- Norway

- /

- Energy Services

- /

- OB:PRS

Even With A 26% Surge, Cautious Investors Are Not Rewarding Prosafe SE's (OB:PRS) Performance Completely

The Prosafe SE (OB:PRS) share price has done very well over the last month, posting an excellent gain of 26%. But the last month did very little to improve the 69% share price decline over the last year.

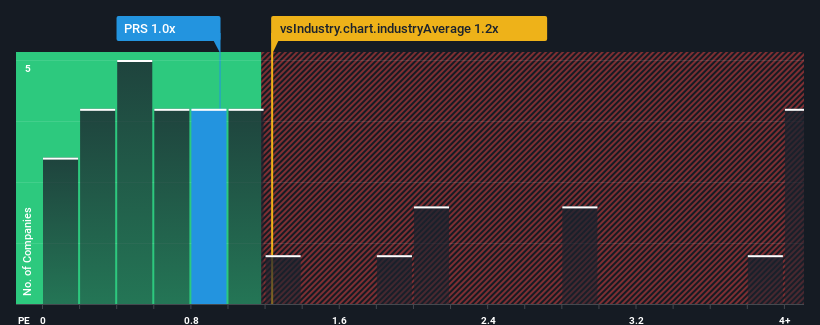

Although its price has surged higher, it would still be understandable if you think Prosafe is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Norway's Energy Services industry have P/S ratios above 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in Prosafe. Read for free now.Check out our latest analysis for Prosafe

What Does Prosafe's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Prosafe has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Prosafe.How Is Prosafe's Revenue Growth Trending?

In order to justify its P/S ratio, Prosafe would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 7.7% over the next year. With the industry only predicted to deliver 5.0%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Prosafe's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Prosafe's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Prosafe's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 3 warning signs we've spotted with Prosafe (including 1 which is a bit unpleasant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Prosafe, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PRS

Prosafe

Owns and operates semi-submersible accommodation vessels in South America, North America, and Europe.

Exceptional growth potential and fair value.

Market Insights

Community Narratives