- Norway

- /

- Medical Equipment

- /

- OB:GENT

Gentian Diagnostics ASA's (OB:GENT) P/S Is Still On The Mark Following 25% Share Price Bounce

Gentian Diagnostics ASA (OB:GENT) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

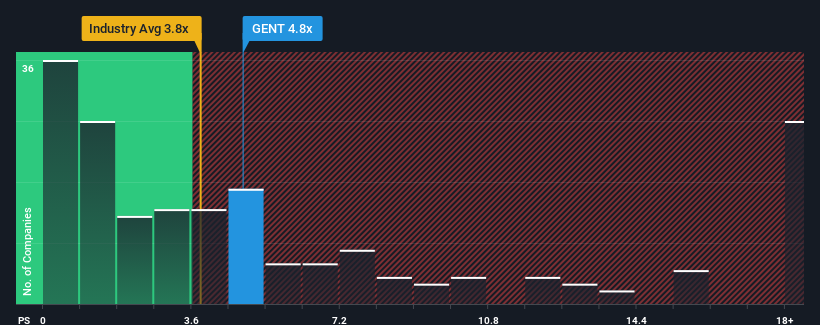

Following the firm bounce in price, Gentian Diagnostics may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 4.8x, since almost half of all companies in the Medical Equipment in Norway have P/S ratios under 3.8x and even P/S lower than 1.3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Gentian Diagnostics

What Does Gentian Diagnostics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Gentian Diagnostics has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Gentian Diagnostics.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Gentian Diagnostics' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The latest three year period has also seen an excellent 56% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 22% over the next year. That's shaping up to be materially higher than the 16% growth forecast for the broader industry.

With this information, we can see why Gentian Diagnostics is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Gentian Diagnostics' P/S

The large bounce in Gentian Diagnostics' shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Gentian Diagnostics shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 3 warning signs for Gentian Diagnostics you should be aware of.

If you're unsure about the strength of Gentian Diagnostics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:GENT

Gentian Diagnostics

Researches, develops, and produces biochemical reagents for use in medical diagnostics and research worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives