- Norway

- /

- Medical Equipment

- /

- OB:GENT

Investors Appear Satisfied With Gentian Diagnostics ASA's (OB:GENT) Prospects As Shares Rocket 33%

The Gentian Diagnostics ASA (OB:GENT) share price has done very well over the last month, posting an excellent gain of 33%. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

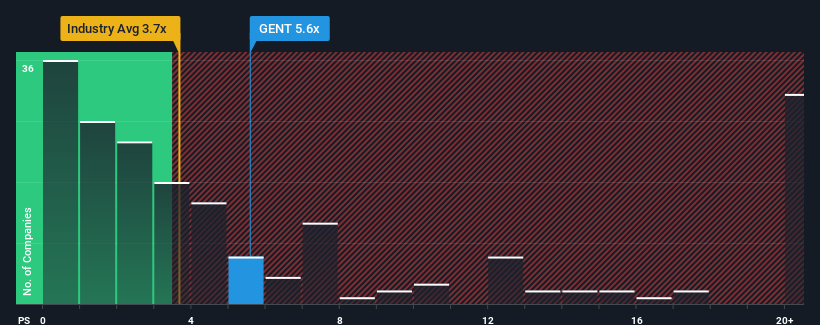

Since its price has surged higher, Gentian Diagnostics may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.6x, when you consider almost half of the companies in the Medical Equipment industry in Norway have P/S ratios under 3.7x and even P/S lower than 1.4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Gentian Diagnostics

What Does Gentian Diagnostics' P/S Mean For Shareholders?

Recent times have been advantageous for Gentian Diagnostics as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Gentian Diagnostics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Gentian Diagnostics' Revenue Growth Trending?

In order to justify its P/S ratio, Gentian Diagnostics would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Pleasingly, revenue has also lifted 78% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 25% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 8.4%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Gentian Diagnostics' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Gentian Diagnostics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Gentian Diagnostics shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 2 warning signs for Gentian Diagnostics you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:GENT

Gentian Diagnostics

Develops, manufactures, and sells biochemical reagents for use in medical diagnostics and research in the United States, Asia, and Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives