Unfortunately for shareholders, when Siem Offshore Inc. (OB:SIOFF) reported results for the period to December 2020, its auditors, PricewaterhouseCoopers LLP, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

View our latest analysis for Siem Offshore

How Much Debt Does Siem Offshore Carry?

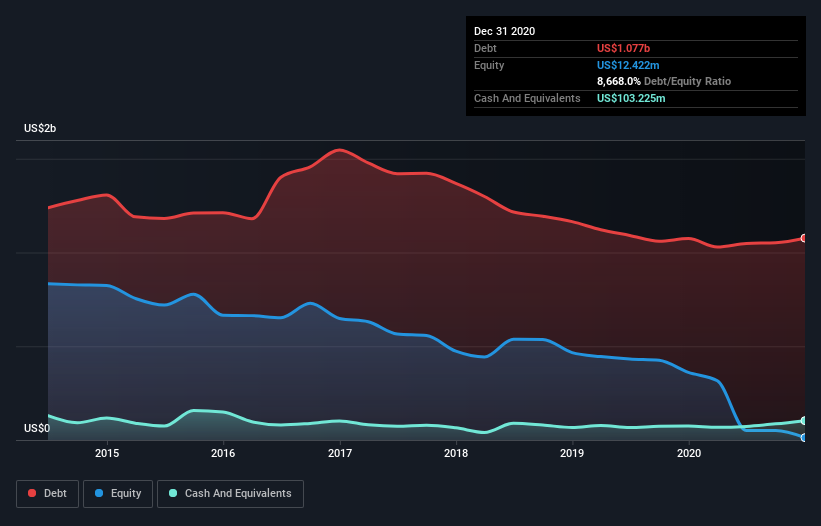

As you can see below, Siem Offshore had US$1.08b of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it also had US$103.2m in cash, and so its net debt is US$973.5m.

How Strong Is Siem Offshore's Balance Sheet?

We can see from the most recent balance sheet that Siem Offshore had liabilities of US$316.0m falling due within a year, and liabilities of US$857.4m due beyond that. Offsetting this, it had US$103.2m in cash and US$40.6m in receivables that were due within 12 months. So it has liabilities totalling US$1.03b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$74.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Siem Offshore would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Siem Offshore shareholders face the double whammy of a high net debt to EBITDA ratio (13.4), and fairly weak interest coverage, since EBIT is just 0.16 times the interest expense. The debt burden here is substantial. Even worse, Siem Offshore saw its EBIT tank 37% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Siem Offshore will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Siem Offshore actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Siem Offshore's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Taking into account all the aforementioned factors, it looks like Siem Offshore has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. We prefer to invest in companies that ensure the balance sheet remains healthier than that. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Siem Offshore (1 is a bit unpleasant) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Siem Offshore, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:SEA1

Sea1 Offshore

Owns and operates offshore support vessels for the offshore energy service industry.

Very undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives