Nordhealth AS (OB:NORDH) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

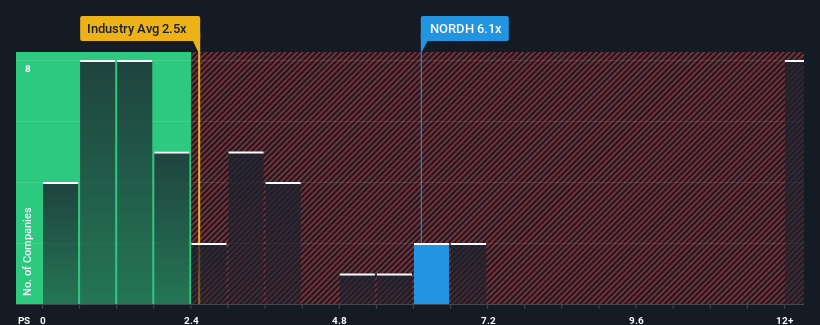

After such a large jump in price, when almost half of the companies in Norway's Healthcare Services industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Nordhealth as a stock not worth researching with its 6.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nordhealth

How Has Nordhealth Performed Recently?

With revenue growth that's superior to most other companies of late, Nordhealth has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nordhealth.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Nordhealth's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow revenue by 190% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 22% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.5%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Nordhealth's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Nordhealth's P/S Mean For Investors?

Nordhealth's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nordhealth maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Nordhealth.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nordhealth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NORDH

Nordhealth

Provides healthcare software solutions in Norway, Finland, Sweden, Denmark, Germany, and internationally.

Flawless balance sheet with reasonable growth potential.