- Norway

- /

- Energy Services

- /

- OB:NODL

Here's Why We're Watching Northern Drilling's (OB:NODL) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Northern Drilling (OB:NODL) shareholders have done very well over the last year, with the share price soaring by 117%. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky Northern Drilling's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Northern Drilling

When Might Northern Drilling Run Out Of Money?

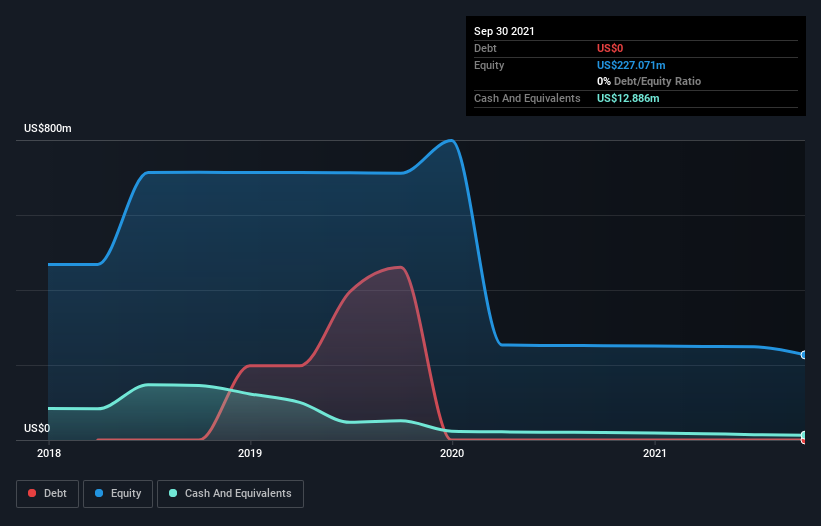

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In September 2021, Northern Drilling had US$13m in cash, and was debt-free. Importantly, its cash burn was US$7.4m over the trailing twelve months. So it had a cash runway of approximately 21 months from September 2021. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Easily Can Northern Drilling Raise Cash?

Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Northern Drilling has a market capitalisation of US$24m and burnt through US$7.4m last year, which is 31% of the company's market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Northern Drilling's Cash Burn Situation?

Given it's an early stage company, we don't have a lot of data with which to judge Northern Drilling's cash burn. But generally speaking, we can say that early stage companies like Northern Drilling are generally higher risk than well established businesses. So while we're not too worried about its cash burn at the moment, we do think shareholders should monitor it closely. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Northern Drilling (2 are significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Northern Drilling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NODL

Northern Drilling

Northern Drilling Ltd. operates as an offshore drilling contractor to the oil and gas industry.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives