Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Reach Subsea ASA (OB:REACH) shareholders for doubting their decision to hold, with the stock down 25% over a half decade. The falls have accelerated recently, with the share price down 10% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Reach Subsea

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

In the last five years Reach Subsea improved its bottom line results, having previously been loss-making. That would generally be considered a positive, so we are surprised to see the share price is down.

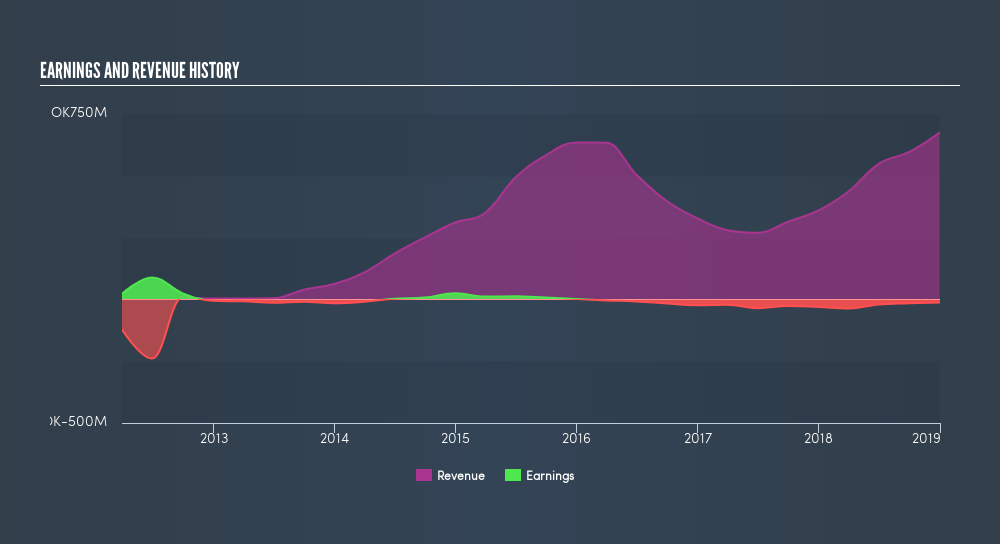

Revenue is actually up 16% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Reach Subsea's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 7.7% in the last year, Reach Subsea shareholders lost 10% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5.5% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Reach Subsea it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:REACH

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives