3 European Dividend Stocks To Consider With Up To 8.6% Yield

Reviewed by Simply Wall St

As European markets experience a boost from easing trade tensions and optimism over potential U.S. interest rate cuts, the pan-European STOXX Europe 600 Index has ended higher, reflecting a positive sentiment across major stock indexes like France’s CAC 40 and Germany’s DAX. In this environment, dividend stocks can offer investors an attractive combination of income and potential capital appreciation, especially when market conditions are favorable for steady earnings growth.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.21% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.64% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.18% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 4.02% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 6.99% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.49% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.06% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.57% | ★★★★★★ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

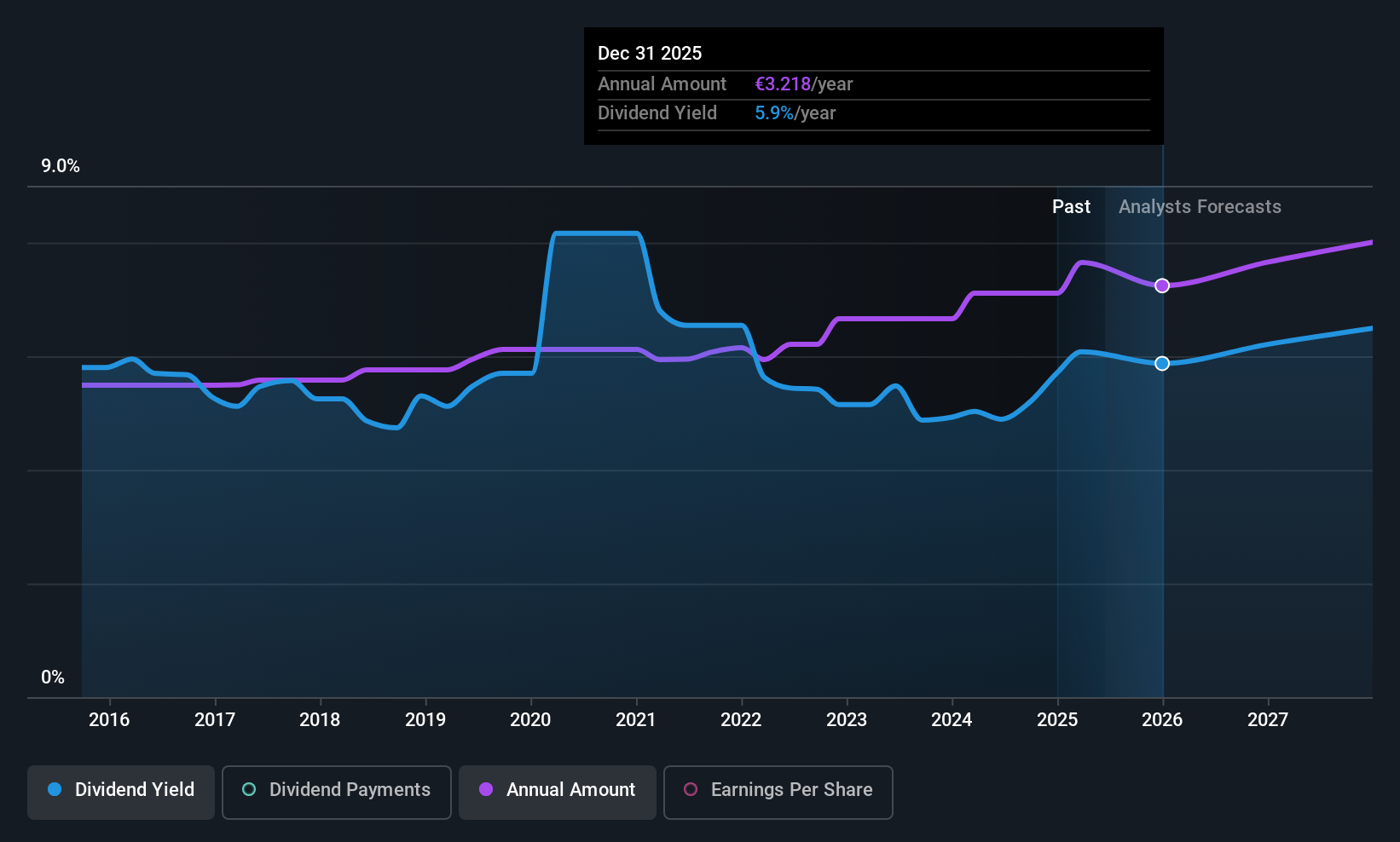

TotalEnergies (ENXTPA:TTE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TotalEnergies SE is a multi-energy company involved in the production and marketing of oil, biofuels, natural gas, biogas, low-carbon hydrogen, renewables, and electricity across France, Europe, and globally with a market cap of approximately €118.75 billion.

Operations: TotalEnergies SE's revenue is primarily derived from its Refining & Chemicals segment at $117.03 billion, followed by Marketing & Services at $62.46 billion, Exploration & Production at $42.46 billion, Integrated Power at $23.08 billion, and Integrated LNG at $21.02 billion.

Dividend Yield: 6.2%

TotalEnergies offers a compelling dividend yield of 6.16%, ranking in the top 25% of French market payers, although its dividends have been volatile over the past decade. The payout is covered by earnings and cash flow, with a reasonable cash payout ratio of 74.3%. Recent earnings showed a decline, but the company affirmed an increased interim dividend for fiscal year 2025. Additionally, TotalEnergies is involved in strategic expansions and asset sales which may impact future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of TotalEnergies.

- Our expertly prepared valuation report TotalEnergies implies its share price may be lower than expected.

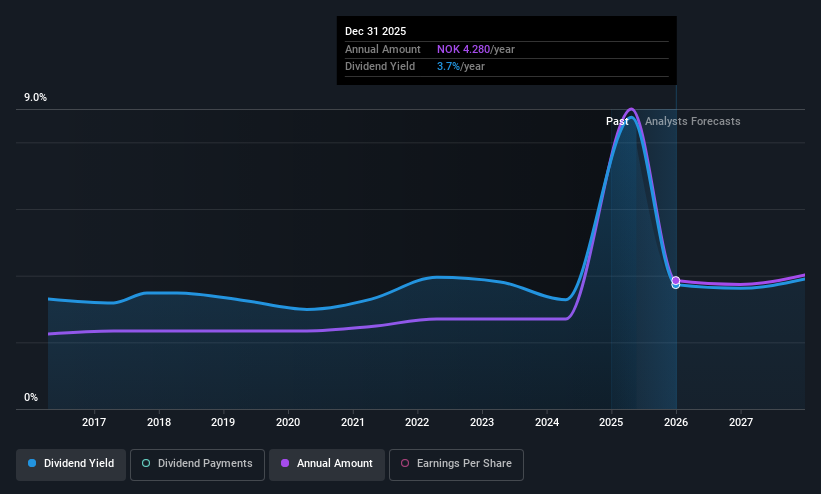

Orkla (OB:ORK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orkla ASA is an industrial investment company focusing on brands and consumer-oriented businesses across Norway, Sweden, Denmark, Finland, Iceland, the Baltics, Europe, and internationally with a market cap of NOK114.91 billion.

Operations: Orkla ASA's revenue segments include Orkla Foods (NOK20.63 billion), Orkla India (NOK3.07 billion), Orkla Health (NOK7.51 billion), Orkla Snacks (NOK10.01 billion), Orkla House Care (NOK1.66 billion), Orkla Food Ingredients (NOK20.36 billion), Orkla Home & Personal Care (NOK2.81 billion), The European Pizza Company (NOK3.06 billion), and the Health and Sports Nutrition Group (NOK1.26 billion).

Dividend Yield: 8.7%

Orkla's dividend has been stable and reliable over the past decade, although its current yield of 8.68% falls short of Norway's top payers. The payout ratio is reasonable at 67%, yet cash flow coverage is inadequate with a cash payout ratio of 140.5%. Recent earnings showed significant growth, with Q2 net income rising to NOK 6.22 billion from NOK 2.04 billion a year ago, potentially supporting future dividends despite forecasted earnings declines.

- Click to explore a detailed breakdown of our findings in Orkla's dividend report.

- Our valuation report here indicates Orkla may be undervalued.

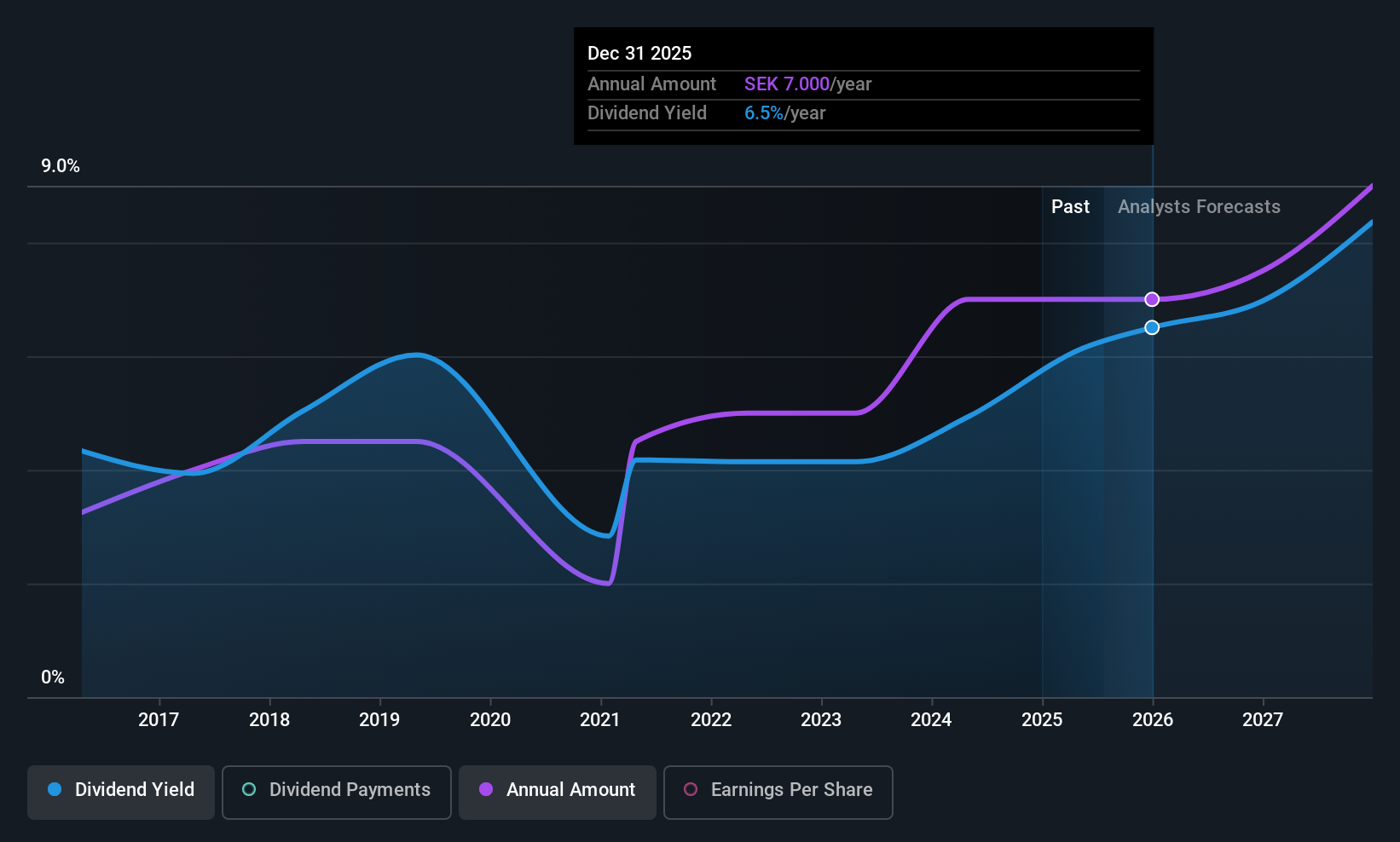

Ework Group (OM:EWRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ework Group AB (publ) provides total talent solutions across IT/OT, research and development, engineering, and business development in several European countries with a market cap of SEK1.89 billion.

Operations: Ework Group AB (publ) generates revenue through its talent solutions services in IT/OT, research and development, engineering, and business development across Sweden, Norway, Finland, Denmark, Poland, and Slovakia.

Dividend Yield: 6.4%

Ework Group's dividend yield of 6.39% ranks in the top 25% of Swedish payers, though payments have been volatile and unreliable over the past decade. The high payout ratio of 102.9% suggests dividends are not well covered by earnings, but a reasonable cash payout ratio of 52.6% indicates coverage by cash flow. Recent Q2 earnings showed a decline in net income to SEK 33.27 million from SEK 34.55 million, amidst leadership changes with CEO Karin Schreil's departure announcement.

- Unlock comprehensive insights into our analysis of Ework Group stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ework Group shares in the market.

Seize The Opportunity

- Explore the 216 names from our Top European Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ORK

Orkla

Operates as an industrial investment company within brands and consumer-oriented businesses in Norway, Sweden, Denmark, Finland, Iceland, the Baltics, rest of Europe, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives