P/F Bakkafrost (OB:BAKKA): Assessing Valuation After Joining the Oslo OBX Total Return Index

Reviewed by Kshitija Bhandaru

P/F Bakkafrost (OB:BAKKA) has just joined the Oslo OBX Total Return Index, an event that often prompts portfolio adjustments from index-tracking funds and increases the company’s profile with institutional investors.

See our latest analysis for P/F Bakkafrost.

The spotlight from joining the Oslo OBX Total Return Index could be a catalyst for P/F Bakkafrost, especially after a year where its share price return has been relatively muted and its 12-month total shareholder return is down about 24%. Momentum has been mixed, leaving investors to weigh whether fresh institutional interest might spark a change in sentiment or signal a value opportunity for patient holders.

If this big index inclusion has you rethinking your strategy, it's a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With Bakkafrost’s shares lagging over the past year despite strong earnings growth and an analyst price target above current levels, the key question now is whether investors are overlooking value or if future growth is already fully priced in.

Most Popular Narrative: 7.2% Undervalued

With P/F Bakkafrost’s last close at NOK456.6 and the most widely followed narrative setting fair value at NOK492.07, all eyes are on whether a re-rating could be on the horizon.

The company's investments to produce larger and more robust smolt in both the Faroe Islands and Scotland, along with state-of-the-art wellboat and processing capabilities, are driving operational efficiencies and reduced biological risk. This positions the company for improved margins and more stable future earnings.

What’s behind this valuation call? Hint: analysts are betting on operational transformation and a sharp uplift in profitability. The full story digs into the financial forecasts and margin projections that could reset expectations for the years ahead.

Result: Fair Value of $492.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational challenges in Scotland and declining global salmon prices could threaten Bakkafrost’s margin recovery. This may potentially dampen the bullish outlook.

Find out about the key risks to this P/F Bakkafrost narrative.

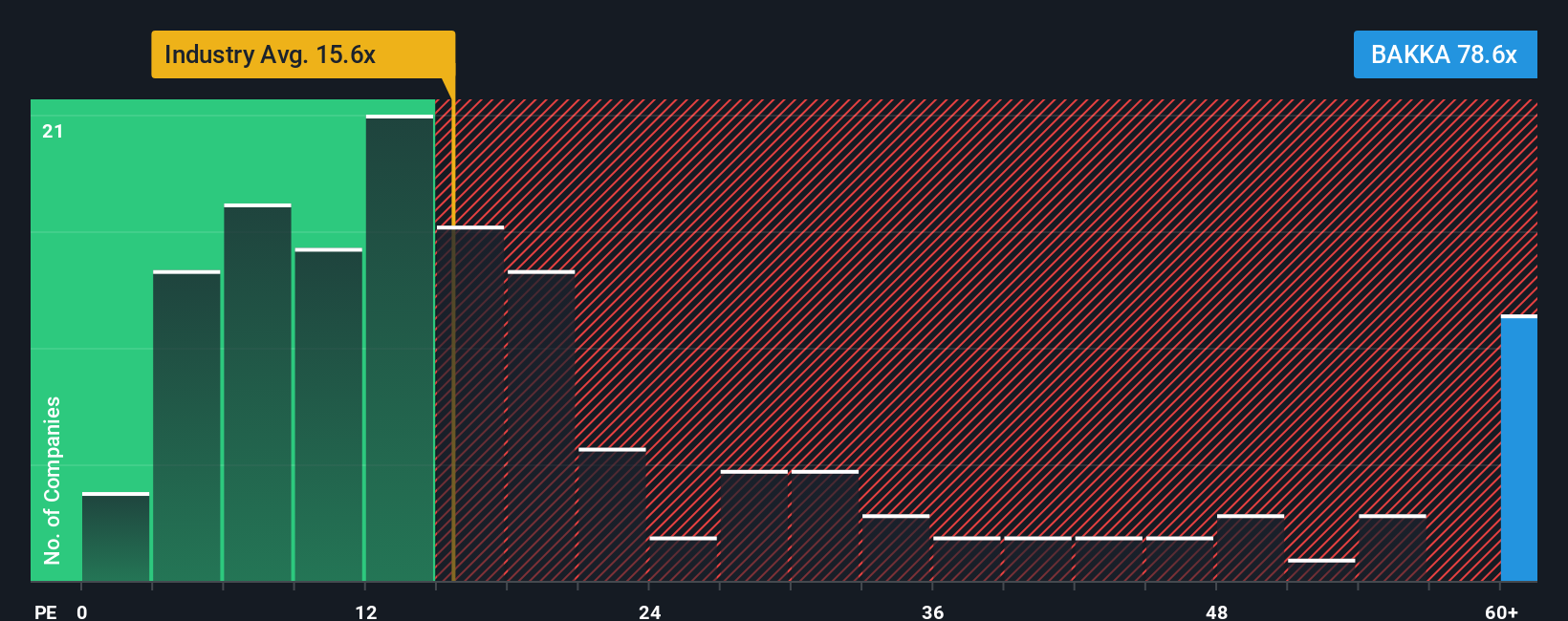

Another View: High Multiple Signals Caution

While analyst forecasts suggest P/F Bakkafrost is undervalued, the company's current price-to-earnings ratio stands at 75.4x, which is far above the European Food industry average of 15.8x and even the estimated fair ratio of 58.7x. This significant premium increases valuation risk if the expected growth does not materialize. Is the market being overly optimistic about a recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own P/F Bakkafrost Narrative

If you'd rather chart your own course or believe this story misses something, you can build your perspective in just a few minutes. Do it your way

A great starting point for your P/F Bakkafrost research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Strategies?

Sticking to just one stock could mean missing out on tomorrow’s top performers. Supercharge your research right now with ideas tailored for growth, yield, and innovation using these powerful tools:

- Accelerate your hunt for big growth with these 24 AI penny stocks, featuring companies that are transforming industries through groundbreaking technology and AI-driven solutions.

- Secure reliable income streams by checking out these 19 dividend stocks with yields > 3%, filled with companies offering robust dividend yields above 3%.

- Capitalize on value the market may have overlooked by reviewing these 909 undervalued stocks based on cash flows, focused on potential upside based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives