European Penny Stocks Spotlight: AFYREN SAS And 2 More Hidden Opportunities

Reviewed by Simply Wall St

Amidst the backdrop of renewed uncertainty in U.S. trade policy and escalating geopolitical tensions, European markets have experienced a downturn, with major indexes like Germany's DAX and Italy's FTSE MIB seeing notable declines. In such fluctuating market conditions, investors often look towards smaller or less-established companies for potential opportunities. Although the term "penny stocks" may seem outdated, it still signifies investment areas where affordability meets growth potential. This article explores three European penny stocks that stand out for their financial strength and promise in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Angler Gaming (NGM:ANGL) | SEK3.77 | SEK282.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.95 | €62.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.41 | €16.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.06 | PLN10.94M | ✅ 2 ⚠️ 4 View Analysis > |

| Libertas 7 (BME:LIB) | €1.78 | €37.93M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| High (ENXTPA:HCO) | €3.80 | €74.66M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 451 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AFYREN SAS offers solutions to substitute petroleum-based ingredients with products derived from non-food biomass in France and has a market cap of €74.94 million.

Operations: Currently, there are no reported revenue segments for AFYREN SAS.

Market Cap: €74.94M

AFYREN SAS, with a market cap of €74.94 million, is pre-revenue but has demonstrated significant operational progress with its first plant, AFYREN NEOXY, achieving continuous production. This development marks a step towards commercialization as the company aims to ramp up production capacity and achieve target profitability. Despite being unprofitable and experiencing increased losses over the past five years, AFYREN maintains a solid financial position with more cash than debt and sufficient short-term assets to cover liabilities. The recent appointment of experienced industrial leaders strengthens its management team as it navigates this critical growth phase.

- Get an in-depth perspective on AFYREN SAS' performance by reading our balance sheet health report here.

- Assess AFYREN SAS' future earnings estimates with our detailed growth reports.

Petrolia (OB:PSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Petrolia SE, with a market cap of NOK247.94 million, operates in the rental and sale of energy service equipment across Norway, Europe, Asia, and Australia.

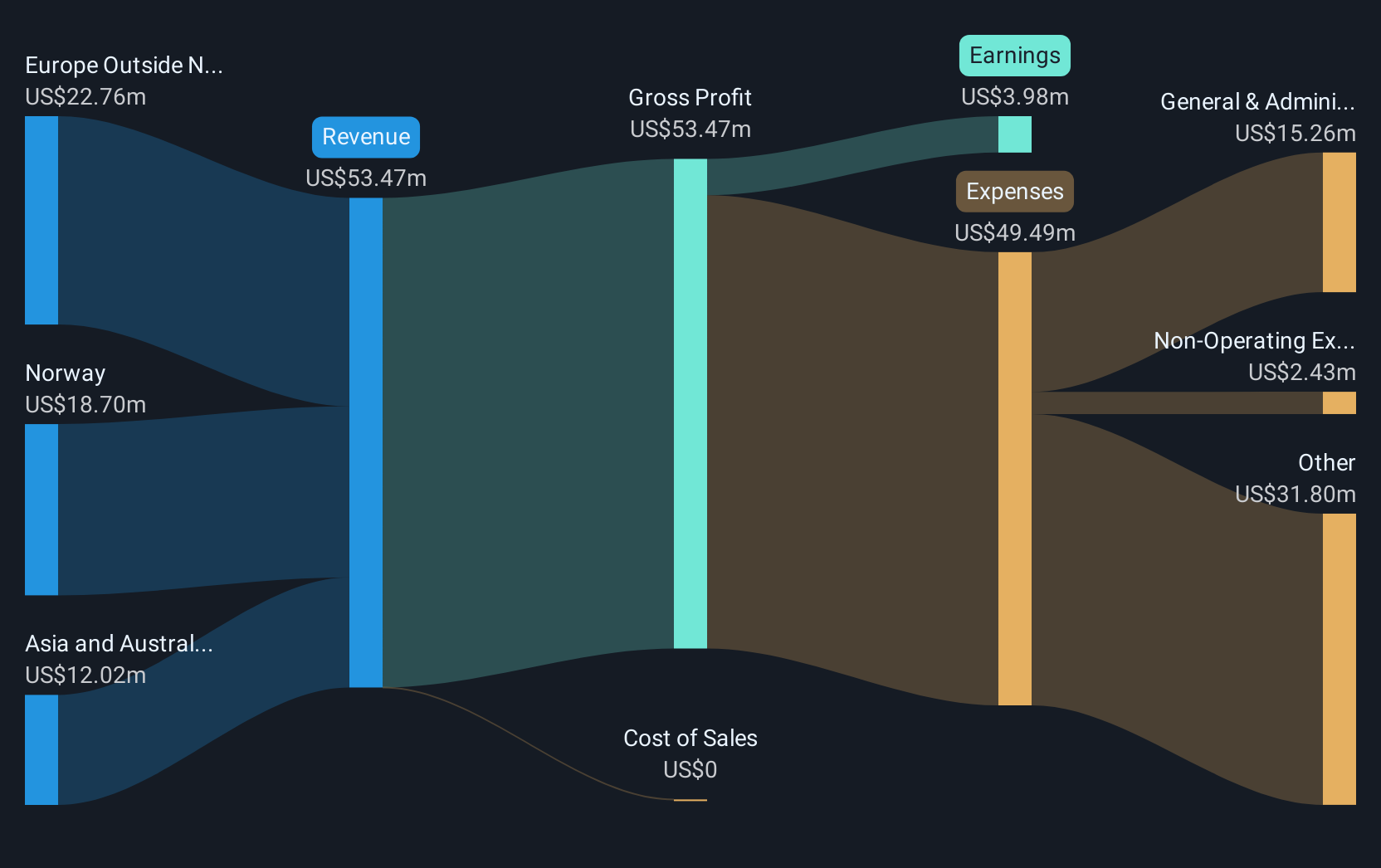

Operations: The company's revenue segment is derived entirely from Energy Service, amounting to $53.47 million.

Market Cap: NOK247.94M

Petrolia SE, with a market cap of NOK247.94 million, operates profitably within the energy service sector, generating $53.47 million in revenue. The company has demonstrated robust financial health; its short-term assets significantly exceed both short and long-term liabilities, and it holds more cash than total debt. Petrolia's earnings growth over the past year (98%) surpasses industry averages, indicating strong operational performance despite high share price volatility recently. The board is experienced with an average tenure of 5.6 years, contributing to stable governance as evidenced by recent proposed amendments to company bylaws ahead of their AGM on May 29, 2025.

- Take a closer look at Petrolia's potential here in our financial health report.

- Evaluate Petrolia's historical performance by accessing our past performance report.

Eniro Group (OM:ENRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eniro Group AB (publ) operates as a software-as-a-service company in Sweden, Norway, Denmark, and Finland, with a market cap of SEK337.80 million.

Operations: The company's revenue is derived from two segments: Dynava, contributing SEK365 million, and Marketing Partner, generating SEK592 million.

Market Cap: SEK337.8M

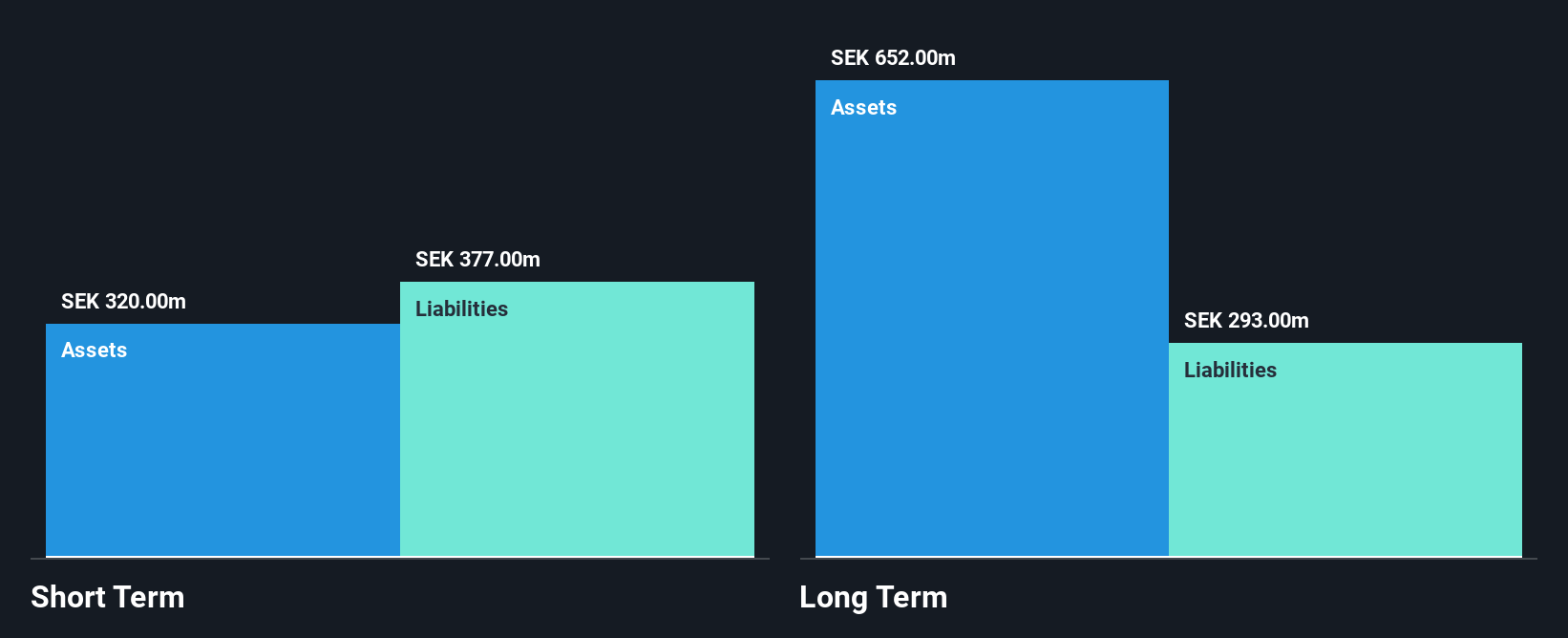

Eniro Group AB, with a market cap of SEK337.80 million, operates debt-free and trades at significant value below its estimated fair value. Recent first-quarter results show sales of SEK237 million and net income rising to SEK16 million from SEK4 million year-over-year. Despite legal challenges concerning share redemption decisions, the company remains financially stable, with short-term assets covering long-term liabilities but not all short-term liabilities. The appointment of Mario von Dahn as CFO is expected to bolster financial management given his extensive SaaS experience. Eniro's earnings are forecasted to grow by nearly 20% annually, reflecting potential upside amidst current challenges.

- Dive into the specifics of Eniro Group here with our thorough balance sheet health report.

- Evaluate Eniro Group's prospects by accessing our earnings growth report.

Key Takeaways

- Discover the full array of 451 European Penny Stocks right here.

- Ready For A Different Approach? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALAFY

AFYREN SAS

Provides solutions to replace petroleum-based ingredients with products derived from non-food biomass in France.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives