- Norway

- /

- Healthtech

- /

- OB:CONTX

Subdued Growth No Barrier To ContextVision AB (publ) (OB:CONTX) With Shares Advancing 25%

ContextVision AB (publ) (OB:CONTX) shares have had a really impressive month, gaining 25% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.0% in the last twelve months.

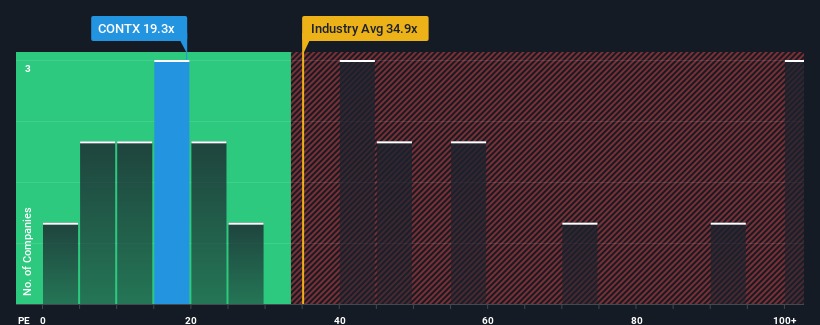

Following the firm bounce in price, given close to half the companies in Norway have price-to-earnings ratios (or "P/E's") below 11x, you may consider ContextVision as a stock to avoid entirely with its 19.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, ContextVision's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for ContextVision

How Is ContextVision's Growth Trending?

ContextVision's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. The last three years don't look nice either as the company has shrunk EPS by 29% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 12% over the next year. Meanwhile, the broader market is forecast to expand by 24%, which paints a poor picture.

With this information, we find it concerning that ContextVision is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On ContextVision's P/E

Shares in ContextVision have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ContextVision currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with ContextVision (including 1 which doesn't sit too well with us).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:CONTX

ContextVision

A software company, provides image analysis and imaging for medical systems in South Korea, China, Japan, the United States, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives