- Norway

- /

- Energy Services

- /

- OB:NOL

European Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the pan-European STOXX Europe 600 Index climbing 2.35% and major single-country indexes also showing gains, investors are increasingly focused on identifying growth opportunities within the region. In this context, stocks with high insider ownership can be particularly attractive as they often indicate strong alignment between company leadership and shareholders' interests, making them worthy of attention in today's market environment.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Here's a peek at a few of the choices from the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions across fashion, automotive, and furniture markets globally, with a market cap of €904.65 million.

Operations: The company's revenue is segmented as follows: €168.04 million from the Americas, €126.97 million from the Asia-Pacific region, and €220.55 million from EMEA (Europe, Middle East, and Africa).

Insider Ownership: 12.7%

Lectra's insider ownership aligns with its growth potential, as earnings are forecast to grow significantly at 22.4% annually, outpacing the French market. Despite recent declines in sales and net income for the nine months ending September 2025, analysts expect a stock price increase of 24.4%. The company trades at a substantial discount to estimated fair value and anticipates revenue growth of 5.4% per year, although this is below high-growth benchmarks.

- Unlock comprehensive insights into our analysis of Lectra stock in this growth report.

- Our comprehensive valuation report raises the possibility that Lectra is priced lower than what may be justified by its financials.

Northern Ocean (OB:NOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Northern Ocean Ltd. offers offshore contract drilling services for the global oil and gas industry, with a market cap of NOK2.54 billion.

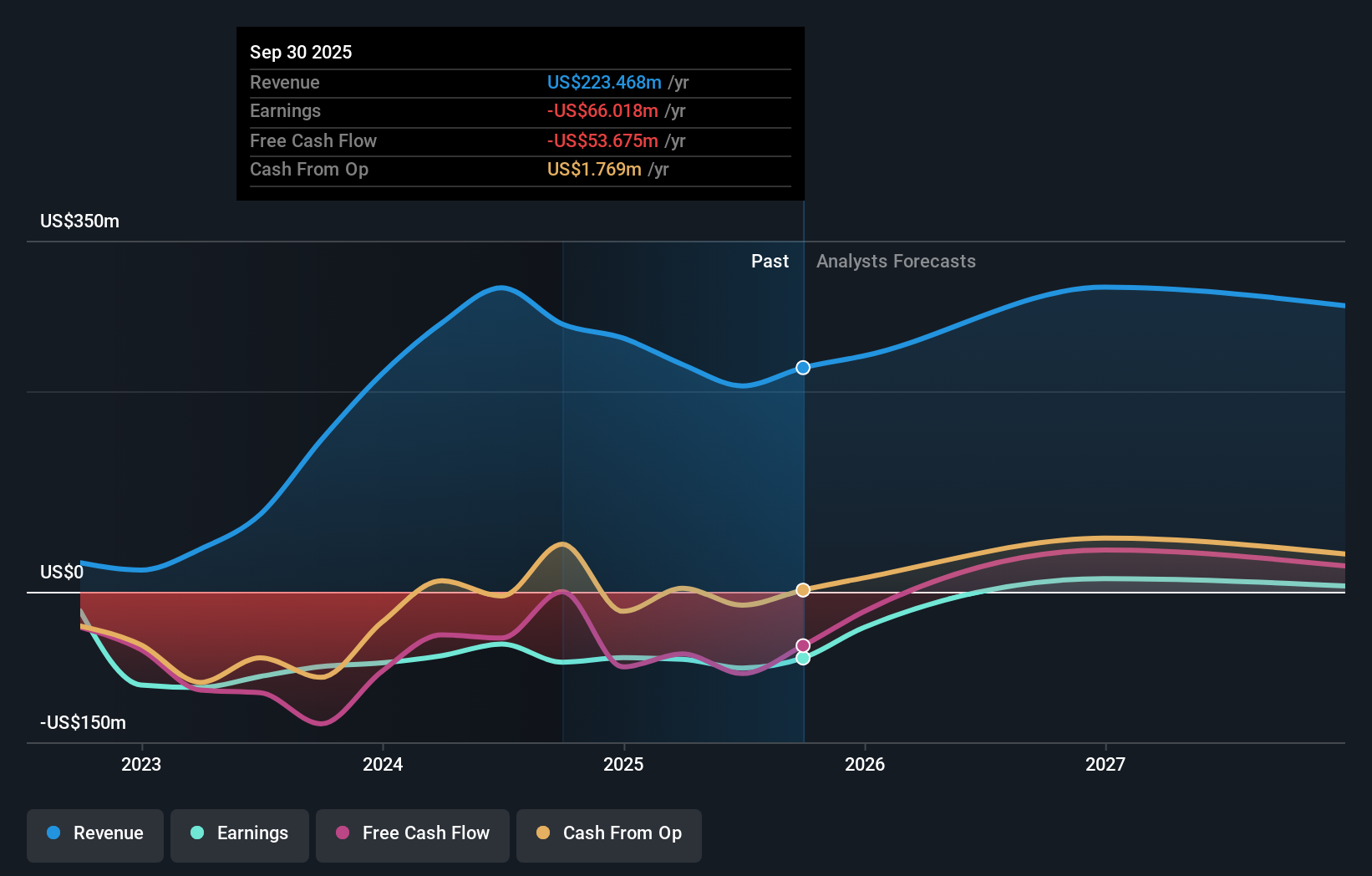

Operations: The company generates revenue of $223.47 million from its offshore contract drilling services for the oil and gas sector globally.

Insider Ownership: 15.5%

Northern Ocean's insider ownership reflects its growth trajectory, with earnings forecasted to grow substantially at 105.51% annually as the company aims for profitability within three years. Recent contract extensions with Rhino Resources and Equinor boost its backlog to approximately US$394 million, supporting future revenue streams. Despite a volatile share price and limited cash runway, Northern Ocean's expected revenue growth of 11.5% per year surpasses the Norwegian market average of 2.2%.

- Click to explore a detailed breakdown of our findings in Northern Ocean's earnings growth report.

- Our valuation report here indicates Northern Ocean may be overvalued.

Xplora Technologies (OB:XPLRA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xplora Technologies AS is an information technology company that develops wearable smart devices and connectivity services for kids and families across several countries, with a market cap of NOK2.55 billion.

Operations: Revenue Segments (in millions of NOK): Xplora Technologies AS generates revenue primarily from developing wearable smart devices and providing connectivity services for children and families in various countries, including Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

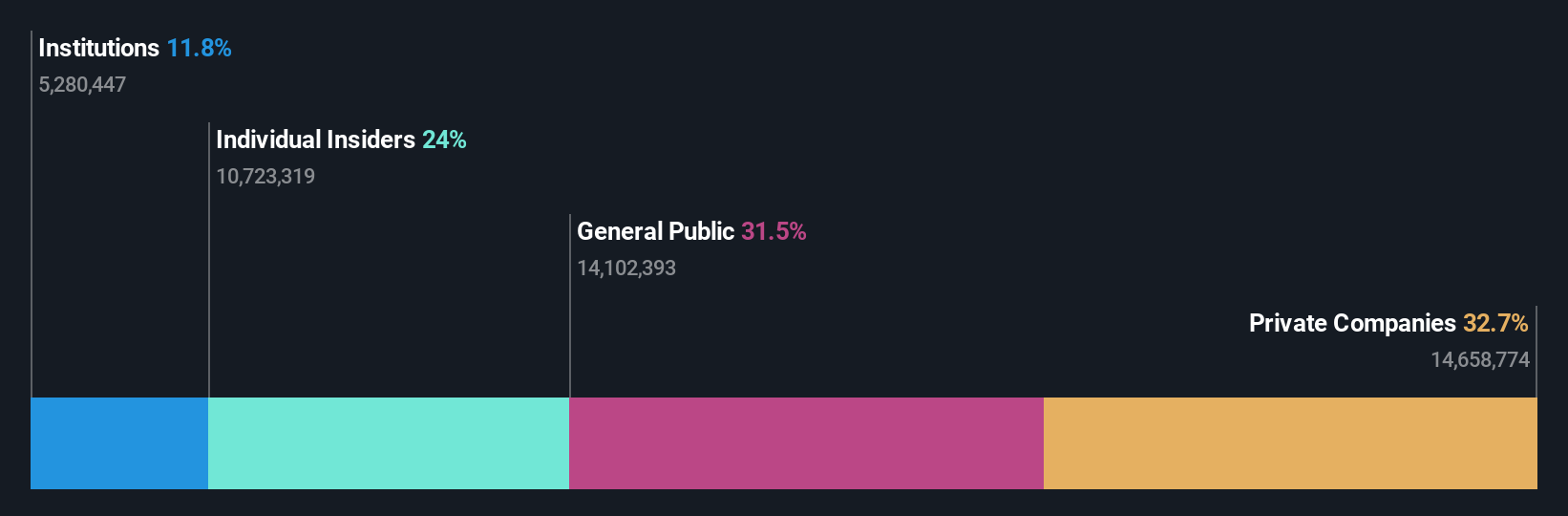

Insider Ownership: 24%

Xplora Technologies exhibits significant insider ownership, aligning with its growth potential. The company recently reported strong third-quarter results, doubling sales year-over-year to NOK 510.02 million and increasing net income to NOK 33.04 million. Despite a nine-month net loss of NOK 79.98 million, Xplora's forecasted earnings growth of 74.7% annually and expected profitability within three years highlight its upward trajectory, supported by consistent subscription growth and insider buying activity without substantial selling pressure.

- Get an in-depth perspective on Xplora Technologies' performance by reading our analyst estimates report here.

- The analysis detailed in our Xplora Technologies valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Discover the full array of 205 Fast Growing European Companies With High Insider Ownership right here.

- Seeking Other Investments? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Northern Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOL

Northern Ocean

Provides offshore contract drilling services for the oil and gas industry worldwide.

Reasonable growth potential with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026