- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Floridienne And 2 Other European Small Caps with Promising Potential

Reviewed by Simply Wall St

As the European market experiences a positive shift, with the pan-European STOXX Europe 600 Index rising by 0.90% and major stock indexes across Germany, Italy, France, and the UK posting gains, investors are increasingly optimistic about small-cap opportunities amid easing inflation and supportive monetary policies. In this environment of cautious optimism fueled by economic resilience and strategic central bank actions, identifying promising small-cap stocks becomes crucial for those looking to capitalize on potential growth areas.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Floridienne (ENXTBR:FLOB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Floridienne S.A. operates through its subsidiaries in the life sciences, food, and chemistry sectors both in Belgium and internationally, with a market cap of approximately €670.95 million.

Operations: Floridienne S.A. generates its revenue primarily from the life sciences division (€507.08 million), followed by the food sector (€150.96 million) and chemicals division (€39.34 million).

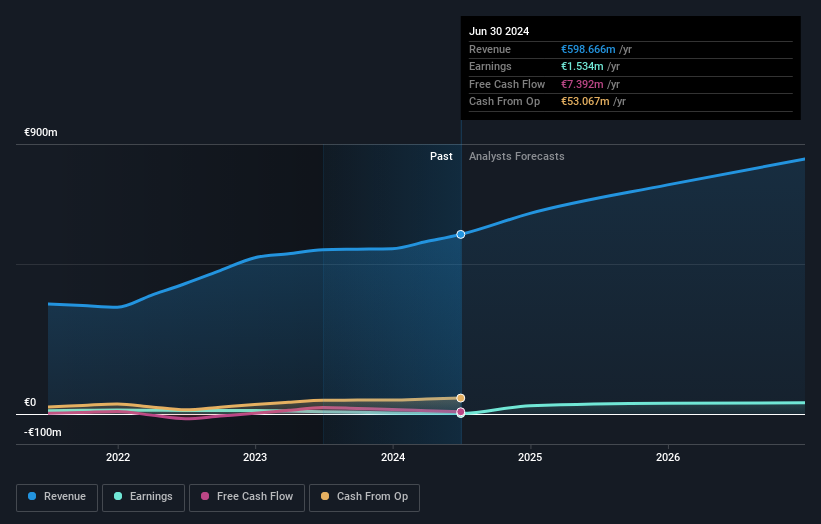

Floridienne, a European gem in the food industry, has showcased impressive growth with earnings skyrocketing by 343.7% over the past year, outpacing the industry's 50.3%. The company's net debt to equity ratio improved from 81.3% to a satisfactory 51.2% over five years, indicating prudent financial management. Trading at a significant discount of 70.8% below its estimated fair value suggests potential undervaluation opportunities for investors. Recent financials reveal robust performance with revenue climbing to €716 million from €559 million and net income jumping to €15.74 million from €3.55 million year-on-year, underscoring strong operational efficiency and profitability improvements.

- Click to explore a detailed breakdown of our findings in Floridienne's health report.

Examine Floridienne's past performance report to understand how it has performed in the past.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme is involved in supplying electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €1.02 billion.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and marketing of electricity and gas, totaling €1.12 billion, followed by consumption-related activities at €311.39 million.

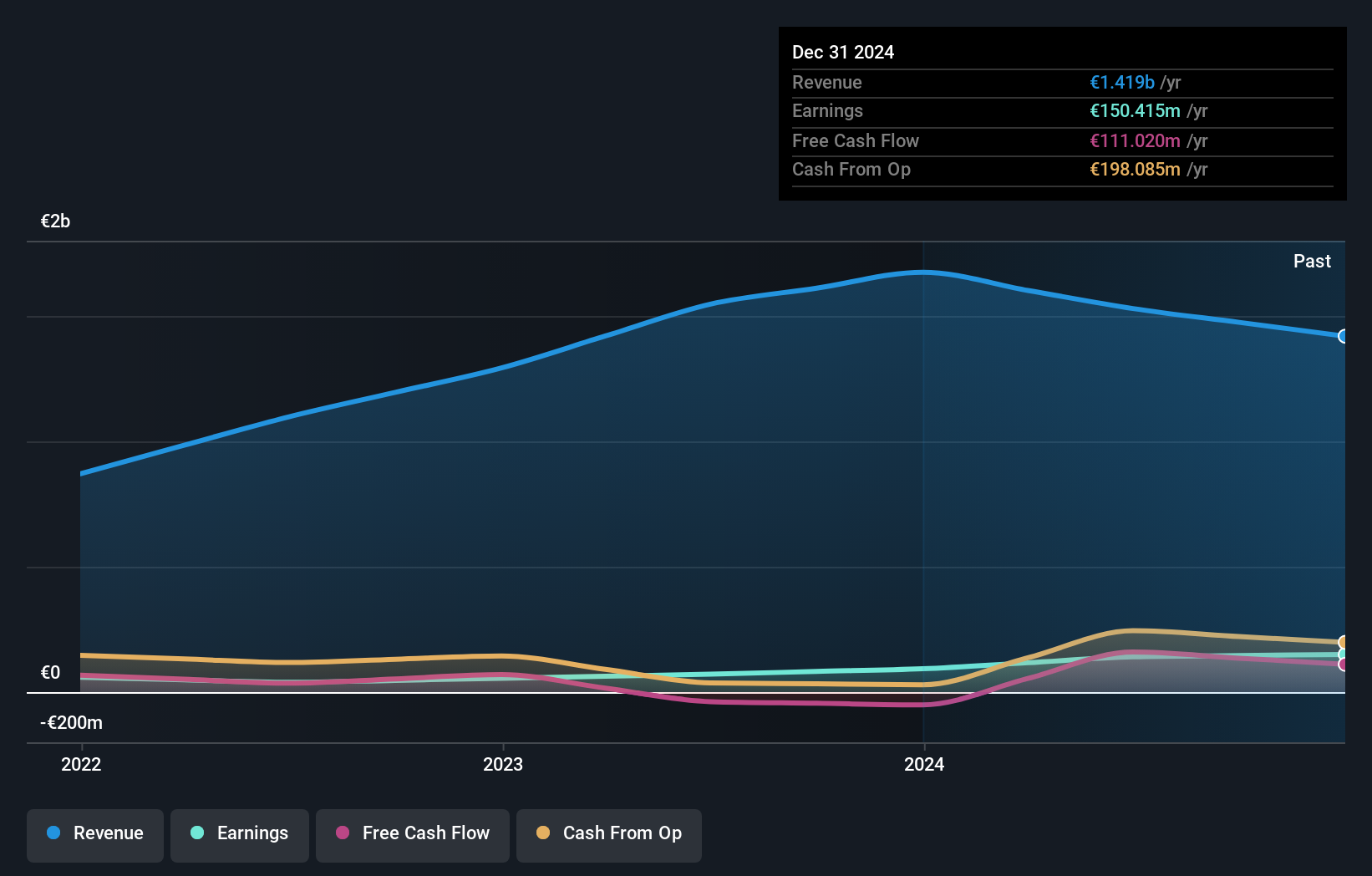

Électricite de Strasbourg, a smaller player in the electric utilities sector, has shown remarkable financial resilience. Over the past year, its earnings surged by 61.1%, outpacing the industry average of -7%. The company has effectively managed its debt, reducing its debt-to-equity ratio from 4.6 to 0.6 over five years and maintaining more cash than total debt. Despite a drop in revenue from €1,840 million to €1,510 million last year, net income rose significantly to €150 million from €93 million previously. Trading at 79% below estimated fair value suggests potential upside for investors considering this stock's robust fundamentals and growth trajectory.

Medistim (OB:MEDI)

Simply Wall St Value Rating: ★★★★★★

Overview: Medistim ASA develops, produces, services, leases, and distributes medical devices for cardiac and vascular surgery globally with a market cap of NOK3.78 billion.

Operations: Medistim generates revenue primarily from the sale of its own products, amounting to NOK 511.31 million, and third-party product sales totaling NOK 99.05 million. The company's financial performance is characterized by a focus on these two key revenue streams.

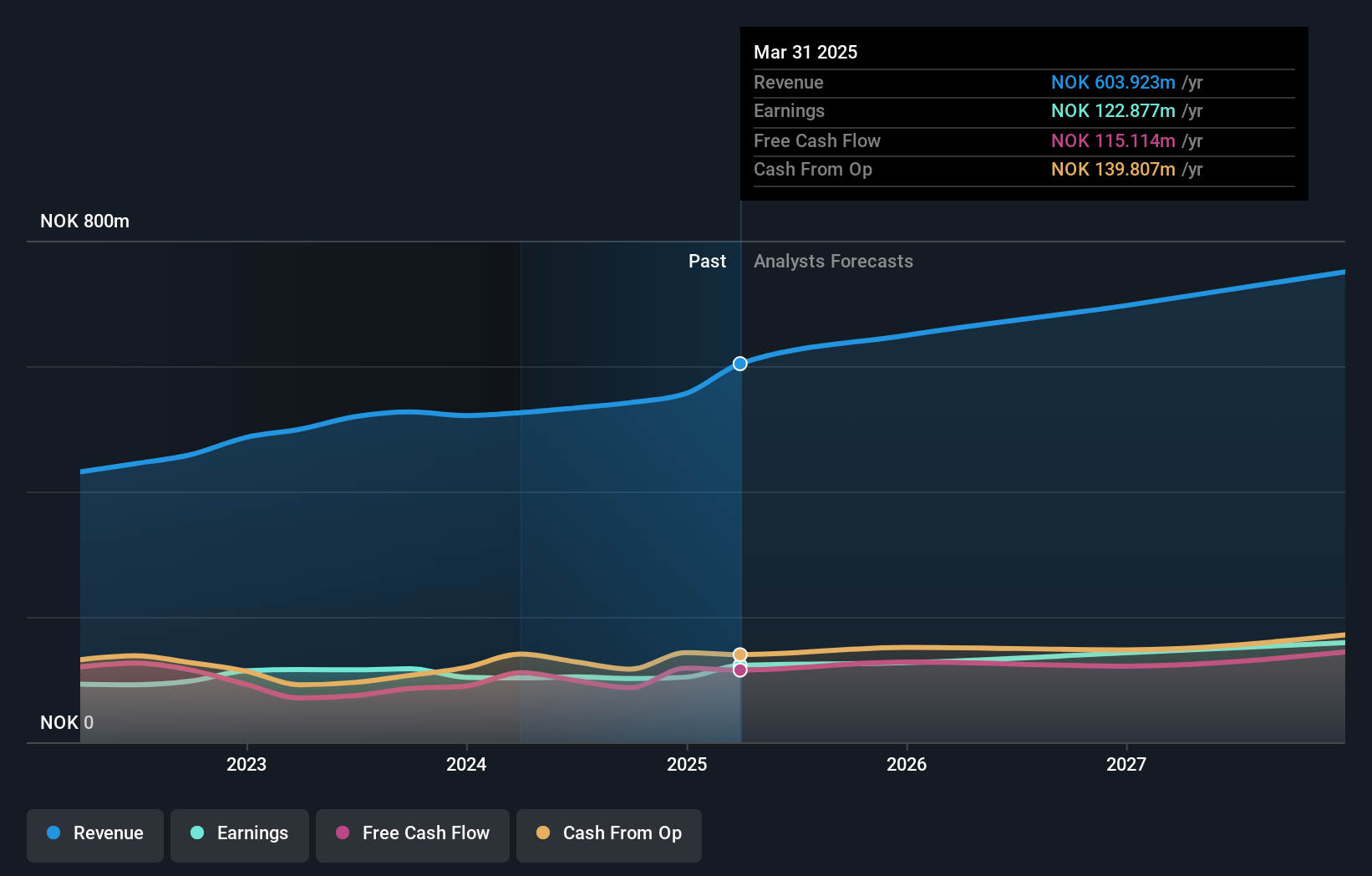

Medistim, a nimble player in the medical devices sector, has shown robust growth with its earnings rising 19.8% over the past year, outpacing the industry average of 11.7%. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 1.4%, reflecting its improved financial health. Recent first-quarter results revealed sales of NOK 181.55 million and net income of NOK 43.43 million, both significantly up from last year’s figures. With a price-to-earnings ratio at 30.8x below the industry average, Medistim could be an attractive proposition for investors seeking value in smaller companies within Europe’s vibrant market landscape.

Make It Happen

- Delve into our full catalog of 329 European Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives