- Norway

- /

- Medical Equipment

- /

- OB:MEDI

Discovering Undiscovered Gems on None in November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are keenly observing the potential impact of geopolitical tensions and economic indicators on small-cap stocks. In this dynamic environment, identifying undiscovered gems requires a focus on companies with strong fundamentals that can thrive amidst market volatility and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Medistim (OB:MEDI)

Simply Wall St Value Rating: ★★★★★★

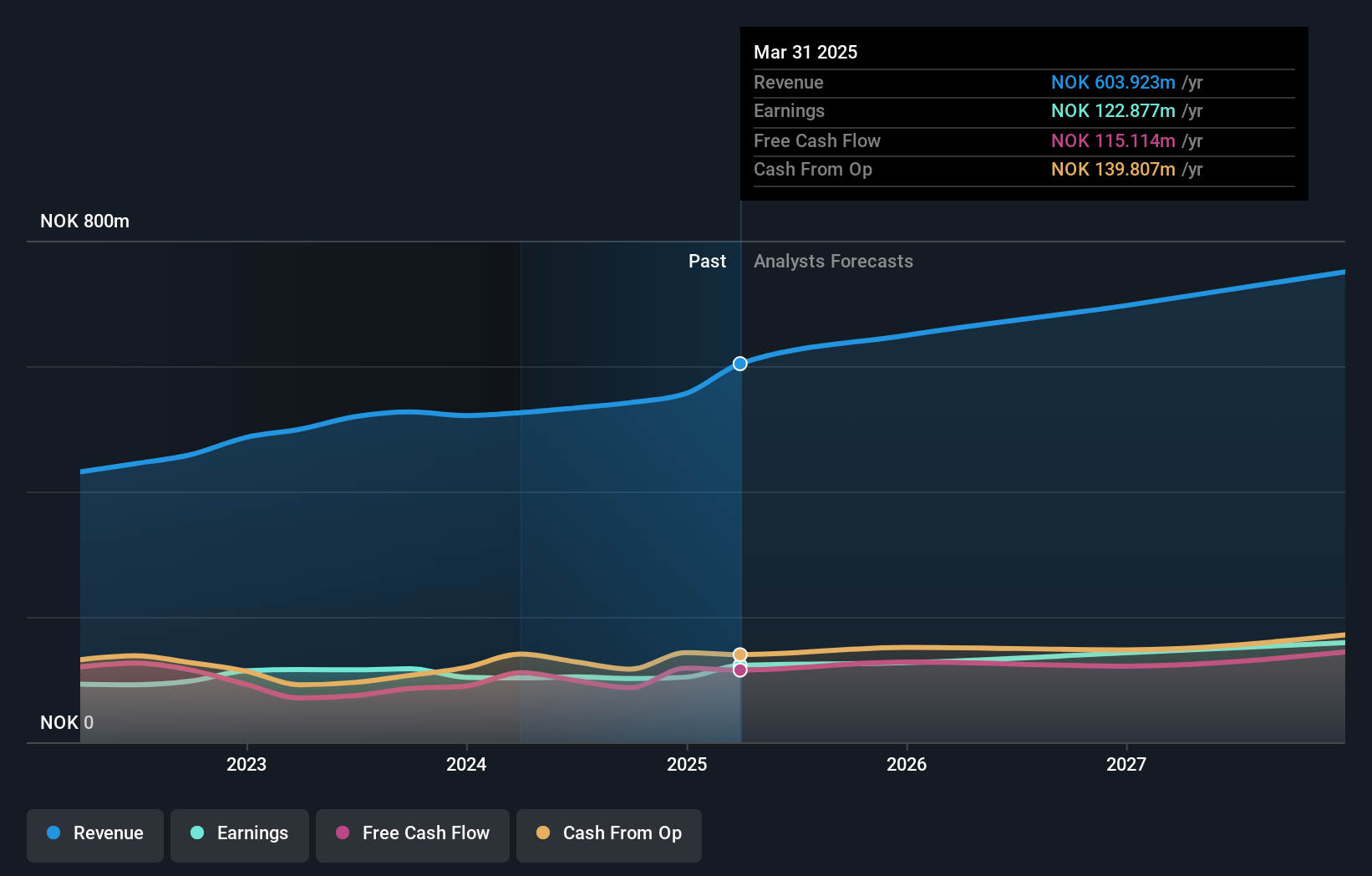

Overview: Medistim ASA is a company that specializes in the development, production, servicing, leasing, and distribution of medical devices for cardiac and vascular surgery across global markets including the United States, Europe, and Asia, with a market capitalization of NOK2.91 billion.

Operations: Medistim generates revenue primarily from its own products, amounting to NOK459.38 million, and from third-party products, contributing NOK87.70 million.

Medistim, a nimble player in the medical equipment space, is making waves with its innovative approach. The company reported third-quarter sales of NOK 132.76 million, up from NOK 124.1 million last year, despite a net income dip to NOK 23.43 million from NOK 26.13 million previously. With no debt on its books now compared to a debt-to-equity ratio of 2.7% five years ago, Medistim's financial health appears robust. The recent launch of the PATENT study and the MiraQ INTUI platform underscores its commitment to growth and innovation in vascular surgery technologies, potentially enhancing future earnings prospects by tapping into untapped markets like the U.S.

- Get an in-depth perspective on Medistim's performance by reading our health report here.

Explore historical data to track Medistim's performance over time in our Past section.

Nameson Holdings (SEHK:1982)

Simply Wall St Value Rating: ★★★★★★

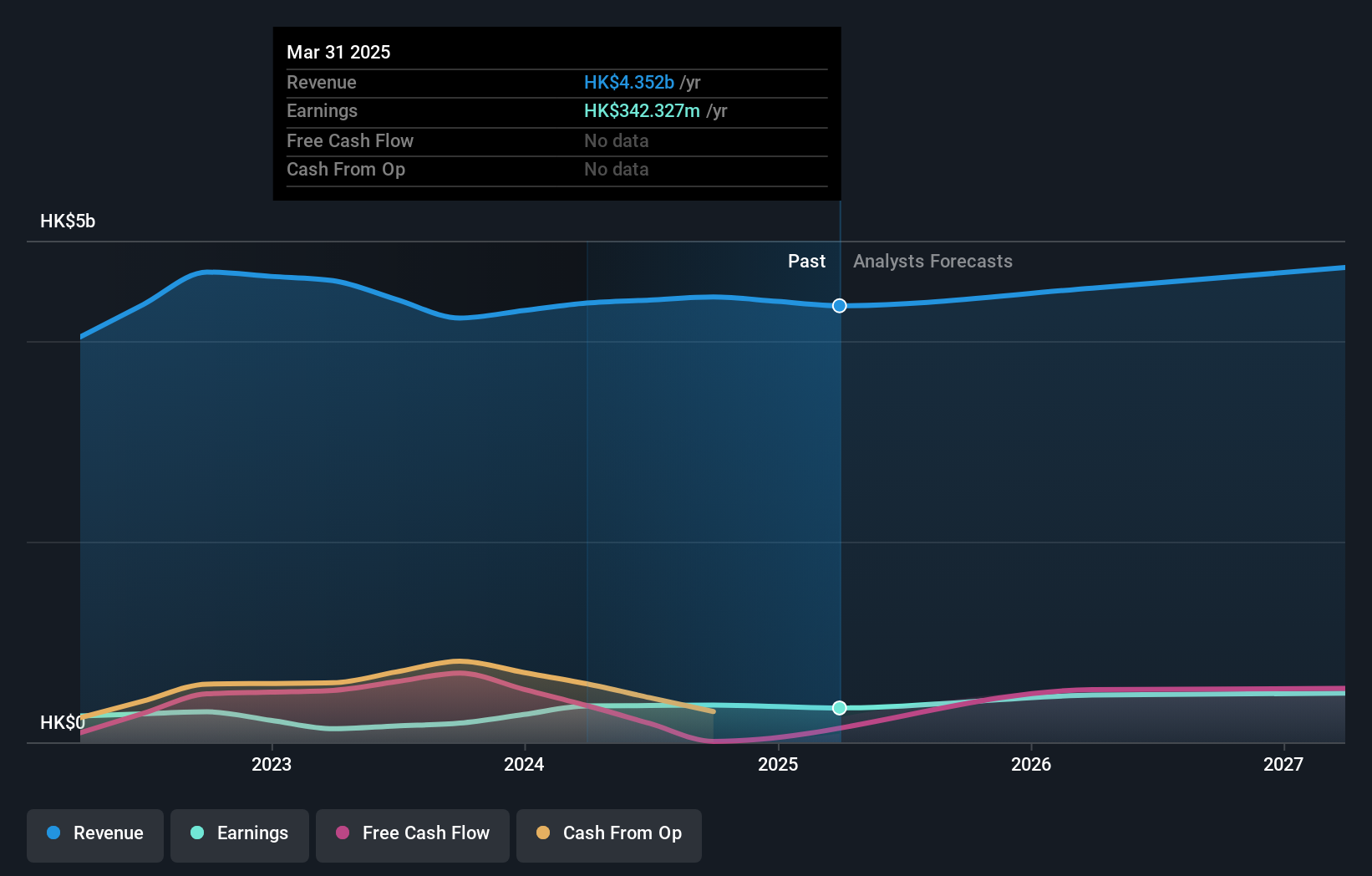

Overview: Nameson Holdings Limited is an investment holding company that focuses on the manufacture and sale of knitwear products across Japan, North America, Europe, Mainland China, and other international markets with a market capitalization of approximately HK$1.98 billion.

Operations: Nameson Holdings derives its revenue primarily from the manufacturing of knitwear products, generating approximately HK$4.44 billion.

Nameson Holdings, a nimble player in its industry, recently reported half-year sales of HKD 2.79 billion, up from HKD 2.73 billion the previous year. Net income saw a slight increase to HKD 298.19 million from HKD 289.12 million, reflecting steady performance despite market challenges. The company announced an interim cash dividend of HKD 0.098 per share, signaling confidence in its financial health and shareholder returns strategy. With a satisfactory net debt to equity ratio of 7.9% and interest payments well covered by EBIT at 12 times, Nameson demonstrates prudent financial management while navigating growth opportunities effectively within the sector.

- Click here to discover the nuances of Nameson Holdings with our detailed analytical health report.

Examine Nameson Holdings' past performance report to understand how it has performed in the past.

GNI Group (TSE:2160)

Simply Wall St Value Rating: ★★★★☆☆

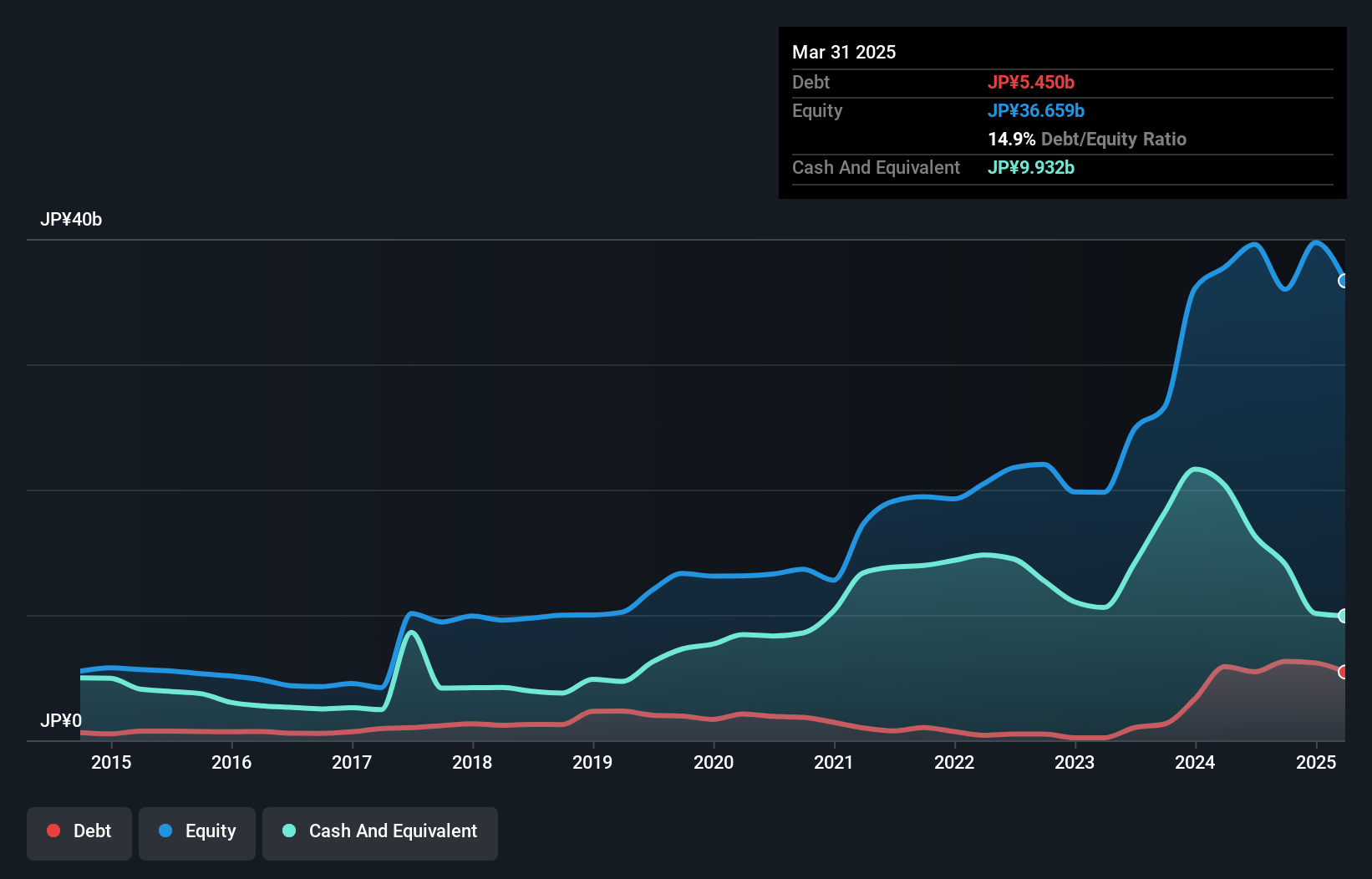

Overview: GNI Group Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally, with a market capitalization of ¥140.08 billion.

Operations: GNI Group generates revenue primarily from its pharmaceutical segment, which accounts for ¥18.31 billion, and a smaller contribution from its medical device segment at ¥4.34 billion. The net profit margin is a key financial metric to consider when evaluating the company's profitability in relation to its revenue streams.

GNI Group, a nimble player in the biotech space, is trading at a price-to-earnings ratio of 19.5x, which is below the industry average of 20.7x. The company has shown impressive earnings growth of 371% over the past year, significantly outpacing the industry's 4%. Despite this robust performance, shareholders faced dilution recently. GNI's debt to equity ratio rose from 14.5% to 17.5% over five years; however, they maintain more cash than total debt and have EBIT covering interest payments by a solid margin of 13.5x. These factors suggest potential for continued financial stability and growth prospects in its sector.

- Delve into the full analysis health report here for a deeper understanding of GNI Group.

Gain insights into GNI Group's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4635 more companies for you to explore.Click here to unveil our expertly curated list of 4638 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MEDI

Medistim

Develops, produces, services, leases, and distributes medical devices for cardiac and vascular surgery in the United States, Asia, Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives