- Norway

- /

- Energy Services

- /

- OB:NOL

Northern Ocean (OB:NOL) Q3 Losses Deepen, Challenging Bullish Profitability Narratives

Reviewed by Simply Wall St

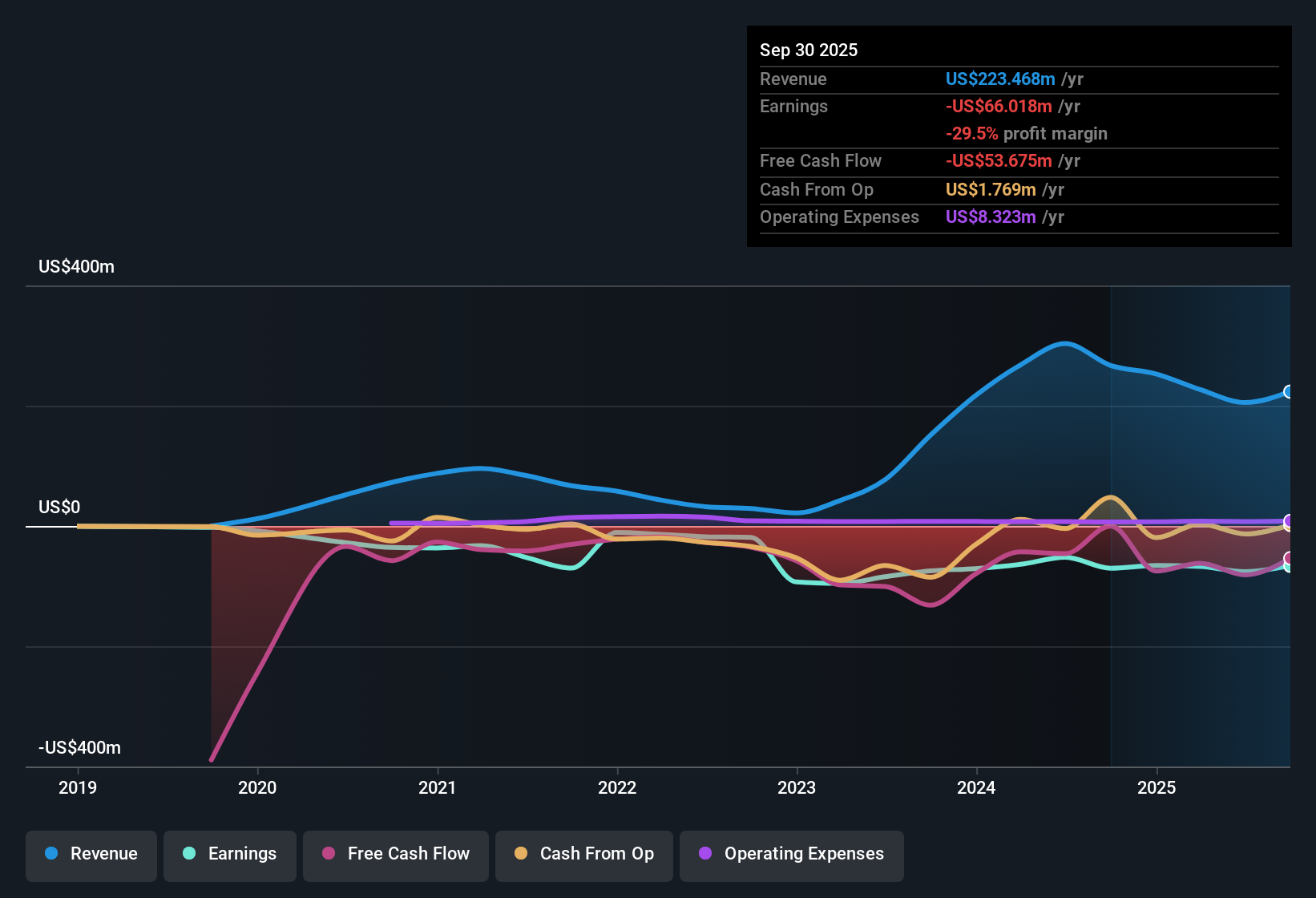

Northern Ocean (OB:NOL) just released its Q3 2025 results, reporting revenue of $57.4 million and basic EPS of -$0.09. Over the past five quarters, the company has seen revenue range from $37.8 million to $70.3 million per quarter, while EPS has stayed in negative territory between -$0.03 and -$0.13. Margins remained compressed as losses continued, putting pressure on near-term profitability.

See our full analysis for Northern Ocean.Next, we will see how these results measure up against the most widely discussed narratives in the Simply Wall St community. We will also examine where the financial story might surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Cash Runway Remains Thin, Profitability Still Out of Reach

- Northern Ocean’s filings show it ended Q3 2025 with less than one year of available cash runway, signaling ongoing liquidity pressure despite $222.5 million in trailing twelve-month revenue.

- Even with forecast annual earnings growth of 105.51% and projected transition to profitability within three years, the path ahead is defined by persistent losses and recent net income trending deeper into negative territory (Q3 net loss: $25.9 million).

- What stands out is that over the last year, net loss accelerated from -$52.0 million to -$66.0 million. This highlights the tension between aggressive growth forecasts and current cost control challenges.

- Meanwhile, net profit margin and earnings quality have not shown concrete improvement. This challenges the idea of a near-term turnaround no matter how strong the future growth prediction may be.

Topline Growth Outpaces Market But Doesn’t Translate Yet

- Trailing twelve-month revenue growth topped 11.7%, beating the Norwegian market average of 2.5% and landing at $222.5 million in total sales.

- On deeper review, revenue momentum supports optimism for the business. However, ongoing unprofitability and a -0.19 USD trailing EPS mean the bullish narrative about growth translating into earnings is still unproven.

- Bulls emphasize that revenue could be the launchpad for future profitability, arguing that faster scaling will eventually absorb fixed costs and lift margins.

- However, with every quarter still showing a loss, the topline story so far provides hope but not certainty for bottom-line improvement.

Valuation Looks Mixed Versus Peers

- Northern Ocean trades at a Price-to-Sales ratio of 1.1x, which makes it cheaper than many direct peers. Yet it remains expensive relative to the wider Norwegian energy services industry average.

- These valuation signals reflect a nuanced debate. Some see upside in the relative peer discount, but analysts point out that near-term liquidity issues and a below-peer DCF fair value of $5.61 add risk for investors at the current share price of $8.24.

- The company’s premium to industry averages is hard to justify while cash runway risks and share price volatility persist.

- Still, valuation may recover quickly if margins improve and forecasts are realized. This underscores the tension between growth potential and current financial constraints.

To see investment arguments for and against this stock brought to life, check out the full Consensus Narrative for Northern Ocean.

📊 Read the full Northern Ocean Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Northern Ocean's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Northern Ocean’s continued losses, thin cash runway, and lack of margin improvement highlight ongoing financial health challenges that may concern risk-averse investors.

Prefer sturdier finances? Use our solid balance sheet and fundamentals stocks screener (1941 results) to find companies that maintain strong balance sheets and robust fundamentals. This can give you more confidence in turbulent times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOL

Northern Ocean

Provides offshore contract drilling services for the oil and gas industry worldwide.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026