- Norway

- /

- Energy Services

- /

- OB:SHLF

Such Is Life: How Shelf Drilling (OB:SHLF) Shareholders Saw Their Shares Drop 54%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Even the best stock pickers will make plenty of bad investments. And there's no doubt that Shelf Drilling, Ltd. (OB:SHLF) stock has had a really bad year. To wit the share price is down 54% in that time. Shelf Drilling may have better days ahead, of course; we've only looked at a one year period. Unfortunately the share price momentum is still quite negative, with prices down 15% in thirty days.

See our latest analysis for Shelf Drilling

Because Shelf Drilling is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Shelf Drilling increased its revenue by 6.9%. That's not a very high growth rate considering it doesn't make profits. It's likely this muted growth has contributed to the share price decline of 54% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

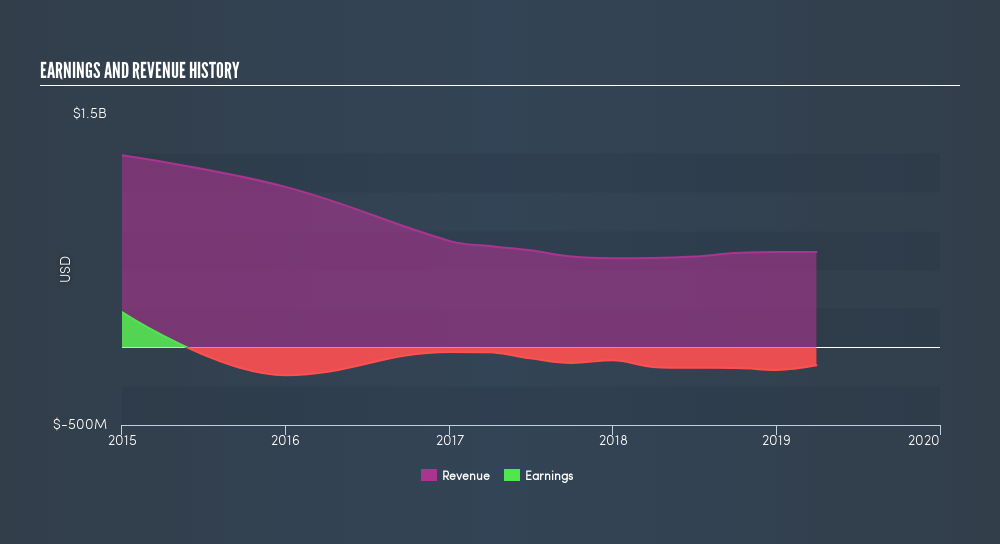

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We doubt Shelf Drilling shareholders are happy with the loss of 54% over twelve months. That falls short of the market, which lost 1.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 12%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You could get a better understanding of Shelf Drilling's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:SHLF

Shelf Drilling

Operates as a shallow water offshore drilling contractor in the Middle East, North Africa, the Mediterranean, Southeast Asia, India, West Africa, and the North Sea.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives