- Norway

- /

- Oil and Gas

- /

- OB:OET

Why You Might Be Interested In Okeanis Eco Tankers Corp. (OB:OET) For Its Upcoming Dividend

Readers hoping to buy Okeanis Eco Tankers Corp. (OB:OET) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Meaning, you will need to purchase Okeanis Eco Tankers' shares before the 1st of December to receive the dividend, which will be paid on the 16th of December.

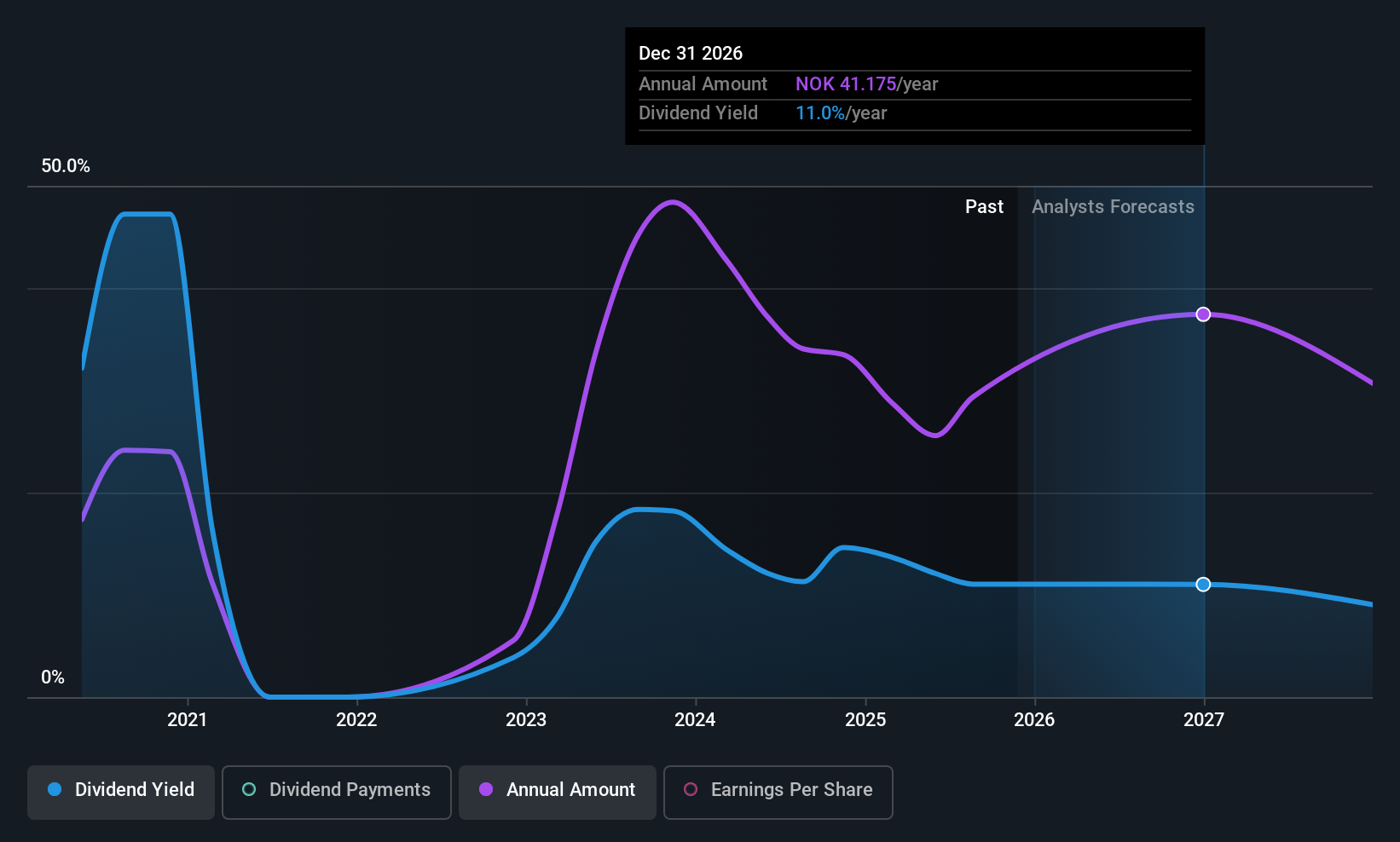

The company's next dividend payment will be US$0.75 per share. Last year, in total, the company distributed US$3.00 to shareholders. Last year's total dividend payments show that Okeanis Eco Tankers has a trailing yield of 8.2% on the current share price of kr0373.50. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Okeanis Eco Tankers can afford its dividend, and if the dividend could grow.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. It paid out 89% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline.

See our latest analysis for Okeanis Eco Tankers

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Okeanis Eco Tankers's earnings have been skyrocketing, up 47% per annum for the past five years. Earnings per share are growing at a rapid rate, yet the company is paying out more than three-quarters of its earnings.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past six years, Okeanis Eco Tankers has increased its dividend at approximately 7.0% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

Is Okeanis Eco Tankers worth buying for its dividend? Okeanis Eco Tankers has an acceptable payout ratio and its earnings per share have been improving at a decent rate. We think this is a pretty attractive combination, and would be interested in investigating Okeanis Eco Tankers more closely.

While it's tempting to invest in Okeanis Eco Tankers for the dividends alone, you should always be mindful of the risks involved. Every company has risks, and we've spotted 2 warning signs for Okeanis Eco Tankers (of which 1 is significant!) you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OET

Okeanis Eco Tankers

A shipping company, owns and operates tanker vessels worldwide.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success