- Norway

- /

- Energy Services

- /

- OB:PRS

Not Many Are Piling Into Prosafe SE (OB:PRS) Stock Yet As It Plummets 39%

Unfortunately for some shareholders, the Prosafe SE (OB:PRS) share price has dived 39% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

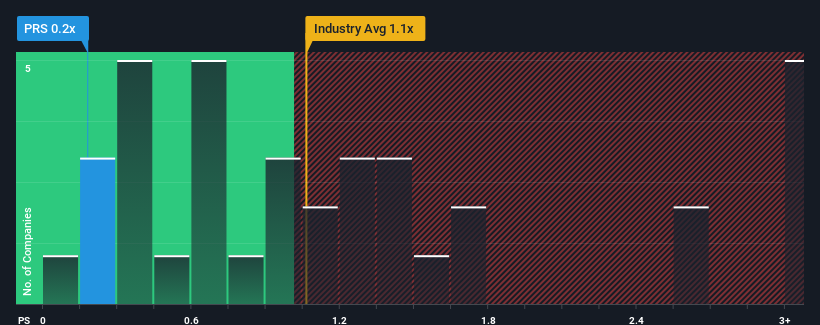

Since its price has dipped substantially, when close to half the companies operating in Norway's Energy Services industry have price-to-sales ratios (or "P/S") above 1x, you may consider Prosafe as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Prosafe

What Does Prosafe's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Prosafe's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Prosafe will help you uncover what's on the horizon.How Is Prosafe's Revenue Growth Trending?

Prosafe's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.8%. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 17% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 19%, which is not materially different.

With this information, we find it odd that Prosafe is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Prosafe's P/S Mean For Investors?

The southerly movements of Prosafe's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Prosafe currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Prosafe that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PRS

Prosafe

Owns and operates semi-submersible accommodation vessels in South America, north America, and Europe.

Exceptional growth potential and fair value.

Market Insights

Community Narratives