Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Prosafe SE (OB:PRS) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Prosafe

What Is Prosafe's Net Debt?

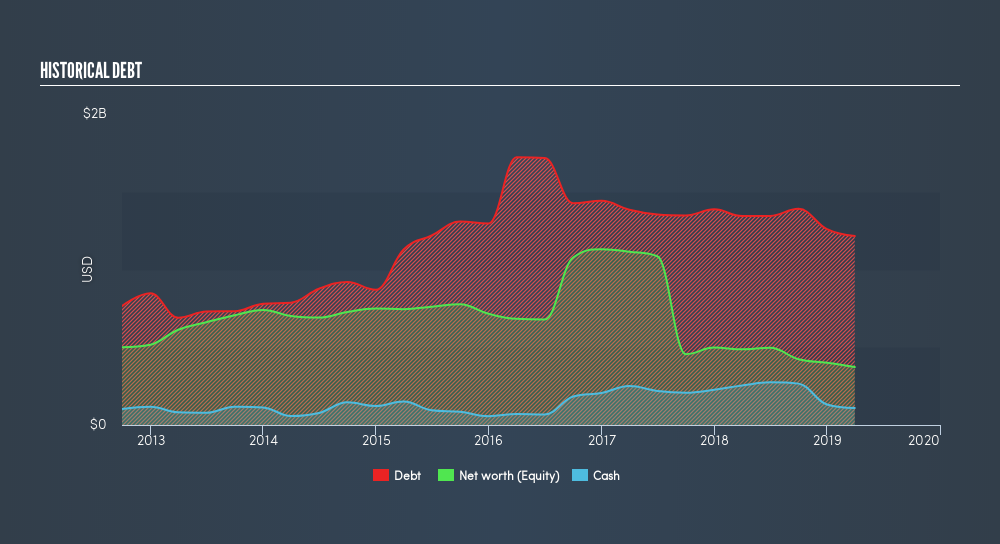

As you can see below, Prosafe had US$1.21b of debt at March 2019, down from US$1.34b a year prior. However, it does have US$109.3m in cash offsetting this, leading to net debt of about US$1.11b.

A Look At Prosafe's Liabilities

The latest balance sheet data shows that Prosafe had liabilities of US$118.6m due within a year, and liabilities of US$1.19b falling due after that. Offsetting this, it had US$109.3m in cash and US$33.4m in receivables that were due within 12 months. So it has liabilities totalling US$1.17b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$90.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt At the end of the day, Prosafe would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Prosafe shareholders face the double whammy of a high net debt to EBITDA ratio (7.9), and fairly weak interest coverage, since EBIT is just 0.18 times the interest expense. This means we'd consider it to have a heavy debt load. Looking on the bright side, Prosafe boosted its EBIT by a silky 43% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Prosafe's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Prosafe actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Prosafe's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that Prosafe's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Even though Prosafe lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:PRS

Prosafe

Owns and operates semi-submersible accommodation vessels in South America, North America, and Europe.

Undervalued slight.

Market Insights

Community Narratives