Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Norcod AS (OB:NCOD) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Norcod

What Is Norcod's Net Debt?

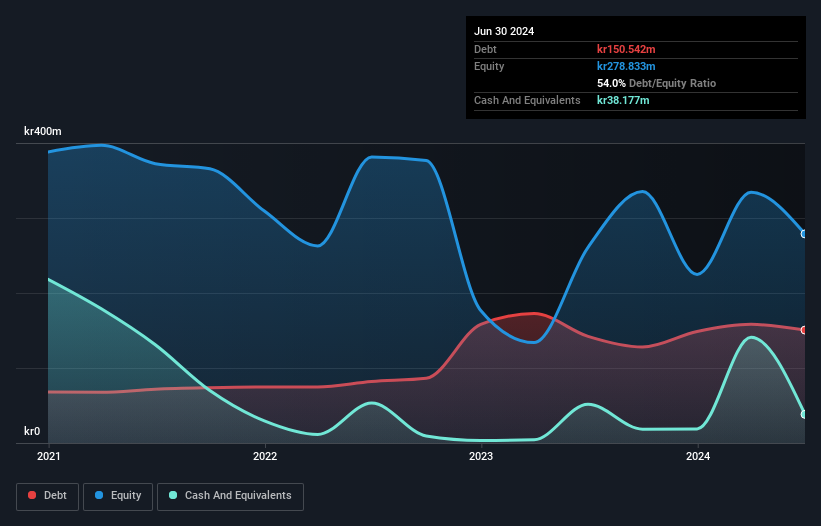

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Norcod had kr150.5m of debt, an increase on kr142.1m, over one year. On the flip side, it has kr38.2m in cash leading to net debt of about kr112.4m.

How Healthy Is Norcod's Balance Sheet?

The latest balance sheet data shows that Norcod had liabilities of kr239.8m due within a year, and liabilities of kr140.2m falling due after that. On the other hand, it had cash of kr38.2m and kr34.2m worth of receivables due within a year. So its liabilities total kr307.5m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Norcod is worth kr1.00b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Norcod will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Norcod wasn't profitable at an EBIT level, but managed to grow its revenue by 42%, to kr309m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Norcod managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Its EBIT loss was a whopping kr237m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through kr254m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Norcod you should be aware of, and 2 of them make us uncomfortable.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Norcod might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NCOD

Norcod

Engages in the farming, production, operation, distribution, marketing, and sale of farmed cod products in Norway and internationally.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026