- Norway

- /

- Energy Services

- /

- OB:SEA1

Some Siem Offshore Shareholders Have Taken A Painful 83% Share Price Drop

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Siem Offshore Inc. (OB:SIOFF) for five years would be nursing their metaphorical wounds since the share price dropped 83% in that time. And some of the more recent buyers are probably worried, too, with the stock falling 24% in the last year. On top of that, the share price is down 13% in the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Siem Offshore

Because Siem Offshore is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Siem Offshore saw its revenue shrink by 2.4% per year. While far from catastrophic that is not good. The share price fall of 30% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

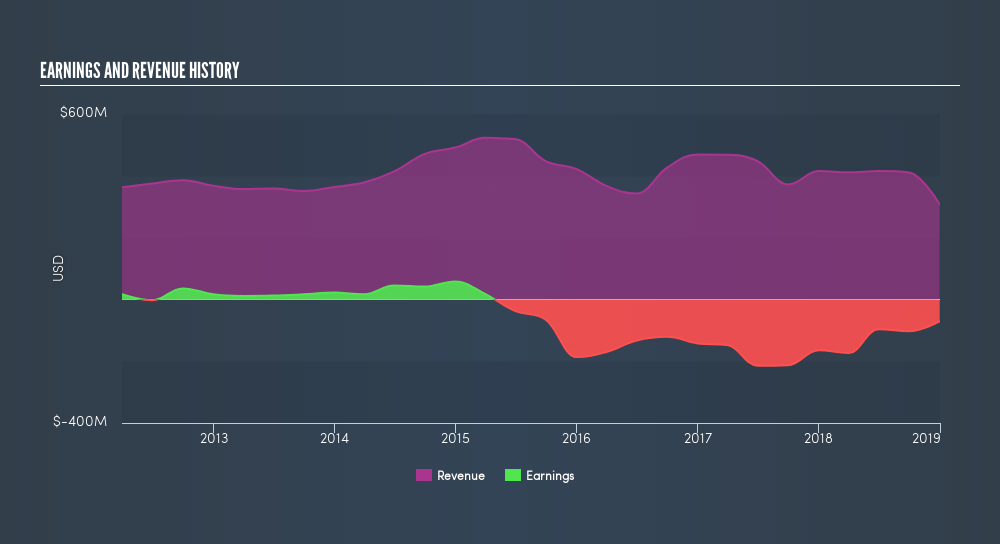

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Siem Offshore's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Siem Offshore shareholders are down 24% for the year. Unfortunately, that's worse than the broader market decline of 11%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 30% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You could get a better understanding of Siem Offshore's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Siem Offshore better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:SEA1

Sea1 Offshore

Owns and operates offshore support vessels for the offshore energy service industry.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives