- Norway

- /

- Energy Services

- /

- OB:NOL

Not Many Are Piling Into Northern Ocean Ltd. (OB:NOL) Stock Yet As It Plummets 26%

Northern Ocean Ltd. (OB:NOL) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

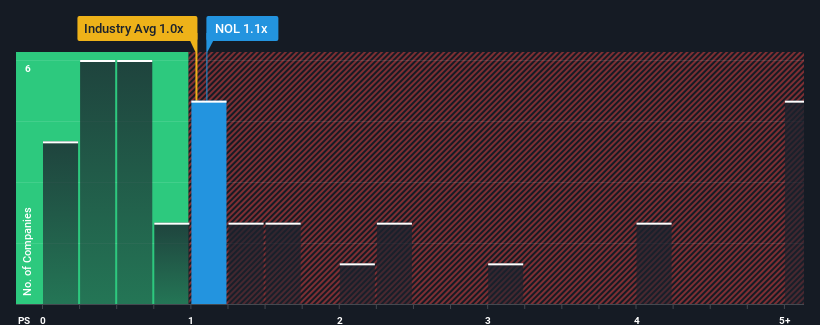

Although its price has dipped substantially, there still wouldn't be many who think Northern Ocean's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in Norway's Energy Services industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Northern Ocean

What Does Northern Ocean's Recent Performance Look Like?

Northern Ocean certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Northern Ocean.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Northern Ocean's to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Pleasingly, revenue has also lifted 109% in aggregate from three years ago, thanks to the last 12 months of explosive growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 82% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 42%, which is noticeably less attractive.

In light of this, it's curious that Northern Ocean's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Northern Ocean's P/S

With its share price dropping off a cliff, the P/S for Northern Ocean looks to be in line with the rest of the Energy Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Northern Ocean's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Northern Ocean that you need to take into consideration.

If these risks are making you reconsider your opinion on Northern Ocean, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Northern Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NOL

Northern Ocean

Provides offshore contract drilling services for the oil and gas industry worldwide.

Reasonable growth potential with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026