- Norway

- /

- Oil and Gas

- /

- OB:PNOR

The PetroNor E&P (OB:PNOR) Share Price Has Gained 21% And Shareholders Are Hoping For More

While PetroNor E&P Limited (OB:PNOR) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 19% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 21%.

Check out our latest analysis for PetroNor E&P

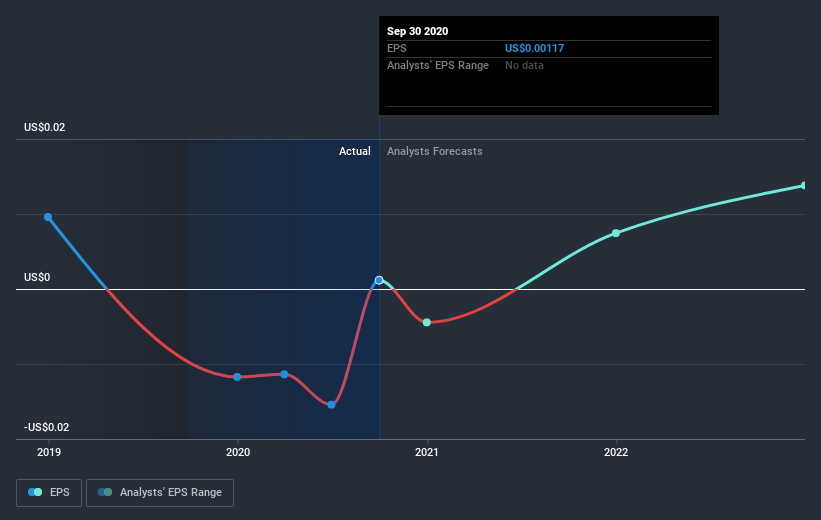

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year PetroNor E&P grew its earnings per share, moving from a loss to a profit.

While it's good to see positive EPS of US$0.0012 this year, the loss wasn't too bad last year. But judging by the share price, the market is happy with the maiden profit. Inflection points like this can be a great time to take a closer look at a company.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that PetroNor E&P has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's nice to see that PetroNor E&P shareholders have gained 21% over the last year. Unfortunately the share price is down 19% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for PetroNor E&P (1 can't be ignored!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

When trading PetroNor E&P or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:PNOR

PetroNor E&P

Operates as an independent oil and gas exploration and production company in in the Republic of the Congo, the Gambia, and Nigeria.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026