In recent weeks, global markets have experienced volatility due to tariff uncertainties and mixed economic signals, with U.S. stocks ending lower amid concerns over potential trade conflicts. Despite these fluctuations, many companies have reported strong earnings, suggesting that certain sectors may still offer growth opportunities even as broader market conditions remain challenging. In this environment, growth companies with high insider ownership can be particularly appealing to investors. Insider ownership often indicates confidence in the company's future prospects and can align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Here's a peek at a few of the choices from the screener.

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

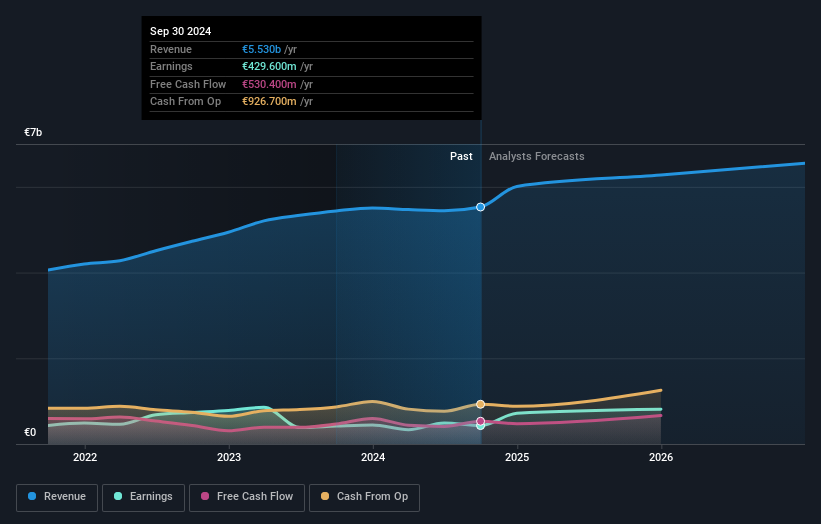

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally with a market capitalization of NOK113.51 billion.

Operations: Mowi's revenue is primarily derived from its operations in farming, producing, and supplying Atlantic salmon products on a global scale.

Insider Ownership: 15.4%

Mowi ASA demonstrates potential as a growth company with strong insider ownership. Recent earnings showed an increase in both sales and net income, with Q4 2024 sales at €1.50 billion and net income at €215.6 million. The company's acquisition of Nova Sea boosts its ownership to 95%, indicating strategic expansion efforts. While revenue growth is slower than desired, forecasted annual profit growth of 22.9% exceeds the Norwegian market's average, supporting its growth trajectory despite high debt levels.

- Delve into the full analysis future growth report here for a deeper understanding of Mowi.

- In light of our recent valuation report, it seems possible that Mowi is trading behind its estimated value.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. is involved in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of approximately CN¥6 billion.

Operations: Optowide Technologies Co., Ltd. generates revenue through its operations in precision optics and fiber components across both domestic and international markets.

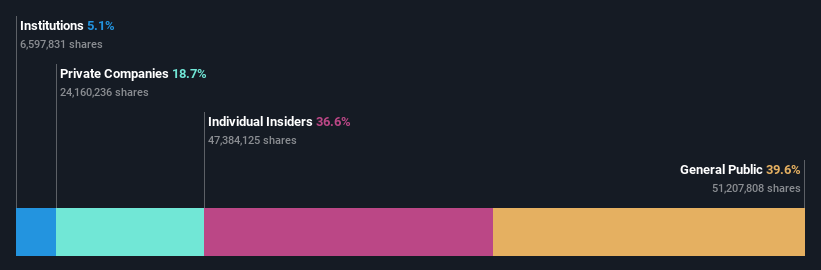

Insider Ownership: 36.6%

Optowide Technologies shows promise with its forecasted revenue growth of 31.1% annually, surpassing the CN market's 13.5%. Earnings are expected to grow significantly at 35.62% per year, outpacing the market's 25.4%, despite a volatile share price and low future return on equity (12%). Although recent buyback activity was inactive, past earnings grew by 47.3%, indicating robust performance potential even without substantial insider trading activity in recent months.

- Click to explore a detailed breakdown of our findings in Optowide Technologies' earnings growth report.

- In light of our recent valuation report, it seems possible that Optowide Technologies is trading beyond its estimated value.

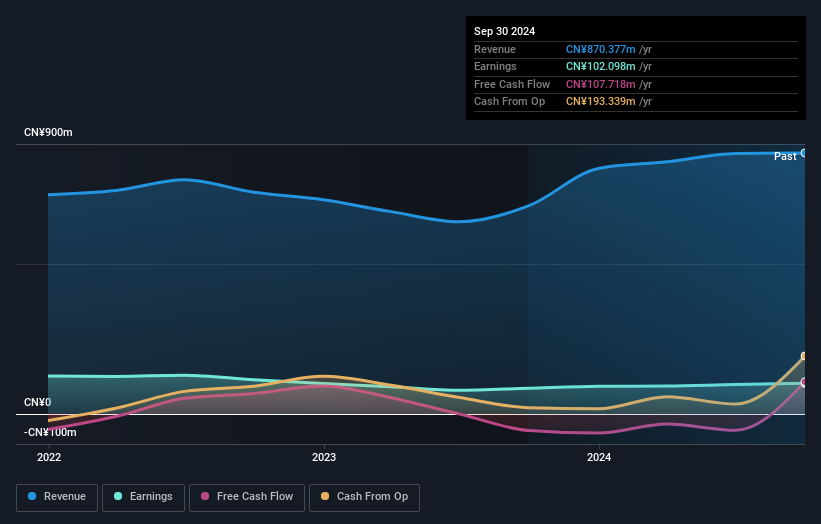

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. operates in the optoelectronics sector, focusing on the development and production of optical communication devices, with a market cap of approximately CN¥12.85 billion.

Operations: Wuxi Taclink Optoelectronics Technology Co., Ltd. generates its revenue primarily from the development and production of optical communication devices.

Insider Ownership: 19.8%

Wuxi Taclink Optoelectronics Technology is positioned for significant growth, with revenue expected to rise 27.9% annually, outpacing the CN market's 13.5%. Earnings are projected to increase by 33.66% each year, exceeding the market's 25.4%, despite a highly volatile share price and a forecasted low return on equity of 8.1%. Recent earnings calls did not reveal substantial insider trading activity, which may affect investor confidence in its growth trajectory.

- Navigate through the intricacies of Wuxi Taclink Optoelectronics Technology with our comprehensive analyst estimates report here.

- Our valuation report here indicates Wuxi Taclink Optoelectronics Technology may be overvalued.

Where To Now?

- Navigate through the entire inventory of 1447 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, farms, produces, and supplies Atlantic salmon products worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives