We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the Petrolia SE (OB:PSE) share price dropped 67% in the last half decade. We certainly feel for shareholders who bought near the top. It's up 3.8% in the last seven days.

See our latest analysis for Petrolia

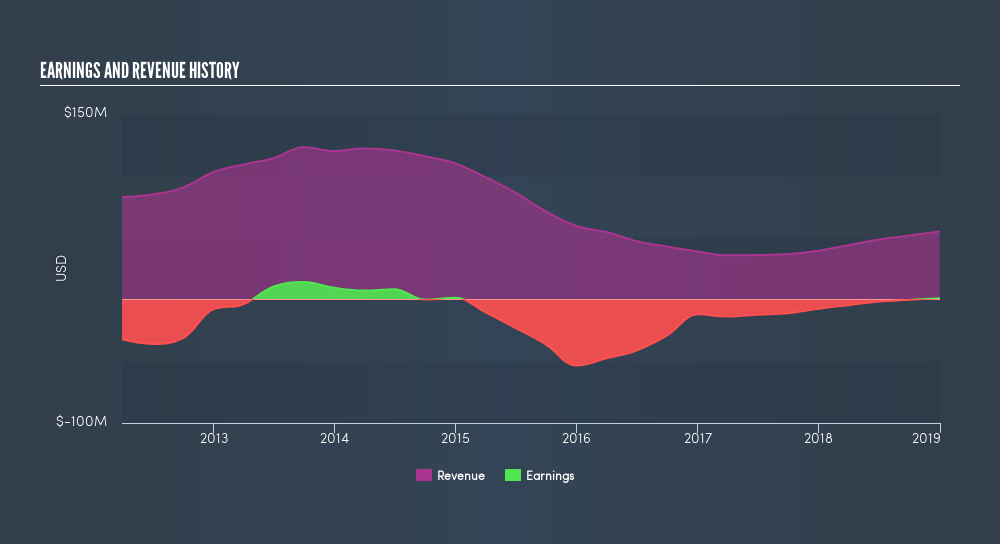

While Petrolia made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over half a decade Petrolia reduced its trailing twelve month revenue by 26% for each year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 20% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

If you are thinking of buying or selling Petrolia stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

It's good to see that Petrolia has rewarded shareholders with a total shareholder return of 42% in the last twelve months. That certainly beats the loss of about 20% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before spending more time on Petrolia it might be wise to click here to see if insiders have been buying or selling shares.

But note: Petrolia may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:PSE

Petrolia

Engages in the rental and sale of energy service equipment to energy industry in Norway, rest of Europe, Asia, and Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives