- Norway

- /

- Energy Services

- /

- OB:SUBC

Assessing Subsea 7 (OB:SUBC) Valuation as Investor Interest Rebuilds in the Energy Sector

Reviewed by Kshitija Bhandaru

See our latest analysis for Subsea 7.

Subsea 7’s share price has maintained modest upward momentum so far this year, and its one-year total shareholder return of 25% suggests investors are warming up to the company’s recovery prospects and renewed appetite for the sector. While the latest moves have been fairly measured, broader performance shows momentum is gradually rebuilding around Subsea 7’s long-term potential.

If you’re curious about what else might be gaining traction in the energy space, it’s worth exploring the latest opportunities in fast growing stocks with high insider ownership.

With the stock trading only slightly below analyst targets but sporting a significant discount to intrinsic value, the question remains: Is Subsea 7 truly undervalued, or is the market already factoring in future growth?

Most Popular Narrative: 28.1% Undervalued

Compared to the last closing price, the most widely followed narrative claims Subsea 7’s fair value sits well above its current level. This opens up the possibility of substantial upside if the thesis holds up. Investor attention is turning to the company’s upcoming quarter, with fresh catalysts on the horizon.

"Even if investors may wait for the Q1 report before taking large positions, we think positions in Subsea 7 should be taken before mid-June, as the valuation is very attractive, the dividend will be significant (again $1.1 billion over the next 18 months, more than 25 percent of market cap), and even if the coming months may not bring many major catalysts, we suspect the share will turn from June, with 1) the announcement of the formal agreement and the first communication of the business plan; 2) the Q2 report with potentially strong orders (Buzios, Sakarya) and a potential upside for guidance (Subsea 7 may fine-tune it upwards); and 3) the first news flow from September from competition authorities."

Want to know what assumptions drive this bold fair value? The narrative hints at a windfall dividend, a game-changing agreement, and blockbuster new orders. Intrigued by what could turn the tables for Subsea 7’s stock in June? Click to see the forecasts and numbers behind this valuation.

Result: Fair Value of $290 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, slower than expected Q2 order flow or delays in finalizing major agreements could quickly test investor patience and weigh on Subsea 7’s outlook.

Find out about the key risks to this Subsea 7 narrative.

Another View: The Multiples Challenge

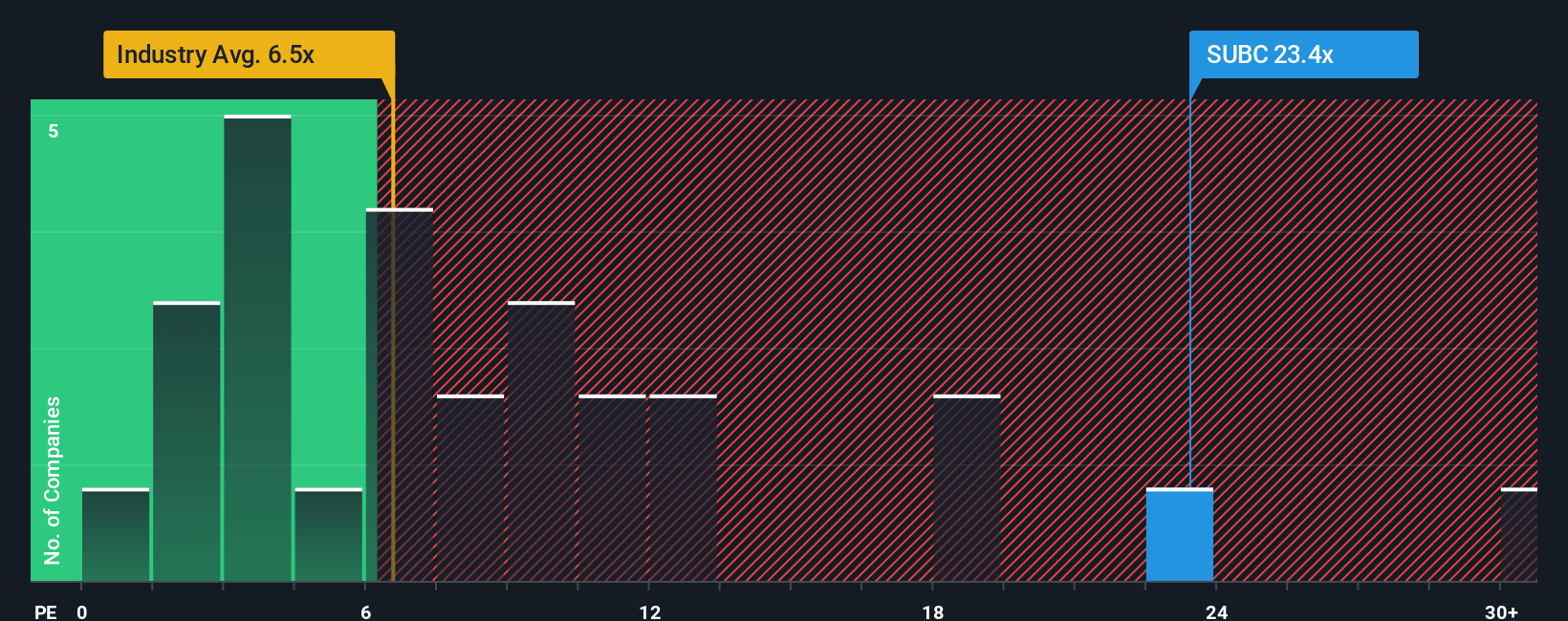

While a fair value approach paints Subsea 7 as notably undervalued, comparing its price-to-earnings ratio to industry benchmarks tells a different story. Subsea 7 trades at 23 times earnings, well above the Norwegian Energy Services industry average of 6.6 and its peer average of 19. The market’s fair ratio sits at 9.7, highlighting a significant disconnect. Does this premium hint at hidden strength, or extra risk if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Subsea 7 Narrative

If you have a different perspective or want to dig into the figures yourself, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Subsea 7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take control of your investing journey by targeting the sectors and opportunities making headlines now. If you want to stay ahead, check out these compelling themes today:

- Boost your portfolio’s passive income by checking out these 19 dividend stocks with yields > 3% with yields above 3% and strong payout histories.

- Tap into the future of healthcare innovation by seeing these 31 healthcare AI stocks shaping patient outcomes with advanced AI-driven solutions.

- Catch the wave of market undervaluation by evaluating these 910 undervalued stocks based on cash flows with significant upside potential based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SUBC

Subsea 7

Subsea 7 S.A. delivers offshore projects and services for the energy industry worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives