ratio.

- They urge investors to scrutinize whether optimistic profit forecasts are achievable given the premium valuation compared to peers and industry norms.

Minimal Risks, Dividends Add Strength

- EDGAR filings show no major or minor risks flagged and the company is notable for steady profit growth, resilient revenue, and attractive dividends.

- Consensus narrative notes that ongoing regulatory scrutiny and the volatility of claims could challenge future stability, even if current risk indicators are muted.

- Potential macroeconomic shocks, regulatory investigations, and large-loss variability, especially in property and motor, are described as factors that could quickly change the outlook.

- Despite few immediate red flags, the consensus view is that investors should stay agile given how quickly these external risks could emerge.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gjensidige Forsikring on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the numbers from a unique angle? Share your perspective and build out your personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Gjensidige Forsikring.

See What Else Is Out There

While Gjensidige Forsikring’s profits are accelerating, its high valuation multiples create real uncertainty about whether future earnings can justify the current share price.

If you’re looking for stocks with more attractive relative pricing and greater upside, check out these 875 undervalued stocks based on cash flows for companies trading below their intrinsic value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:GJF

Gjensidige Forsikring

Provides general insurance and pension products in Norway, Sweden, Denmark, Finland, Latvia, Lithuania, and Estonia.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives