- Norway

- /

- Energy Services

- /

- OB:SOFF

Solstad Offshore And 2 Other Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable declines, with U.S. stocks falling significantly before a late-week rally provided some relief. Amid these turbulent conditions, investors are increasingly drawn to growth companies with high insider ownership, as this can signal confidence in the company's potential and align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Solstad Offshore (OB:SOFF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solstad Offshore ASA provides offshore service vessels and maritime services to the offshore energy industry, with a market cap of NOK3.71 billion.

Operations: Revenue Segments (in millions of NOK): Platform Supply Vessels: 1,200; Anchor Handling Tug Supply Vessels: 950; Subsea Construction Vessels: 1,500.

Insider Ownership: 16.7%

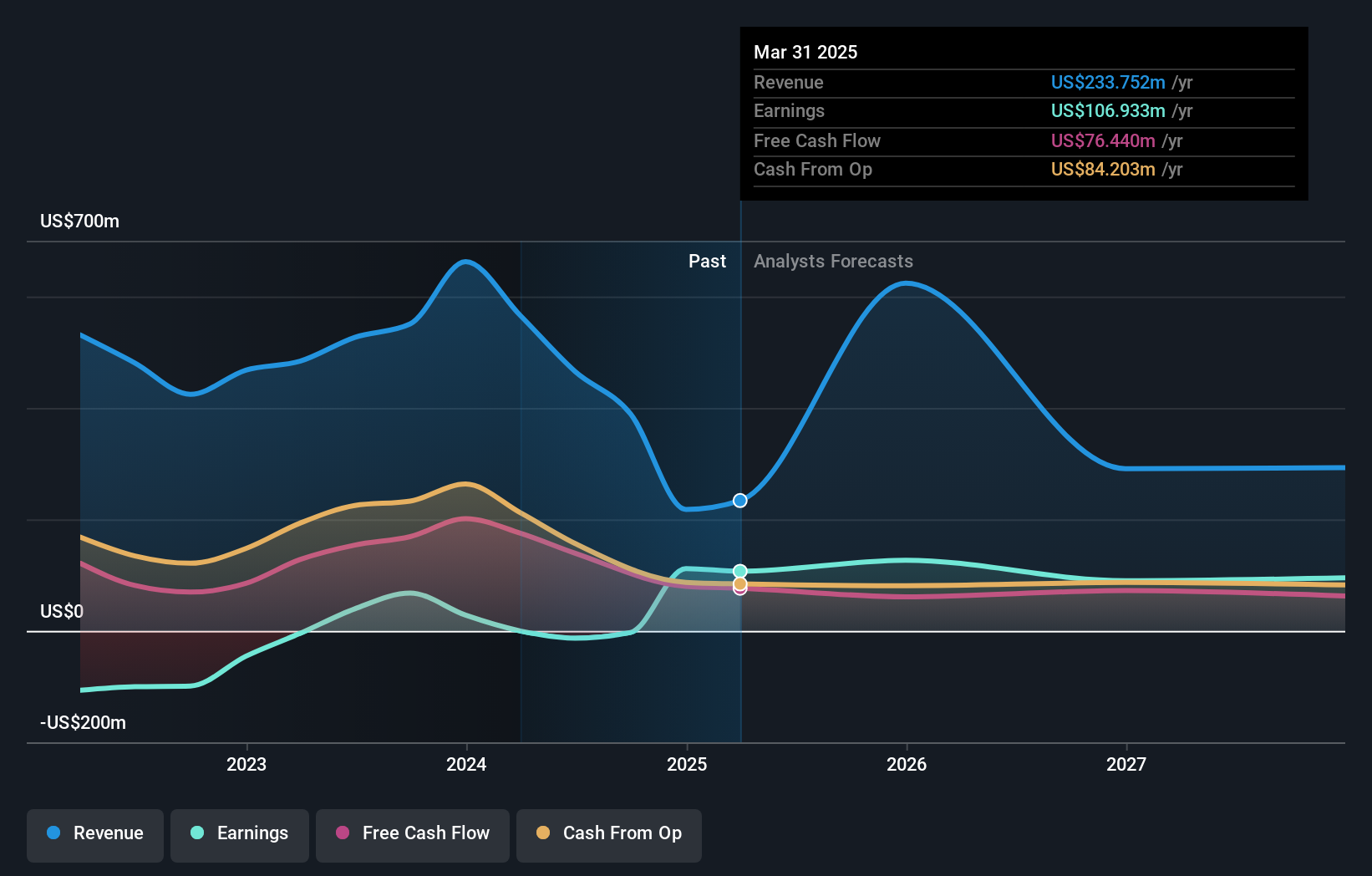

Solstad Offshore has secured significant contracts totaling US$113 million, indicating strong operational momentum. Despite recent shareholder dilution and volatile share prices, the company trades at a substantial discount to its estimated fair value. While revenue is forecasted to decline by 5% annually over the next three years, Solstad is expected to achieve profitability with earnings growth projected at 34.91% per year. High insider ownership may align management interests with shareholders despite no recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Solstad Offshore.

- Upon reviewing our latest valuation report, Solstad Offshore's share price might be too pessimistic.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd is a Chinese lithography company focused on designing, developing, and producing mask products, with a market cap of CN¥5.23 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥793.19 million.

Insider Ownership: 32.1%

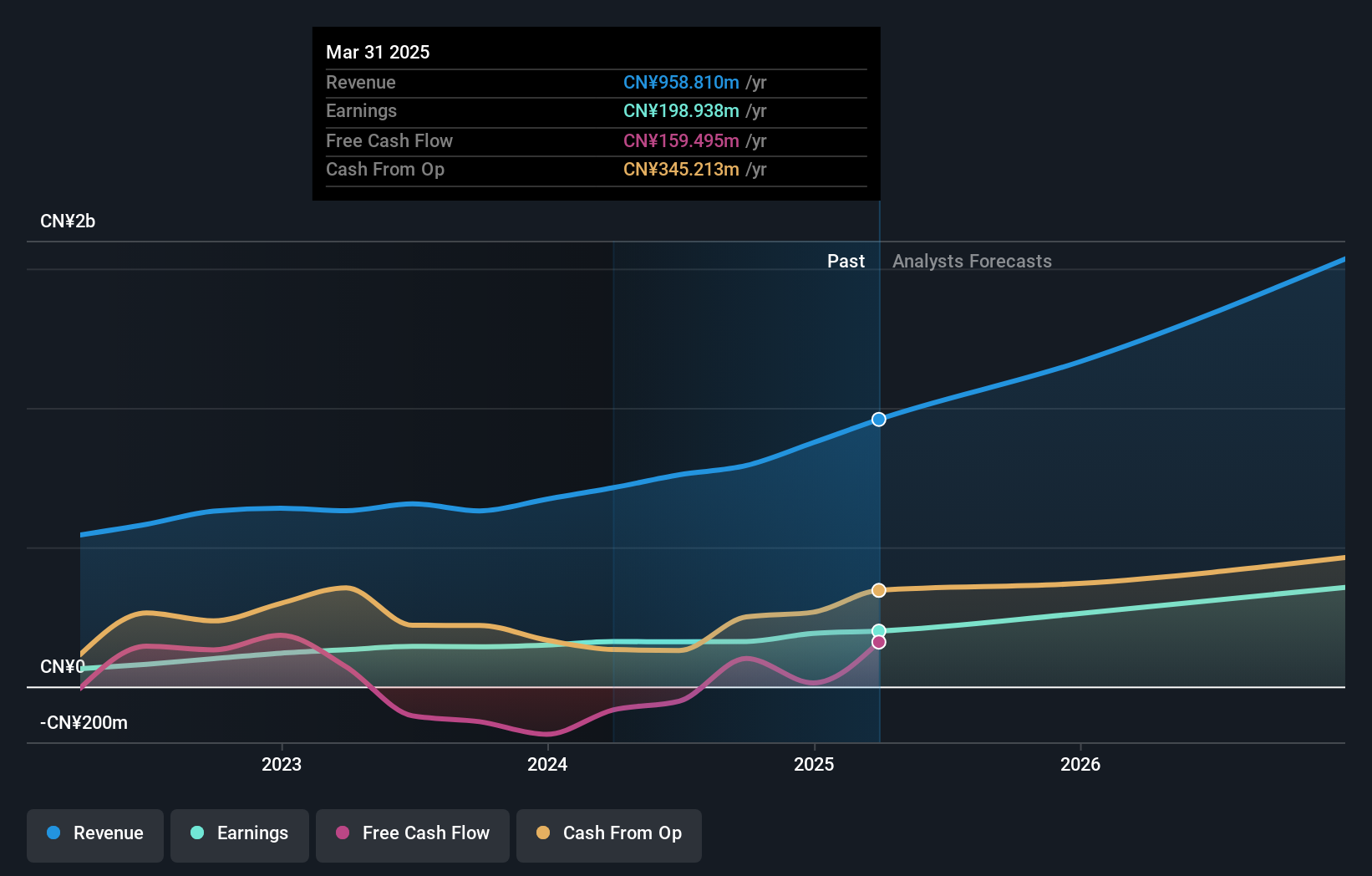

Shenzhen Newway Photomask Making shows promising growth potential, with earnings projected to grow significantly at 31.87% annually over the next three years, outpacing the Chinese market average. Revenue is expected to rise by 26.3% per year, also surpassing market growth rates. The company trades at a favorable price-to-earnings ratio of 32.4x compared to the broader CN market's 35.5x, suggesting good relative value despite low forecasted return on equity of 15.5%.

- Unlock comprehensive insights into our analysis of Shenzhen Newway Photomask Making stock in this growth report.

- The valuation report we've compiled suggests that Shenzhen Newway Photomask Making's current price could be quite moderate.

Xiamen Wanli Stone StockLtd (SZSE:002785)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Wanli Stone Stock Co., Ltd engages in the development, processing, and installation of stone products and related items across multiple countries including China, Japan, South Korea, and the United States, with a market cap of CN¥7.68 billion.

Operations: The company's revenue primarily comes from its Stone Processing and Manufacturing Industry segment, which generated CN¥1.01 billion.

Insider Ownership: 18.9%

Xiamen Wanli Stone Stock Ltd is expected to achieve significant earnings growth of 107.53% annually, outpacing the Chinese market's average, although its revenue growth forecast of 19.2% per year remains below the 20% threshold. Despite a low return on equity forecasted at 15.3%, the company is anticipated to become profitable within three years. Recent earnings showed modest sales increase to CNY 911.25 million, but net income declined slightly year-over-year.

- Navigate through the intricacies of Xiamen Wanli Stone StockLtd with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Xiamen Wanli Stone StockLtd implies its share price may be too high.

Next Steps

- Unlock our comprehensive list of 1512 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SOFF

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives